Global Biocompatible Materials Market Size, Share, and COVID-19 Impact Analysis, By Material (Polymers, Metals, Ceramics, Composites), By Application (Surgical & Medical Instruments, Implants, Drug Delivery, Others), By End-User (Medical Device Manufacturers, Academic & Research Institutes, Biopharmaceutical & Pharmaceutical Companies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Biocompatible Materials Market Insights Forecasts to 2033

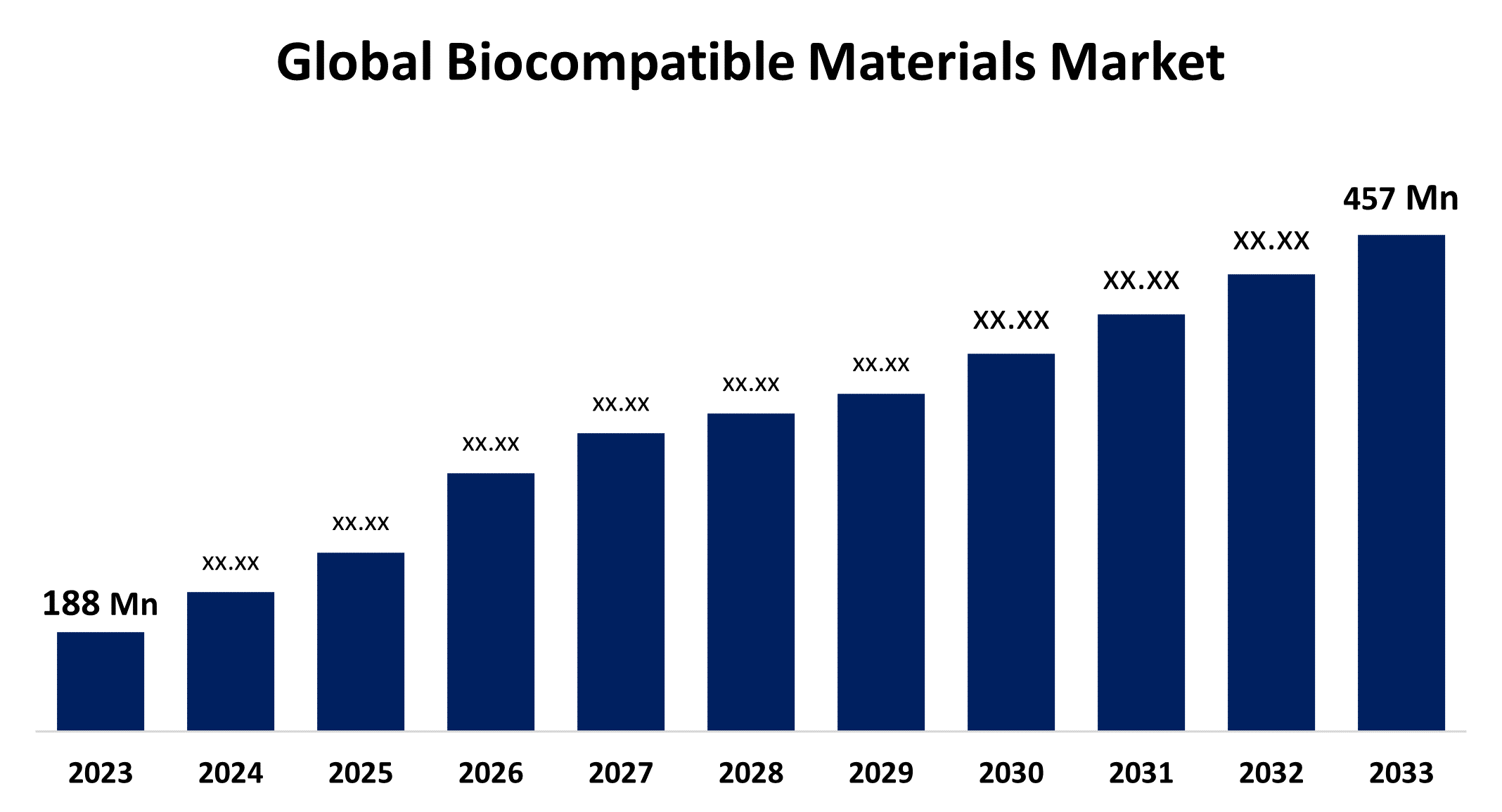

- The Global Biocompatible Materials Market Size was Valued at USD 188 Million in 2023

- The Market Size is Growing at a CAGR of 9.29% from 2023 to 2033

- The Worldwide Biocompatible Materials Market Size is Expected to Reach USD 457 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Biocompatible Materials Market Size is Anticipated to Exceed USD 457 Million by 2033, Growing at a CAGR of 9.29% from 2023 to 2033.

Market Overview

Biocompatible materials are materials designed to interact safely with biological systems without causing an adverse reaction. They are used in medical applications, such as implants, prosthetics, and drug delivery systems, and possess properties that promote compatibility with living tissues. These materials can include polymers, metals, ceramics, and composites, each selected based on their specific characteristics, such as mechanical strength, flexibility, and the ability to support cellular integration. The goal of biocompatible materials is to facilitate healing and function and minimize inflammation, toxicity, or other negative biological responses.

