Global Bioplastic Utensils Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Polyhydroxyalkanoates (PHA), Polylactic Acid (PLA), Starch Blends, and Others), By Application (Institutional, Household, Food Service, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others), By End-user (Commercial and Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Bioplastic Utensils Market Insights Forecasts to 2033

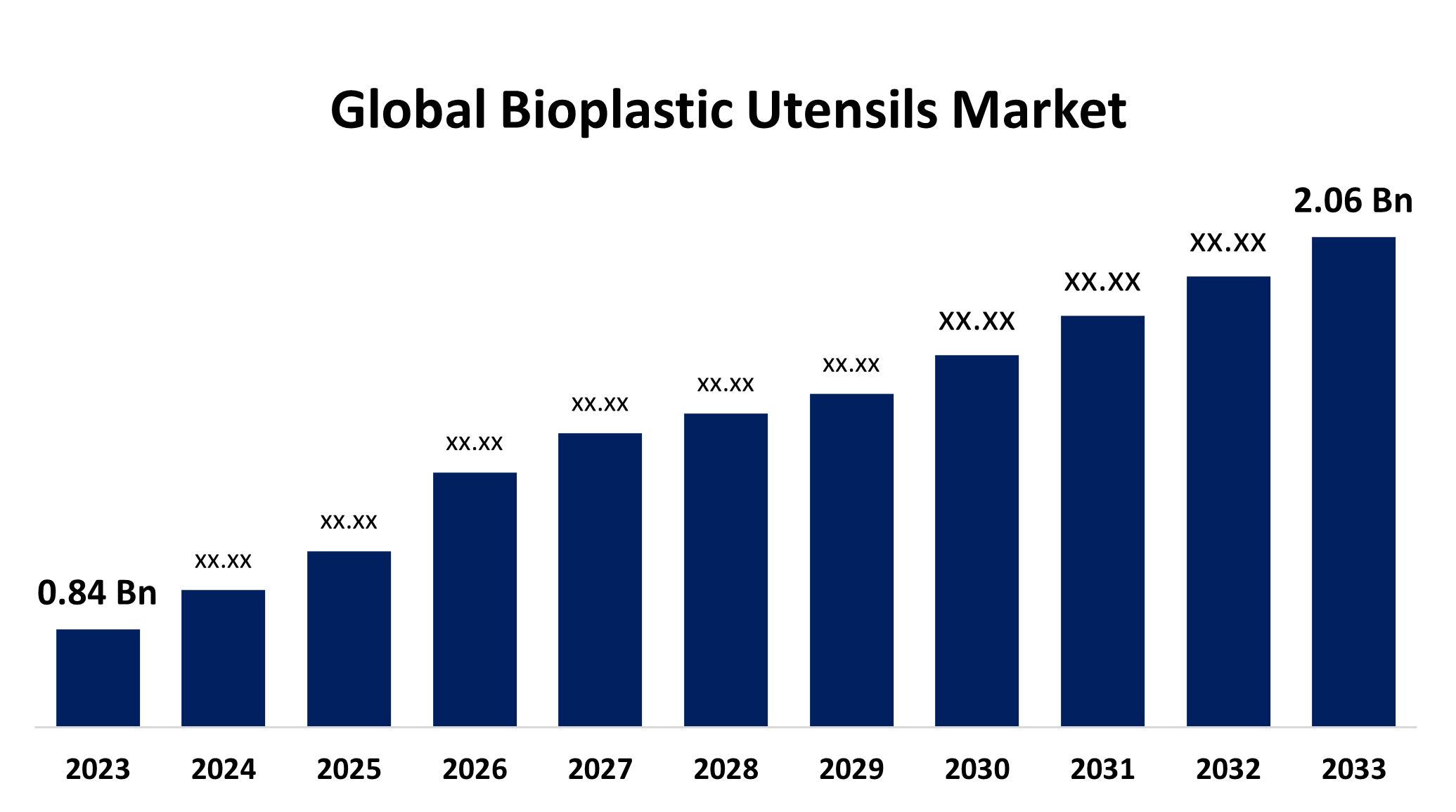

- The Global Bioplastic Utensils Market Size was estimated at USD 0.84 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 9.39% from 2023 to 2033

- The Worldwide Bioplastic Utensils Market Size is Expected to Reach USD 2.06 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Bioplastic Utensils Market Size is anticipated to cross USD 2.06 Billion by 2033, Growing at a CAGR of 9.39% from 2023 to 2033.

Market Overview

The market for utensils manufactured from organic materials and renewable resources, such as plants, is referred to as the global bioplastic utensils market. These utensils such as containers, plates, spoons, and forks. Bioplastics, which are materials obtained from renewable resources, can reduce the amount of plastic waste generated worldwide. The bioplastic utensils market expanded because more restaurants are offering quick services, such as Pizza Hut, KFC, McDonald’s, and others, bioplastic utensils are projected to become more popular in the market. It is predicted that customers' desire for food on the go will promote global market expansion and increase the use of bioplastic utensils. Additionally, it is estimated that simple access to paper plates and cups will support the expansion of the market. The market is attributed to their affordability and safety; bioplastic utensils are widely used in commercial industries such as restaurants, hotels, and catering services, and their increasing use.

