Global Biomarker Clinical Phase Outsourcing Services Market Size, Share, and COVID-19 Impact Analysis, By Biomarker Type (Surrogate Endpoints, Predictive Biomarker, Prognostic Biomarker, Safety Biomarker, and Others), By Therapeutic Area (Oncology, Neurology, Cardiology, Autoimmune Diseases, and Others), By End-User (Pharmaceutical Companies, Biotechnology Companies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Biomarker Clinical Phase Outsourcing Services Market Insights Forecasts to 2033

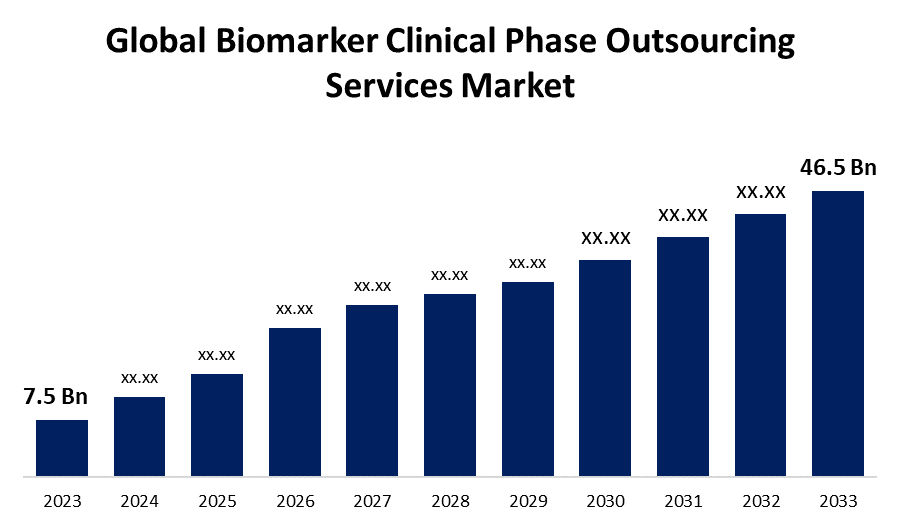

- The Global Biomarker Clinical Phase Outsourcing Services Market Size was Valued at USD 7.5 Billion in 2023

- The Market Size is Growing at a CAGR of 20.02% from 2023 to 2033

- The Worldwide Biomarker Clinical Phase Outsourcing Services Market Size is Expected to Reach USD 46.5 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Biomarker Clinical Phase Outsourcing Services Market Size is Anticipated to Exceed USD 46.5 Billion by 2033, Growing at a CAGR of 20.02% from 2023 to 2033.

Market Overview

Biomarker clinical phase outsourcing services refer to the use of biological indicators in drug development, supporting various stages of clinical trials, including study design, patient stratification, treatment response assessment, and safety monitoring. These biomarkers are utilized to provide insights into the underlying biological processes, disease mechanisms, and treatment effects, ultimately aiding in the development of novel therapeutics and personalized medicine approaches. Biomarkers are measurable indicators that play a crucial role in clinical trials and can be used to assess the presence or progression of a disease, evaluate the efficacy of a treatment, or the potential risks associated with a particular therapy. The advancement in biomarker technologies often leads to the development of more complex and specialized assays, that can be effectively used in clinical trials. The advancements in genomics, proteomics, and metabolomics have enabled the identification of novel biomarkers for providing valuable insights into disease progression and drug response. The shift towards precision medicine is another significant factor supporting the demand for biomarker testing services, for enabling better patient care and more effective treatments. There is augmenting technological development for achieving highly selective and sensitive detection of biomarkers for point-of-care applications.

Report Coverage

This research report categorizes the market for the global biomarker clinical phase outsourcing services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global biomarker clinical phase outsourcing services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global biomarker clinical phase outsourcing services market.

Global Biomarker Clinical Phase Outsourcing Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 20.02% |

| 2033 Value Projection: | USD 46.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Biomarker Type, By Therapeutic Area, By End-User, By Region |

| Companies covered:: | Laboratory Corporation of America Holdings, Fujirebio lnc., Charles River Laboratories, Parexel International Corporation, ICON plc, Proteome Sciences, WuXi AppTec, NorthEast BioAnalytical Laboratories LLC, Eurofins Scientific, GenScript ProBio, Celerion, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

There are rapid advancements in biomarker technology that can enable early diagnosis of cancer. Thus, the increasing demand for cancer biomarkers for early detection and diagnosis of the condition is driving the market growth of biomarker clinical phase outsourcing services. The increasing use of biomarkers for early detection and diagnosis is enhancing the market growth. The rising government initiatives and funding for R&D activities are significantly contributing to the market growth. The rapid advancements in OMICS technologies and the shift toward precision medicine are the factors responsible for driving the market. In addition, there is increasing demand for cancer biomarkers for early detection and diagnosis of the condition which ultimately leads to driving the global biomarker clinical phase outsourcing services market.

Restraining Factors

The high cost associated with the development and validation of biomarkers is considered to be challenging for the availability of biomarkers for outsourcing services which is ultimately restraining the global biomarker clinical phase outsourcing services market. The regulatory framework and the lack of standardization negatively affect the quality and reliability of biomarkers, thereby affecting the drug development process and leading to hampering the market growth.

