Global Biomarker Discovery Outsourcing Services Market Size, By Type (Predictive, Prognostic, Safety, Surrogate Endpoints), By Service (Genomics, Proteomics, Bioinformatics), By Therapeutic Area (Oncology, Cardiology, Cardiovascular), By End-use (Pharmaceutical, Biotechnology, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecasts to 2033

Industry: HealthcareGlobal Biomarker Discovery Outsourcing Services Market Insights Forecasts to 2033

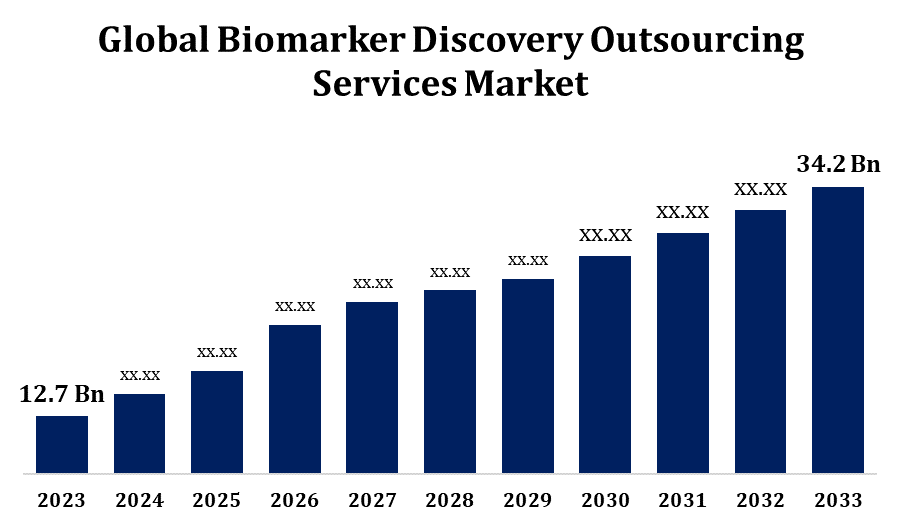

- The Global Biomarker Discovery Outsourcing Services Market Size was valued at USD 12.7 Billion in 2023

- The Market is Growing at a CAGR of 10.41% from 2023 to 2033

- The Worldwide Biomarker Discovery Outsourcing Services Market Size is Expected to reach USD 34.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Biomarker Discovery Outsourcing Services Market Size is Expected to reach USD 34.2 Billion by 2033, at a CAGR of 10.41% during the forecast period 2023 to 2033.

The biomarker discovery outsourcing services market includes a variety of services provided by contract research organisations (CROs) and other specialised firms to pharmaceutical, biotechnology, and academic institutions in identifying and validating biomarkers for a variety of applications such as drug discovery and development, diagnostics, personalised medicine, and prognostics. The demand for biomarker discovery services is increasing as the focus shifts to precision medicine, personalised medicines, and the need for predictive and prognostic tools in healthcare. Biomarker discovery outsourcing services encompass a wide range of operations, such as biomarker identification, validation, assay development, and clinical validation. Some companies also provide bioinformatics and data analysis services to help interpret biomarker results.

Biomarker Discovery Outsourcing Services Market Value Chain Analysis

The biomarker discovery outsourcing services market encompasses a comprehensive value chain starting from research and development activities aimed at identifying potential biomarkers, followed by specialized service providers offering biomarker discovery services such as identification, validation, and assay development. Collaborations and partnerships with pharmaceutical companies and academic institutions facilitate access to resources and expertise. Validated biomarkers undergo further validation in preclinical and clinical studies to demonstrate their clinical utility and regulatory compliance. Successful biomarkers are commercialized as diagnostic tests or companion diagnostics, with distribution and sales efforts targeting healthcare providers and decision-makers. Throughout the value chain, adherence to regulatory standards and continuous innovation are essential for driving advancements in biomarker discovery and its applications in healthcare.

Biomarker Discovery Outsourcing Services Market Opportunity Analysis

Pharmaceutical and biotechnology businesses continue to make significant investments in research and development to discover new medicines and diagnostic tools. Outsourcing biomarker discovery allows these organisations to have access to specialised skills and technologies while remaining focused on their core capabilities. The rise of personalised medicine, which tailors therapies to individual patients based on their genetic composition and biomarker profiles, is boosting the demand for biomarker discovery services. Outsourcing partners can assist pharmaceutical businesses in identifying predictive and prognostic biomarkers that will guide treatment decisions. The rising frequency of chronic diseases such as cancer, cardiovascular problems, and neurological conditions emphasises the importance of biomarkers in disease detection, diagnosis, and progression tracking.