Also, the government's initiatives aid in the expansion of the bioplastic utensils market, for instance, the Indian government is being encouraged for usage of bioplastics. Initiatives such as the “Swachh Bharat Abhiyan” (Clean India Mission) have promoted the prohibition of single-use plastic products, which could build up a market for bio-based substitutes.

Report Coverage

This research report categorizes the bioplastic utensils market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the excavator bucket market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bioplastic utensils market.

Global Bioplastic Utensils Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.84 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 9.39% |

| 023 – 2033 Value Projection: | USD 2.06 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Material Type, By Application, By Distribution Channel and By Regional Analysis |

| Companies covered:: | Biopak, Eco-Products, Inc, Ecogreen International, PrimeWare, Trellis Earth, BioMass Packaging, World Centric, Bionatic GmbH, GreenGood, Better Earth, NatureHouse Green, BioGreenChoice, GreenHome, Vegware, Biodegradable Food Service, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bioplastic utensils market has expanded due to growing environmental consciousness and a trend toward sustainable products. The need for alternatives to conventional plastic utensils is rapidly increasing as customers grow more environmentally concerned. Additionally, the market driven by improved bioplastic technology, such as the creation of novel biodegradable materials, offers producers the opportunity to produce products that are both superior and satisfy consumer demands. In addition, the market was propelled because of the advances in the production of biopolymers have produced bioplastics that are as durable and useful as traditional plastics, while also being more environmentally friendly. Improved performance attributes such as strength, flexibility, and heat resistance have expanded the range of applications for bioplastics, leading to their adoption in many industries, including household and food service. furthermore, it is estimated that continuous research and development efforts will improve bioplastic formulations, which will promote market development. The market penetration and growth increased due to social media and other digital platforms have increased awareness of the negative impacts of plastic waste and the advantages of bioplastics.

Restraining Factors

The market expansion is restricted because of their complex processing, high cost, and potential for harmful emissions, bioplastic utensils manufactured from corn and soybeans are at risk of infection by chemicals. Another major barrier is that bioplastics are more expensive than conventional plastics. In addition, some consumers are usually unaware of the benefits of bioplastic utensils which contribute to reducing the acceptance rate in particular areas. The variation can disrupt the expansion of the market and demand more educational initiatives from producers and environmental organizations.

Market Segmentation

The bioplastic utensils market share is classified into material type, application, distribution channel, and end-user.

- The polylactic (PLA) segment held the largest share of 50.33% in 2023 and is estimated to grow at a CAGR of 8.74% throughout the projection period.

Based on the material type, the global bioplastic utensils market is categorized into polyhydroxyalkanoates (PHA), polylactic acid (PLA), starch blends, and others. Among these, the polylactic (PLA) segment held the largest share of 50.33% in 2023 and is estimated to grow at a CAGR of 8.74% throughout the projection period. The segment expansion is due to PLA being a popular material for constructing bioplastic utensils since it is made from renewable resources such as sugarcane or corn starch. The substance is an environmentally beneficial option for plastic obtained from petroleum as it is both biodegradable and compost. The PLA is estimated to continue in high demand due to its beneficial properties and increasing environmental stability consciousness.

- The food service segment accounted for the largest market share in 2023 and is estimated to grow at a CAGR of 7.83% throughout the projection period.

Based on the application, the global bioplastic utensils market is classified into institutional, household, food service, and others. Among these, the food service segment accounted for the largest market share in 2023 and is estimated to grow at a CAGR of 7.83% throughout the projection period. This segment is attributed because it creates a high demand for disposable utensils. This segment expanded due to bioplastic utensils being used more and more by cafes, catering services, and restaurants to meet regulations and lessen their environmental effect. Another driving factor is the demand for disposable bioplastic utensils has been further stimulated by the growing trend of delivery and ordering services, making the food service industry an essential area for market expansion.

- The online stores segment held a significant market share in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the global bioplastic utensils market is divided into supermarkets and hypermarkets, specialty stores, online stores, and others. Among these, the online stores segment held a significant market share in 2023 and is anticipated to grow at the fastest CAGR during the forecast period. Online stores have gained popularity as a distribution channel for bioplastic cutlery due to their comprehensive product selection and ease of use. Customers can easily use various brands and varieties of bioplastic utensils on e-commerce platforms, often at inexpensive prices. The growth of this market is estimated to be promoted by the trend of online shopping and the expansion of the growing penetration of the Internet. To help customers make well-informed purchasing decisions, online store vendors also provide comprehensive product details and user reviews.

- The residential segment dominated the bioplastic utensils market share in 2023 and is expected to grow at a CAGR of 8.38% during the forecast period.