Market Segmentation

The global biomarker clinical phase outsourcing services market share is classified into biomarker type, therapeutic area, and end-user.

- The surrogate endpoints segment dominated the market with the largest revenue share in 2023.

Based on the biomarker type, the global biomarker clinical phase outsourcing services market is categorized into surrogate endpoints, predictive biomarker, prognostic biomarker, safety biomarker, and others. Among these, the surrogate endpoints segment dominated the market with the largest revenue share in 2023. The utilization of surrogate endpoint biomarkers reduces the time and cost of clinical trials, which would speed up drug development. Several drug sponsors are continuously making huge investments in the development of surrogate endpoints. The growing demand for precision medicine along with the rise in a number of clinical trials are driving the market demand.

- The oncology segment is expected to hold the largest share of the global biomarker clinical phase outsourcing services market during the forecast period.

Based on the therapeutic area, the global biomarker clinical phase outsourcing services market is categorized into oncology, neurology, cardiology, autoimmune diseases, and others. Among these, the oncology segment is expected to hold the largest share of the global biomarker clinical phase outsourcing services market during the forecast period. According to the Journal of Precision Medicine, more than 55% of all cancer trials from 2018-20 involved the use of biomarkers. There is increasing usage of biomarkers in clinical trials of oncology and a tremendous surge in the total percentage of cancer trials using biomarker analysis for efficient treatment discovery. Thus, increasing demand for cancer biomarkers for early detection and diagnosis of the condition upsurges the market demand.

- The biotechnology companies segment is anticipated to grow at the fastest CAGR through the forecast period.

Based on the end-user, the global biomarker clinical phase outsourcing services market is categorized into pharmaceutical companies, biotechnology companies, and others. Among these, the biotechnology companies segment is anticipated to grow at the fastest CAGR through the forecast period. There is an increasing number of biopharmaceutical companies that support novel biomarker development for diagnosing and monitoring various chronic ailments. Thus, the investments by several biopharmaceutical companies in developing novel biomarker testing services are propelling the market growth.

Regional Segment Analysis of the Global Biomarker Clinical Phase Outsourcing Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global biomarker clinical phase outsourcing services market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global biomarker clinical phase outsourcing services market over the forecast period. A large number of pharmaceutical organizations prefer to outsource their manufacturing services to U.S. based CROs in North America, fostering a robust environment for biomarker clinical phase outsourcing services. The United States is the leading biomarker outsourcing market in the region. The robust and advanced healthcare infrastructure and the availability of state-of-the-art research facilities and laboratories are significantly contributing to regional market growth.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global biomarker clinical phase outsourcing services market during the forecast period. The supportive regulatory reforms as well as economical clinical research alternatives in countries like India and China are driving the market in the region. The presence of U.S. FDA and European Medicines Agency-approved facilities in the region is also responsible for market growth. The rising number of Western pharmaceutical companies outsourcing their manufacturing activities to developing economies such as China and India is augmenting the market growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global biomarker clinical phase outsourcing services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Laboratory Corporation of America Holdings

- Fujirebio lnc.

- Charles River Laboratories

- Parexel International Corporation

- ICON plc

- Proteome Sciences

- WuXi AppTec

- NorthEast BioAnalytical Laboratories LLC

- Eurofins Scientific

- GenScript ProBio

- Celerion

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Labcorp launched a liquid biopsy test to enable targeted therapy selection for patients with advanced or metastatic solid tumors. The test, called Labcorp Plasma Focus, uses genetic sequencing to evaluate circulating cell-free DNA (cfDNA) released by tumor cells so that oncologists can better manage the care of their patients, the firm said.

- In November 2022, Celerion, a clinical research organization (CRO) in the biopharmaceutical industry, announced the expansion of molecular and cellular capabilities to Good Laboratory Practice/Good Clinical Practice (GLP/GCP) standards to support the development of new modality therapies, such as cell and gene therapies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global biomarker clinical phase outsourcing services market based on the below-mentioned segments:

Global Biomarker Clinical Phase Outsourcing Services Market, By Biomarker Type

- Surrogate Endpoints

- Predictive Biomarker

- Prognostic Biomarker

- Safety Biomarker

- Others

Global Biomarker Clinical Phase Outsourcing Services Market, By Therapeutic Area

- Oncology

- Neurology

- Cardiology

- Autoimmune Diseases

- Others

Global Biomarker Clinical Phase Outsourcing Services Market, By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Others

Global Biomarker Clinical Phase Outsourcing Services Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global biomarker clinical phase outsourcing services market over the forecast period?The global biomarker clinical phase outsourcing services market is projected to expand at a CAGR of 20.02% during the forecast period.

-

2. What is the projected market size & growth rate of the global biomarker clinical phase outsourcing services market?The global biomarker clinical phase outsourcing services market was valued at USD 7.5 Billion in 2023 and is projected to reach USD 46.5 Billion by 2033, growing at a CAGR of 20.02% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global biomarker clinical phase outsourcing services market?The North America region is expected to hold the highest share of the global biomarker clinical phase outsourcing services market.

Need help to buy this report?