Global Biogas Plants Construction Market Size, Share, and COVID-19 Impact Analysis, By Type (Wet Digestion and Dry Digestion), By Application (Industrial and Agricultural), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Biogas Plants Construction Market Insights Forecasts to 2033

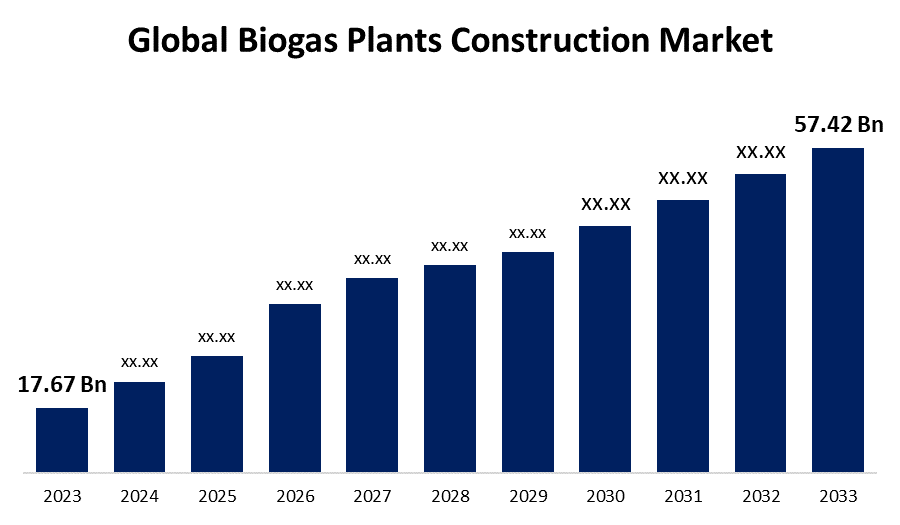

- The Global Biogas Plants Construction Market Size was Valued at USD 17.67 Billion in 2023

- The Market Size is Growing at a CAGR of 12.51% from 2023 to 2033

- The Worldwide Biogas Plants Construction Market Size is Expected to Reach USD 57.42 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Biogas Plants Construction Market Size is Anticipated to Exceed USD 57.42 Billion By 2033, Growing at a CAGR of 12.51% from 2023 to 2033.

Market Overview

Biogas arises from the anaerobic fermentation of organic matter, such as animal waste, food waste, and agricultural residues, making it a renewable energy source. Microorganisms break down the organic matter during the digestion process and release a gas mainly composed of methane and carbon dioxide. This biogas can serve as a fuel for heating and electricity generation, with the remaining residue used as fertilizer. A biogas plant encompasses a subversive digester, a tank made of bricks, and its dome-shaped roof built with cement and bricks. The dome of the digester tank functions as a gas vessel for the biogas.

Landfills are designated sites for waste disposal from residential, industrial, and commercial sources, and they rank as the third-largest human-related methane emission source in the United States, according to the U.S. Environmental Protection Agency (EPA). Biogas produced in these landfills, also known as landfill gas (LFG), results from the digestion process in the ground as a replacement for an anaerobic digester. As of July 2023, the EPA recorded 532 operational LFG projects in the United States, but most of them are used for electricity generation rather than powering natural gas vehicles. In 2023, approximately 470 anaerobic digester systems were in operation at commercial livestock farms in the United States, common with biogas for electricity generation. Some farms, like Calgren Dairy Fuels in California and Fair Oaks Farms in Indiana, utilize biogas for transportation fuel production. The EPA's AgSTAR database provides wide information about these systems in the United States.

Report Coverage

This research report categorizes the market for biogas plant construction based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biogas plant construction market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biogas plant construction market.

Global Biogas Plants Construction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.67 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.51% |

| 2033 Value Projection: | USD 57.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | IG Biogas, Zorg Biogas AG, BTA International GmbH, kIEFER TEK LTD, Lundsby Biogas A / S, Finn Biogas, Ludan Group, Naskeo, Agraferm GmbH, Mitsui E&S Engineering Co. Ltd, Hitachi Zosen Inova, Toyo Engineering Corp., Qingdao Green Land Environment Equipment Co. Ltd., Xinyuan Environment Project, Shandong Tianmu Environment Engineering Co. Ltd., and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for renewable energy sources and sustainable waste management solutions is the primary driver of the biogas plant construction market. Governments globally are implementing policies and incentives to promote the use of biogas as a clean energy option, reducing confidence in fossil fuels. Investments in biogas technology are further fueled by increasing awareness of climate change and environmental sustainability. Additionally, the need for effective waste management and nutrient recycling in the agricultural sector has generated curiosity about biogas plants. Technological advancements, such as enhanced anaerobic digestion processes and the integration of biogas systems into existing infrastructures, improve their efficiency and economic viability. The growing adoption of circular economy practices encourages the use of organic waste for energy production, making biogas plants an attractive option for both public and private sectors.

Restraining Factors

The biogas plant construction market faces multiple restraining factors. High initial capital costs associated with plant construction and technology execution can dishearten investment. The complexity of regulatory frameworks and the need for compliance with environmental standards can slow down project approvals. Limited awareness and technical expertise in certain regions deter the adoption of biogas technology.

Market Segmentation

The biogas plant construction market share is classified into product and end user.