Market Dynamics

Biomarker Discovery Outsourcing Services Market Dynamics

Increasing prevalence of chronic diseases to propelling the market growth

Chronic diseases such as cancer, diabetes, cardiovascular disease, and neurological disorders typically have better prognoses when discovered early. Biomarkers are important in early identification and diagnosis because they indicate the existence or course of a disease. Outsourcing biomarker discovery services provides pharmaceutical and diagnostic industries with access to specialised skills and tools for identifying and validating biomarkers linked with various chronic illnesses. Precision medicine seeks to personalise medical therapy to each patient's unique traits, including genetic makeup, lifestyle, and biomarker profiles. Biomarkers are critical to precision medicine approaches because they enable healthcare practitioners identify the most effective medicines and predict treatment outcomes for patients with chronic conditions.

Restraints & Challenges

Biomarker discovery is a difficult and multifaceted process that necessitates the integration of several data types, including genomes, proteomics, metabolomics, and clinical data. Analysing these diverse datasets and identifying appropriate biomarkers can be difficult, necessitating knowledge in bioinformatics, statistics, and molecular biology. Biomarker discovery efforts frequently entail intellectual property considerations such as patentability, ownership, and commercialization rights. Outsourcing partnerships may involve the sharing of private data, technology, and know-how, which raises concerns regarding intellectual property protection and privacy. Addressing these difficulties requires negotiating clear contractual agreements and establishing systems for intellectual property management and technology transfer. Biomarker discovery initiatives necessitate significant investments in knowledge, infrastructure, and resources. Outsourcing biomarker discovery services can be less expensive than in-house efforts, but cost considerations are still a significant challenge, especially for small biotech enterprises and academic research groups with restricted funding.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Biomarker Discovery Outsourcing Services Market from 2023 to 2033. North America has a sophisticated healthcare infrastructure, including well-established pharmaceutical, biotechnology, and contract research organisations (CROs). These organisations have the experience, resources, and technological skills to carry out biomarker discovery initiatives successfully. The region is home to a thriving research and development environment that includes top academic institutions, research hospitals, and biotech clusters. Collaborations between academia and industry foster innovation in biomarker discovery while also facilitating knowledge exchange and technology transfer. North America is at the forefront of personalised medicine projects, with an increasing emphasis on using biomarkers to customise therapies for specific patients. Biomarker discovery outsourcing services are crucial in advancing the development of personalised medicine solutions for a variety of illness indications.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region's healthcare industry is rapidly expanding, driven by factors such as population ageing, urbanisation, and rising healthcare costs. As the region's chronic disease burden grows, so does the demand for improved diagnostic and treatment options, such as biomarker-based techniques. The Asia-Pacific pharmaceutical market is quickly expanding, driven by factors such as rising healthcare spending, an increase in the prevalence of chronic diseases, and government measures to improve healthcare access. Pharmaceutical businesses in the region are investing in biomarker research to help drug development programmes and improve therapeutic efficacy and safety levels. The Asia-Pacific area is making substantial advances in omics technologies, such as genomics, proteomics, metabolomics, and transcriptomics.

Segmentation Analysis

Insights by Service

The genomics biomarker segment accounted for the largest market share over the forecast period 2023 to 2033. Genomic biomarkers are critical in personalised medicine techniques, which seek to customise medical treatments to individual patients based on genetic makeup. As personalised medicine gains popularity in healthcare, there is an increasing demand for genomic biomarkers capable of predicting medication reactions, guiding treatment decisions, and improving patient outcomes. Outsourcing services focused on genomics biomarker discovery are well-positioned to help personalised medicine ambitions by generating actionable genetic markers for patient classification and targeted therapy. Cancer is a major focus for biomarker development, and genomic biomarkers have emerged as useful tools for cancer diagnosis, prognosis, and treatment selection. Genomic profiling of tumour samples enables the detection of somatic mutations, copy number changes, gene fusions, and other genomic abnormalities that drive cancer development and progression.