Based on the end-user, the global bioplastic utensils market is divided into commercial and residential. Among these, the residential segment dominated the bioplastic utensils market share in 2023 and is expected to grow at a CAGR of 8.38% during the forecast period. Residents are choosing bioplastic utensils as a sustainable option as a result of increasing awareness about the negative environmental effects of plastic waste. The variety of available bioplastic utensils, from long-lasting utensils to throwing utensils, is fulfilling various demands of residential customers. The requirement for bioplastic utensils in the residential market is estimated to increase as more residences accept environmentally friendly lifestyles.

Regional Segment Analysis of the Bioplastic Utensils Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

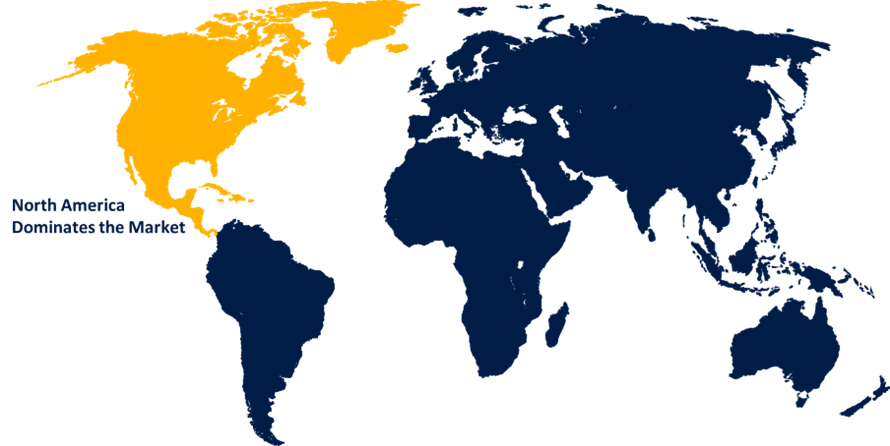

North America is anticipated to hold the largest share of the bioplastic utensils market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the bioplastic utensils market over the predicted timeframe. The United States and Canada are the main suppliers of the bioplastic utensil market in North America, which contributes to the market of the region. In addition, the adoption of bioplastic utensils gives significant emphasis on strict laws and the environmental stability of the region against plastic waste. Additionally, the market is increasing due to North America's growing consumer awareness and preference for environmentally friendly products. An important end-user of bioplastic utensils in the area is the food services sector, especially due to the distribution and extended popularity of tech-out services. It is estimated that North America will continue to grow in the forecast period.

Asia Pacific is expected to grow at the fastest CAGR growth of the bioplastic utensils market during the forecast period. The region's market is driven by government efforts to limit plastic waste and growing environmental consciousness. In addition, stricter laws against single-use plastics are being implemented in nations such as China, India, and Japan, which is expected to increase demand for bioplastic utensils. Additionally, the region's sizable population and growing disposable incomes fuel the expansion of the market for sustainable products. Furthermore, the market is attributed to growing several food joints and restaurants in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bioplastic utensils market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biopak

- Eco-Products, Inc

- Ecogreen International

- PrimeWare

- Trellis Earth

- BioMass Packaging

- World Centric

- Bionatic GmbH

- GreenGood

- Better Earth

- NatureHouse Green

- BioGreenChoice

- GreenHome

- Vegware

- Biodegradable Food Service

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Loliware introduced a new seaweed-based resin designed for injection molding, enabling the production of their Seaweed Utensil Set. This innovation allows for the creation of compostable utensils using standard plastic injection molding equipment, offering a sustainable alternative to traditional plastic cutlery.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the bioplastic utensils market based on the below-mentioned segments:

Global Bioplastic Utensils Market, By Material Type

- Polyhydroxyalkanoates (PHA)

- Polyacetic Acid (PLA)

- Starch Blends

- Others

Global Bioplastic Utensils Market, By Application

- Institutional

- Household

- Food Service

- Others

Global Bioplastic Utensils Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Global Bioplastic Utensils Market, By End-user

- Commercial

- Residential

Global Bioplastic Utensils Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the bioplastic utensils market over the forecast period?The bioplastic utensils market is projected to expand at a CAGR of 9.39% during the forecast period.

-

2. What is the market size of the bioplastic utensils market?The Global Bioplastic Utensils Market Size is Expected to Grow from USD 0.84 Billion in 2023 to USD 2.06 Billion by 2033, at a CAGR of 9.39% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the bioplastic utensils market?North America is anticipated to hold the largest share of the bioplastic utensils market over the predicted timeframe.

-

1. What is the CAGR of the screen protective film market over the forecast period?The screen protective film market is projected to expand at a CAGR of 4.63% during the forecast period.

-

2. What is the market size of the screen protective film market?The Global Screen Protective Film Market Size is Expected to Grow from USD 22.14 Billion in 2023 to USD 34.80 Billion by 2033, at a CAGR of 4.63% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the screen protective film market?North America is anticipated to hold the largest share of the screen protective film market over the predicted timeframe.

Need help to buy this report?