Global Biobanks Market Size, Share, and COVID-19 Impact Analysis, By Product (LIMS, Biobanking Equipment), By Biospecimen Type (Organs, Stem Cells), By Application (Therapeutics, Drug Discovery & Clinical Research, and Clinical Diagnostics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Biobanks Market Insights Forecasts to 2033

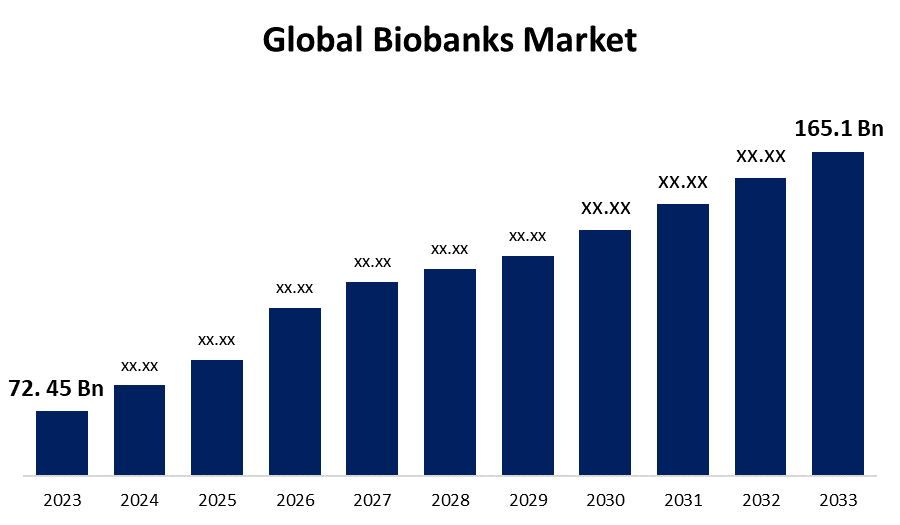

- The Global Biobanks Market Size was Valued at USD 72.45 Billion in 2023

- The Market Size is Growing at a CAGR of 8.59% from 2023 to 2033

- The Worldwide Biobanks Market Size is Expected to Reach USD 165.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Biobanks Market Size is Anticipated to Exceed USD 165.1 Billion by 2033, Growing at a CAGR of 8.59% from 2023 to 2033.

Market Overview

Biobank is a secure biorepository that stores biological samples such as blood, plasma, tissue, and DNA, it plays a crucial role in medical research and development by providing valuable resources for studying how genes, the environment, and lifestyle affect a person's health. Researchers use the data collected in biobanks to ask questions, research, and gain new perspectives. These research results are then fed back into the biobank, making it more useful over time.

Biobanks can be large or small and, can collect different types of samples and information depending on their purpose. For example, some biobanks might focus on a specific disease, like cancer, while others might focus on a certain population or region. Biobanks differ in study design, such as cross-sectional, translational, retrospective, or prospective. They use special laboratory equipment, such as mechanical freezers and liquid nitrogen storage devices, and laboratory information management systems (LIMS) to track, process, and store samples.

Current market trends show a shift towards virtual biobanks and the standardization of biobanking protocols globally, enhancing the quality and accessibility of stored samples. For instance, In April 2024, the world’s largest biomedical database, UK Biobank, offers researchers from low and middle-income countries (LMICs) free access through a donor-funded scheme launched.

Report Coverage

This research report categorizes the market for the global biobanks market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global biobanks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global biobanks market.

Global Biobanks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 72.45 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.59% |

| 2033 Value Projection: | USD 165.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Biospecimen Type, By Application, By Region |

| Companies covered:: | MyBank, Thermo Fisher Scientific Inc., Merck KGaA, Qiagen, Biocision LLC., Stemcell Technologies, Danaher Corporation, Tecan Trading AG, UK Biobank, Becton, Dickinson, and Company (BD), Hamilton Company, Biovault Family, Charles River Laboratories, Promocell GmbH, Taylor-Wharton, Precision Cellular Storage Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The technological innovations in biobanking processes, like automation, have significantly enhanced the efficiency and accuracy of sample collection, storage, and data management, driving the global biobanks market. The rising number of chronic diseases such as cancer, diabetes, and cardiovascular conditions has generated the need for medical research and the development of new treatments, which require high-quality biological samples to support the research.

Additionally, substantial investments and funding from government and private organizations are fuelling innovation in genomic research and precision medicine, expanding the scope and capabilities of biobanks. Also, there is a growing focus on personalized medicine according to the combination of symptoms and diseases, relying mainly on biological databases. Moreover, big data analytics and artificial intelligence in biobanking data management and drug predictions are enabling more advanced, effective, and accurate research outcomes.