Insights by Therapeutic Area

The oncology segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Cancer is a prominent cause of illness and mortality globally, with ageing populations, lifestyle changes, and environmental factors all contributing to the disease's expanding burden. As the prevalence of cancer grows, there is a greater need for novel biomarkers to improve cancer detection, diagnosis, prognosis, and treatment. Genomic technologies like next-generation sequencing (NGS), microarray analysis, and digital PCR have transformed cancer biomarker identification. These methods provide thorough profiling of the cancer genome, transcriptome, and epigenome, enabling for the detection of driver mutations, fusion genes, and other genomic aberrations that contribute to cancer genesis and progression.

Insights by End Use

The biotechnology companies segment accounted for the largest market share over the forecast period 2023 to 2033. Biotechnology firms invest extensively in R&D to find and develop novel treatments, diagnostics, and personalised medicine solutions. Biomarker discovery is crucial to these R&D efforts since biomarkers are used to identify targets, validate them, stratify patients, and monitor therapy outcomes. Outsourcing biomarker discovery services enables biotechnology companies to have access to specialised skills, technologies, and resources, accelerating their R&D pipeline. Biomarker discovery necessitates transdisciplinary knowledge in fields such as genetics, proteomics, bioinformatics, and clinical research. Biotechnology firms may not have in-house competence in all of these disciplines. Outsourcing biomarker discovery services gives biotechnology businesses access to specialised experience and capabilities found at CROs, academia research centres, and specialised laboratories, allowing them to enhance their internal capabilities and speed biomarker discovery efforts.

Insights by Type

The surrogate biomarkers segment accounted for the largest market share over the forecast period 2023 to 2033. Surrogate biomarkers are substitute endpoints that can accurately predict clinical outcomes like disease progression, therapy response, and patient survival. Pharmaceutical companies can speed up medication development, shorten trial times, and cut costs by using surrogate biomarkers in clinical trials. Outsourcing biomarker discovery services that specialise in surrogate biomarkers allows pharmaceutical companies to uncover and confirm predictive biomarkers for use in clinical trials, increasing trial efficiency and success rates. Surrogate biomarkers with proven clinical utility and market demand have a high commercialization potential. Biomarker discovery outsourcing services, which specialise in surrogate biomarkers, can help pharmaceutical companies uncover biomarkers with high predictive value, strong analytical performance, and clinical utility.

Recent Market Developments

- In January 2022, Agilent Technologies Inc. has inked an MOU with Theragen Bio in South Korea to improve precision oncology using sophisticated bioinformatic technologies.

Competitive Landscape

Major players in the market

- Laboratory Corporation of America Holdings

- Charles River Laboratories

- Eurofins Scientific

- Celerion

- ICON plc.

- Parexel International (MA) Corporation

- Proteome Sciences

- GHO Capital

- Thermo Fisher Scientific Inc.

- Evotec

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Global Biomarker Discovery Outsourcing Services Market, Type Analysis

- Predictive

- Prognostic

- Safety

- Surrogate Endpoints

Global Biomarker Discovery Outsourcing Services Market, Service Analysis

- Genomics

- Proteomics

- Bioinformatics

Global Biomarker Discovery Outsourcing Services Market, Therapeutic Area Analysis

- Oncology

- Cardiology

- Cardiovascular

Global Biomarker Discovery Outsourcing Services Market, End Use Analysis

- Pharmaceutical

- Biotechnology

- Others

Biomarker Discovery Outsourcing Services Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Biomarker Discovery Outsourcing Services Market?The global Biomarker Discovery Outsourcing Services Market is expected to grow from USD 12.7 billion in 2023 to USD 34.2 billion by 2033, at a CAGR of 10.41% during the forecast period 2023-2033.

-

2. Who are the key market players of the Biomarker Discovery Outsourcing Services Market?Some of the key market players of the market are Laboratory Corporation of America Holdings; Charles River Laboratories; Eurofins Scientific; Celerion; ICON plc.; Parexel International (MA) Corporation; Proteome Sciences; GHO Capital; Thermo Fisher Scientific Inc., Evotec.

-

3. Which segment holds the largest market share?The oncology segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Biomarker Discovery Outsourcing Services Market?North America is dominating the Biomarker Discovery Outsourcing Services Market with the highest market share.

Need help to buy this report?