The biocompatible materials market is fueled by rising healthcare demand, technological advancements, investment in research, regulatory support, personalized medicine, and sustainability trends. Innovative polymers and composites enhance medical performance, while personalized medicine and sustainability drive market growth. Biocompatible materials are utilized in various medical applications, including implants, surgical instruments, drug delivery systems, tissue engineering, wound care products, surgical sutures, and contact lenses, promoting healing, ensuring safety, facilitating targeted medication release, and advancing patient care and medical technologies.

Report Coverage

This research report categorizes the market for biocompatible materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biocompatible materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biocompatible materials market.

Global Biocompatible Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 188 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.29% |

| 2033 Value Projection: | USD 457 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Application, By End-User, By Region |

| Companies covered:: | Dupont, Ensinger, Stratasys Ltd., Covestro AG, Foster Corporation, Merck KGaA, BASF SE (Exxon Mobil Corporation), Wacker Chemie AG, Celanese Corporation, Royal DSM, Evonik Industries AG, Shin-Etsu Chemical Co. Ltd., Henkel AG & Co., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the biocompatible materials market is propelled by several factors including the growing healthcare industry, an aging population, and advancements in technology. The increasing prevalence of chronic diseases, regulatory support, and a focus on personalized medicine further enhance demand for innovative materials. Furthermore, investments in research and development and a shift towards sustainable, biodegradable options are shaping the market growth worldwide.

Restraining Factors

The biocompatible materials market is restrained by several factors including high production costs and stringent regulatory challenges, which can delay product development. Limited availability of specialized materials and potential biocompatibility issues raise safety concerns, while competition from alternative technologies might hinder market growth.

Market Segmentation

The biocompatible materials market share is classified into material, application, and end-user.

- The polymers segment is estimated to hold the highest market revenue share through the projected period.

Based on the material, the biocompatible materials market is classified into polymers, metals, ceramics, and composites. Among these, the polymers segment is estimated to hold the highest market revenue share through the projected period. The segment dominance is primarily due to the versatility of polymers, which can be engineered to meet specific requirements for various medical applications, such as drug delivery systems and implants. Polymer's lightweight nature, ease of processing, and customizable properties make them highly favorable for use in medical devices. Furthermore, advancements in polymer technology, including the development of biodegradable and bioresorbable options, are further driving polymer adoption.

- The implants segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the biocompatible materials market is divided into surgical & medical instruments, implants, drug delivery, and others. Among these, the implants segment is anticipated to hold the largest market share through the forecast period. The implant segment dominance can be attributed to the increasing use of implants in various medical procedures, driven by advancements in materials that enhance biocompatibility and functionality. The rising prevalence of orthopedic, dental, and cardiovascular conditions necessitates the development of innovative implant solutions, further solidifying the implant segment's market leadership.

- The biopharmaceutical & pharmaceutical companies segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the end-user, the biocompatible materials market is categorized into medical device manufacturers, academic & research institutes, and biopharmaceutical & pharmaceutical companies. Among these, the biopharmaceutical & pharmaceutical companies segment is anticipated to grow at the fastest CAGR growth through the forecast period. This rapid expansion is driven by the rising demand for advanced drug delivery systems, the growing prevalence of chronic diseases, increased research and development efforts, and favorable regulatory support. Furthermore, ongoing technological advancements in material science are leading to the manufacture of more effective and safer biocompatible materials. Collaborations between pharmaceutical companies and material scientists enhance the development of new applications.

Regional Segment Analysis of the Biocompatible Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the biocompatible materials market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the biocompatible materials market over the predicted timeframe. The region's dominance can be attributed to several factors, including advanced healthcare infrastructure, increasing investments in medical technology, and a strong focus on research and development. The rising demand for biocompatible materials in applications such as implants, prosthetics, and drug delivery systems is driving market expansion in the region. Furthermore, the presence of key players and a growing aging population that requires innovative medical solutions further contribute to North America's leading position in the biocompatible materials market.

Asia Pacific is expected to grow at the fastest CAGR growth of the biocompatible materials market during the forecast period. Rapid healthcare expansion, fueled by increasing investments in medical technology and a growing middle-class population, is boosting demand for biocompatible materials. Furthermore, a significant aging population in countries like Japan and China is raising the demand for medical implants and devices, further contributing to the region's robust market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biocompatible materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dupont

- Ensinger

- Stratasys Ltd.

- Covestro AG

- Foster Corporation

- Merck KGaA

- BASF SE (Exxon Mobil Corporation)

- Wacker Chemie AG

- Celanese Corporation

- Royal DSM

- Evonik Industries AG

- Shin-Etsu Chemical Co. Ltd.

- Henkel AG & Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Formlabs, a specialist in SLA and SLS 3D printing technologies, introduced several new items, including two new resin compositions and three post-processing equipment for SLA and SLS components.

- In August 2024, Greentank announced Heating Chip is an innovative heating element that revolutionizes atomization technology and liquid delivery systems. The Heating Chip, composed completely of biocompatible materials, raises the bar for safety and efficacy in heated atomization technology.

- In June 2024, NewBioGen introduced a novel biomaterial production technique that can resolve the existing challenges and provide a new generation of orthopedic bio-implants.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the biocompatible materials market based on the below-mentioned segments:

Global Biocompatible Materials Market, By Material

- Polymers

- Metals

- Ceramics

- Composites

Global Biocompatible Materials Market, By Application

- Surgical & Medical Instruments

- Implants

- Drug Delivery

- Others

Global Biocompatible Materials Market, By End-User

- Medical Device Manufacturers

- Academic & Research Institutes

- Biopharmaceutical & Pharmaceutical Companies

Global Biocompatible Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?