Restraining Factors

Some challenges that could restrict the growth of the global biobanks market include high establishment, maintenance, and operational costs, as it requires huge investments in advanced technologies, infrastructure, equipment, and skilled personnel. Additionally, ethical and legal issues related to the collection, storage, and use of biological samples pose hurdles. Concerns about data privacy, security, and informed consent can lead to regulatory issues and public skepticism. Strict regulation across different regions can complicate collaboration and standardization efforts.

Market Segmentation

The global biobanks market share is classified into product, biospecimen type, and application.

- The biobanking equipment segment is expected to hold the largest share of the global biobanks market during the forecast period.

Based on the product, the global biobanks market is divided into LIMS and biobanking equipment. Among these, the biobanking equipment segment is expected to hold the largest share of the global biobanks market during the forecast period.

Biobanking equipment plays an essential role in the effective storage and preservation of biological samples. Critical components such as storage systems, sample transport solutions, and processing equipment ensure the integrity and viability of samples, making them necessary for biobanks. The continuous advancements in cryopreservation techniques and automation technologies have significantly improved the efficiency and reliability of biobanking operations. Additionally, the increasing focus on automation and regulatory compliance necessitates the use of advanced biobanking equipment.

- The stem cells segment is expected to hold the largest share of the global biobanks market during the forecast period.

Based on the biospecimen type, the global biobank market is divided into organs and stem cells. Among these, the stem cells segment is expected to hold the largest share of the global biobanks market during the forecast period. Stem cells are special cells in the body that have the ability to create other cells, such as muscle, blood, and brain cells. This process is called differentiation. They have the potential for use in regenerative medicine, making them crucial for various research and therapeutic applications. Advancements in stem cell therapies for conditions such as Parkinson's, diabetes, and cardiac diseases boost segmental growth. The use of stem cells in clinical trials and medical research, and investments in stem cell biobanking highlight their significance.

- The drug discovery & clinical research segment is expected to grow at the fastest CAGR in the global biobanks market during the forecast period.

Based on the application, the global biobanks market is divided into therapeutics, drug discovery & clinical research, and clinical diagnostics. Among these, the drug discovery & clinical research segment is expected to grow at the fastest CAGR in the global biobanks market during the forecast period. The rapid growth can be due to the increasing dependence on biobanks for the development of new pharmaceuticals and the improvement of existing ones. Biobanks provide high-quality, well-characterized biological samples that are essential for understanding disease mechanisms and identifying potential treatment goals. The rise in precision medicine requires comprehensive data and sample repositories, accelerating drug discovery processes. Additionally, advanced technologies such as genomics, proteomics, and bioinformatics in clinical research have improved the capability to analyze and utilize biobank samples effectively.

Regional Segment Analysis of the Global Biobanks Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

