Global Biomedical Textiles Market Size, Share, and COVID-19 Impact Analysis, By Fiber Type (Non-Biodegradable, Biodegradable), Fabric Type (Non-Woven, Woven), Application (Non-Implantable, Surgical Sutures), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Chemicals & MaterialsGlobal Biomedical Textiles Market Insights Forecasts to 2032

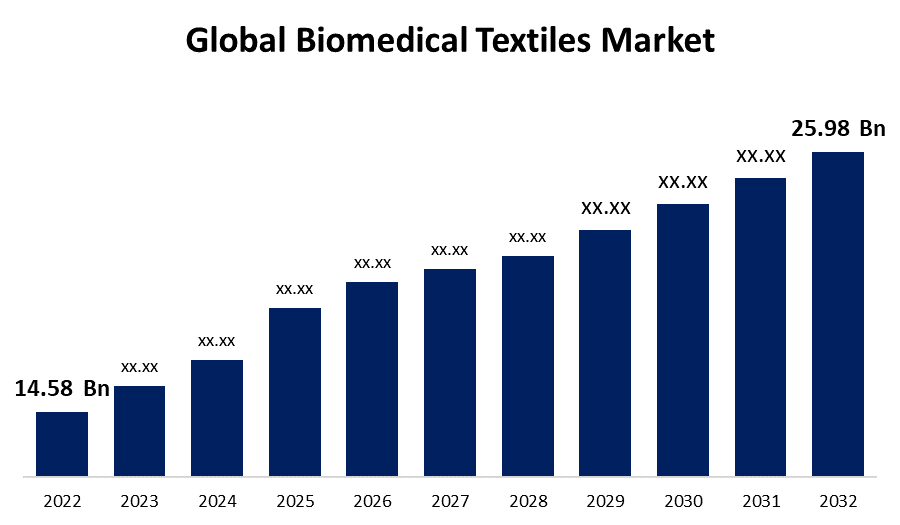

- The Global Biomedical Textiles Market Size was valued at USD 14.58 Billion in 2022.

- The Market is Growing at a CAGR of 5.9% from 2022 to 2032.

- The Worldwide Biomedical Textiles Market Size is expected to reach USD 25.98 Billion By 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Biomedical Textiles Market Size is anticipated to exceed USD 25.98 Billion By 2032, Growing at a CAGR of 5.9% from 2022 to 2032.

During the forecast period, an increasing number of surgeries, rapidly aging populations, and increased healthcare spending in emerging economies are projected to propel the biomedical textiles market.

Market Overview

Biomedical textiles are designed and engineered to meet specific medical requirements such as biocompatibility, durability, and functionality. Biomedical textiles are fibrous textiles used in medical and biological applications. The biocompatibility fabrics are used in first aid, surgery, and environmental cleaning. The performance of such textiles is determined by their biocompatibility with biological tissues and fluids. A biomedical textile must be chemically inert, sterilized, non-allergic, biocompatible, flexible, and non-toxic. This type of textile is used in a variety of medical fields, including dentistry, surgery, neurology, and cardiology. Biomedical textiles are used to make surgical sutures, tissue implants, and prosthetic organs.

Report Coverage

This research report categorizes the market for the global biomedical textiles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biomedical textiles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biomedical textiles market.

Global Biomedical Textiles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 14.58 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.9% |

| 2032 Value Projection: | USD 25.98 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Fiber Type, Fabric Type, Application, and By Region |

| Companies covered:: | Royal DSM, Johnson & Johnson, Medtronic, Cardinal Health, Integra LifeSciences Corporation, Smith & Nephew, Medline, Paul Hartmann AG, BSN Medical, ATEX Technologies, Elkem Silicones, Bally Ribbon Mills, US Biodesign, Nitto Denko Corporation, Kimberly-Clark, Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Demand for advanced wound dressing materials is increasing due to an increase in chronic wounds and surgical procedures. Furthermore, the rising demand for advanced wound dressing materials as a result of chronic diseases such as cancer, diabetes, and autoimmune diseases, among others, is one of the key factors driving the biomedical textiles market's revenue growth. Biomedical textile research and development has been funded by both the government and private organizations. These funds will be used to develop new textile materials, improve manufacturing techniques, and research novel biomedical textile applications. Research and development efforts drive market growth by facilitating the introduction of new and improved products.