- The wet digestion segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the biogas plant construction market is classified into wet digestion and dry digestion. Among these, the wet digestion segment is estimated to hold the highest market revenue share through the projected period. This is because it is known to be very efficient especially when it comes to the disposal of organic waste. With this method, new moist biomass slurry is used which is more efficient in breaking the materials as compared to dry digestion. The tolerance of wet digestion to high moisture content makes wet digestion applicable especially to agricultural residues, food waste, and municipal solid waste. Since these feedstocks are available in large quantities, the wet digestion technology has the potential to boost biogas production. Further, the research in the technology of anaerobic digestion has been beneficial in the scale-up and cost-effective way of wet digestion systems thus getting the investors. Increased attention to the use of waste to generate energy is well matched to the advantages of wet digestion which makes wet digestion popular among biogas plant operators.

- The agricultural segment is anticipated to hold the largest market share through the forecast period.

Based on the end user, the biogas plant construction market is divided into industrial and agricultural. Among these, the agricultural segment is anticipated to hold the largest market share through the forecast period. This is especially so because the majority of the wastes produced globally are organic and come from farming activities such as crop remnants, animal droppings, and food processing residues. Biogas plants in this segment are a sustainable technology solution on the one hand towards the disposal of waste while on the other providing an opportunity for the farm to generate renewable energy. Biogas technology can be integrated into farms to generate energy from waste hence cutting expenses on disposal and improving energy self-sufficiency. In addition, biogas is used as a fertilizer which improves the quality of the soil hence encouraging the use of sustainable farming. The trend toward a circular economy in the agricultural sector will also act as a driver for the use of biogas plants, thus reinforcing the role of the company in the biogas market.

Regional Segment Analysis of the Biogas Plants Construction Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the biogas plant construction market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the biogas plant construction market over the predicted timeframe. This is due to rapid urbanization, population growth, and increasing energy demands during the forecast period. China and India are heavily investing in renewable energy initiatives, specifically biogas, to address environmental concerns and energy shortages. With the region's vast agricultural sector producing substantial organic waste, there is ample feedstock for biogas plants. Government policies promoting waste-to-energy projects and providing subsidies for renewable energy technologies further enhance market growth. Additionally, the adoption of biogas systems is encouraged by the rising awareness of sustainable waste management practices among communities. However, regulatory hurdles and technological gaps need to be addressed to fully leverage this potential. Overall, with government support, technological advancements, and abundant organic waste, Asia Pacific is positioned as a leader in the biogas construction market.

Bottom of Form

Europe is expected to grow at the fastest CAGR growth of the biogas plant construction market during the forecast period. This growth is primarily attributed to stringent environmental regulations and ambitious renewable energy targets set by the European Union. Countries such as Germany, France, and the Netherlands are leading in biogas adoption due to their commitment to reducing greenhouse gas emissions and increasing energy independence. The European agricultural sector generates significant organic waste, creating a sustainable feedstock base for biogas production. Moreover, technological innovations in anaerobic digestion and biogas upgrading are increasing the efficiency and profitability of biogas plants. The market growth is further supported by the growing trend of local energy production and community-based renewable energy projects. With increasing awareness of the benefits of biogas and expanding investment in infrastructure, Europe is poised to lead the biogas plant construction market in the coming years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biogas plant construction market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IG Biogas

- Zorg Biogas AG

- BTA International GmbH

- kIEFER TEK LTD

- Lundsby Biogas A / S

- Finn Biogas

- Ludan Group

- Naskeo

- Agraferm GmbH

- Mitsui E&S Engineering Co. Ltd

- Hitachi Zosen Inova

- Toyo Engineering Corp.

- Qingdao Green Land Environment Equipment Co. Ltd.

- Xinyuan Environment Project

- Shandong Tianmu Environment Engineering Co. Ltd.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Nurmo was chosen as the site for Finland’s first industrial-scale liquefied biogas plant. Finland's first industrial-scale liquefied biogas production plant is set to be constructed in Nurmo.

- In May 2024, Germany's largest biogas producer EnviTec Biogas, has completed two more biogas projects in the USA in Cassville, New York, and Ellington, Connecticut. The two plants were planned, designed, and constructed by the company's subsidiary, EnviTec Biogas USA Inc. over the past 18 months. EnviTec supplied South Jersey Industries (SJI), the owner of both plants, with fermenter technology, internal and external heating systems, digester covers, pumps, raw gas treatment, O2 generation, and EnviThan gas upgrading system.

- In March 2024, Hyundai E&C wins a $132 mn biogas facility project. It was selected as the preferred bidder for a private investment project of a metropolitan integrated Biogas facility in Gumi.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the biogas plant construction market based on the below-mentioned segments:

Global Biogas Plants Construction Market, By Type

- Wet Digestion

- Dry Digestion

Global Biogas Plants Construction Market, By Application

- Industrial

- Agricultural

Global Biogas Plants Construction Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the biogas plant construction market over the forecast period?The biogas plant construction market is projected to expand at a CAGR of 12.51% during the forecast period.

-

2. What is the market size of the biogas plant construction market?The Global Biogas Plants Construction Market Size is Expected to Grow from USD 17.67 Billion in 2023 to USD 57.42 Billion by 2033, at a CAGR of 12.51% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the biogas plant construction market?Asia Pacific is anticipated to hold the largest share of the biogas plant construction market over the predicted timeframe.

Need help to buy this report?