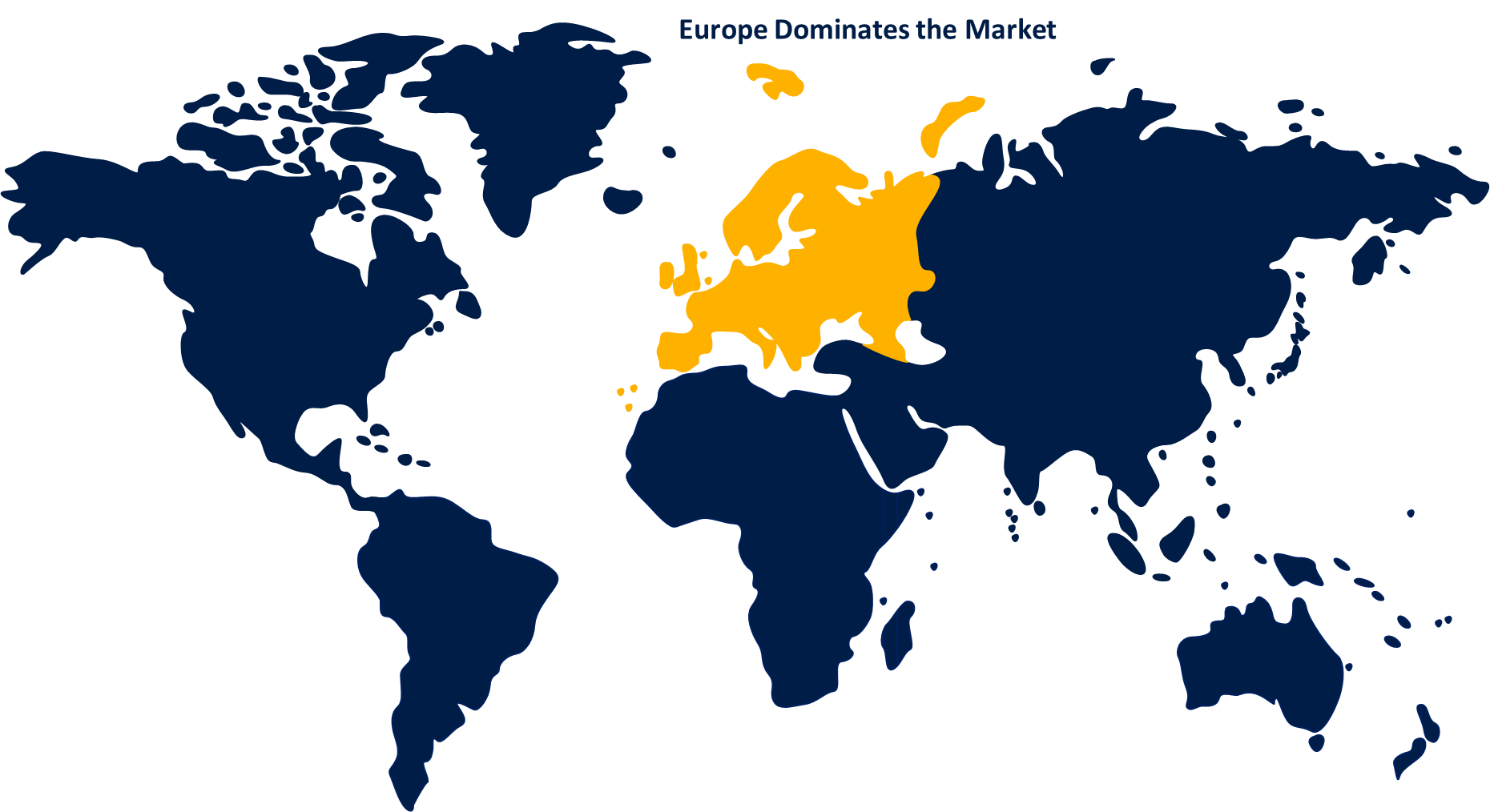

Europe is anticipated to hold the largest share of the global biobanks market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global biobanks market over the predicted timeframe. The region has a robust healthcare infrastructure and a strong emphasis on medical research and development. Countries like Germany, the United Kingdom, and Sweden are at the forefront, with a well-established network of biobanks and significant government funding to support biobanking initiatives. The presence of leading research institutions and pharmaceutical companies fuels the market in this region. Additionally, Europe benefits from strict regulations that ensure high standards and quality in biobanking practices. The growing focus on personalized medicine, and the increasing chronic diseases, further boost the demand for biobanks. Academic institutions, healthcare providers, and industry players in Europe foster innovation and development, boosting regional growth.

Asia Pacific is expected to grow at the fastest pace in the global biobanks market during the forecast period. The region has witnessed increasing investments in healthcare infrastructure and research and development within the region. Countries like India are leading the charge with various government initiatives and private pharmaceutical companies aimed at advancing medical research and biobanking capabilities. The rising number of chronic diseases and the growing population fuel the demand for biobanking services. Additionally, the lower operational costs, the presence of skilled professionals, and the increasing involvement of international collaborations and partnerships also play a significant role in boosting the market growth in Asia-Pacific.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global biobanks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MyBank

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Qiagen

- Biocision LLC.

- Stemcell Technologies

- Danaher Corporation

- Tecan Trading AG

- UK Biobank

- Becton, Dickinson, and Company (BD)

- Hamilton Company

- Biovault Family

- Charles River Laboratories

- Promocell GmbH

- Taylor-Wharton

- Precision Cellular Storage Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, nearly £50 million was unlocked for the world-leading UK Biobank following new industry backing. Research being used to develop new ways to prevent, diagnose, and treat diseases like dementia, Parkinson’s, diabetes, and cancer will benefit from a £16 million boost to upgrade how UK Biobank uses and stores its growing wealth of health data.

- In April 2024, UK Biobank launched a new Global Researcher Access Fund that covers application costs of approved researchers at institutes from less wealthy countries and aims to further democratize worldwide access to this biomedical database.

- In March 2024, Autoscribe Informatics Pty Ltd, the Australian arm of Autoscribe Informatics, announced its relocation to new offices in West Lakes Adelaide, in response to the growing demand for its Laboratory Information Management System (LIMS) solutions across the Asia Pacific region.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global biobanks market based on the below-mentioned segments:

Global Biobanks Market, By Product

- LIMS

- Biobanking Equipment

Global Biobanks Market, By Biospecimen Type

- Organs

- Stem Cells

Global Biobanks Market, By Application

- Therapeutics

- Drug Discovery & Clinical Research

- Clinical Diagnostics

Global Biobanks Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?