Restraining Factors

Biomedical textiles are made of biocompatible materials with mechanical, dimensional, and physical properties, such as metals and polymers. Biomaterials such as polypropylene and polyester offer several advantages for the development of biomedical textiles. However, the cost of these raw materials is rising, resulting in more expensive end-use products. During the forecast period, these factors are expected to impede market revenue growth.

Market Segmentation

The Global Biomedical Textiles Market share is classified into fiber type and fabric type.

- The biodegradable segment is expected to hold the largest share of the global biomedical textiles market during the forecast period.

The global biomedical textiles market is categorized by fiber type into non-biodegradable and biodegradable. Among these, the biodegradable segment is anticipated to account for the largest share of the global biomedical textiles market. Because of their lower long-term environmental impact and compatibility with tissue regeneration, biodegradable fibers are becoming more popular in biomedical textiles. Additionally, advances in biodegradable materials and processing techniques have expanded their range of applications, propelling their use in a variety of medical devices and products.

- The non-woven segment accounted for the largest share of the global biomedical textiles market in 2022.

Based on the fabric type, the global biomedical textiles market is divided into non-woven and woven. Among these, the non-woven segment accounted for the largest share of the global biomedical textiles market in 2022. Non-woven fabrics provide critical safety properties such as infection and disease prevention by preventing cross-contamination and infection spread in a medical or surgical environment. Furthermore, non-woven are increasingly being used in the design of smart wound care products, with functions such as promoting moist wound healing environments, reducing skin adhesion, and controlling vapor transmission. Nonwoven fabrics are also more adaptable, cost-effective, disposable, and efficient than woven fabrics, leading to increased adoption of healthcare applications.

Regional Segment Analysis of the Global Biomedical Textiles Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America accounted for the largest share of the global biomedical textiles market in 2022.

Get more details on this report -

North America accounted for the largest share of the global biomedical textiles market in 2022. North America includes the United States, Canada, and Mexico. It is the largest biomedical textiles market due to high consumer awareness of biomedical products, rising demand for high-quality products, and the concentration of most of the market's key players in the country. Safety regulations and ongoing investments in R&D activities to develop advanced fabrics also contribute to the market's growth. The market is also driven by a strong export market, advanced and high-performance products, and the expansion of the medical and healthcare industries.

Asia Pacific is expected to grow at the fastest pace in the global biomedical textiles market during the forecast period. The increase in chronic wounds and surgical procedures can be attributed to the regional growth. Furthermore, increased healthcare funding and rapid growth of the healthcare industry in developing countries such as India and China are driving market revenue growth.

During the forecast period, the Europe market is anticipated to expand at a significantly robust CAGR. The increasing number of patients suffering from cardiovascular diseases in this region has led to an increase in the use of biomedical textiles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global biomedical textiles along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Royal DSM

- Johnson & Johnson

- Medtronic

- Cardinal Health

- Integra LifeSciences Corporation

- Smith & Nephew

- Medline

- Paul Hartmann AG

- BSN Medical

- ATEX Technologies

- Elkem Silicones

- Bally Ribbon Mills

- US Biodesign

- Nitto Denko Corporation

- Kimberly-Clark

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, Medtronic plc bought Affera Inc., a leading provider of cardiac arrhythmia treatment technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Biomedical Textiles Market based on the below-mentioned segments:

Global Biomedical Textiles Market, By Fiber Type

- Non-Biodegradable

- Biodegradable

Global Biomedical Textiles Market, By Fabric Type

- Non-Woven

- Woven

Global Biomedical Textiles Market, By Application

- Non-Implantable

- Surgical Sutures

Global Biomedical Textiles Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?