Global Bitcoin Payment Ecosystem Market Size, Share, and COVID-19 Impact Analysis, By Type (Hardware, Software, Services), By Application (Decentralize Identity, Decentralize Organization, Smart Contacts, ATMs, Analytics and Big data, Trading Marketplaces, Others), By End User (Government, Enterprises, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Information & TechnologyGlobal Bitcoin Payment Ecosystem Market Insights Forecasts to 2032

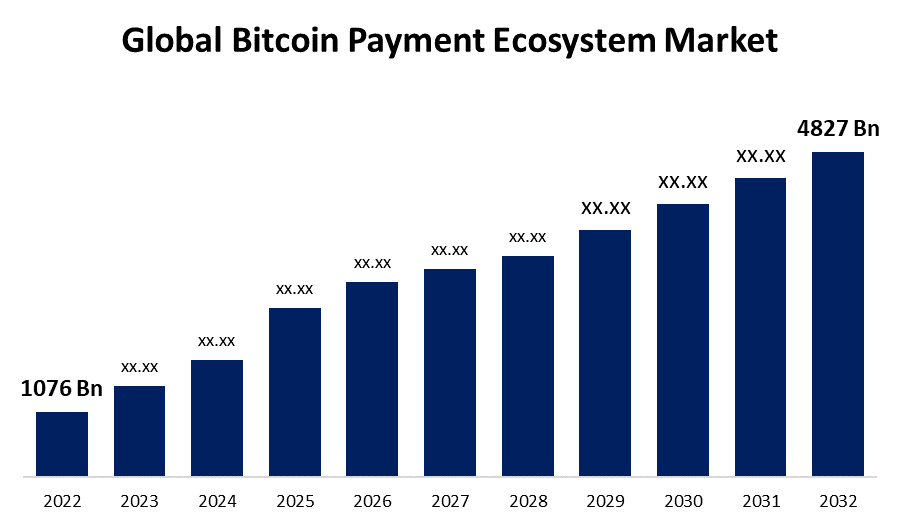

- The Global Bitcoin Payment Ecosystem Market Size was valued at USD 1076 Billion in 2022.

- The Market Size is Growing at a CAGR of 16.19% from 2022 to 2032.

- The Worldwide Bitcoin Payment Ecosystem Market is expected to reach USD 4827 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Bitcoin Payment Ecosystem Market Size is expected to reach USD 4827 Billion by 2032, at a CAGR of 16.19% during the forecast period 2022 to 2032.

The network of online resources and technological advancements that facilitate cryptocurrency transactions is known as the crypto ecosystem. It is built with blockchain technology. This technology enables the secure and decentralized storage and exchange of digital assets. Growing exchange markets, non-compliance, and the growing flexibility of commercial transactions in e-commerce industries are some of the factors contributing to the analysis of the bitcoin payment ecosystem's significant growth during the forecast period. In addition, increasing digital ledger adoption in the bitcoin payment ecosystem to reduce the risk of cyber-attacks and financial fraud tends to boost consumer interest in cryptocurrency, which is expected to drive the bitcoin payment ecosystem market growth. Furthermore, the use of physical wallets for cryptocurrency payment is expected to boost the bitcoin payment ecosystem market. The cryptocurrencies stored in these wallets are kept offline, lowering the risk of hacking. These continuing security developments and payment convenience are expected to propel the bitcoin payment ecosystem market growth around the world. Moreover, innovation and market expansion are being propelled by the increase in series funding for start-ups providing payment services. Increased funding allows these start-ups to create cutting-edge technologies and user-friendly interfaces, making bitcoin payments more accessible and convenient.

Global Bitcoin Payment Ecosystem Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1076 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.19% |

| 2032 Value Projection: | USD 4827 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By End User, By Region |

| Companies covered:: | BitPay, Avalon, Mt. Gox, Coinsetter, BitcoinX, Nvidia, Butterfly labs, Coinbase, ATI, Bitcoin Foundation, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

These government regulations are expected to significantly increase demand for the bitcoin payment ecosystem, boosting its market growth. Using cryptocurrencies like Bitcoin, mainstream banking and other financial institutions that are required to offer their clients safe and compliant services can initiate the next wave of financial transactions. New technology in the areas of identity management, compliance management, reporting, and analytics must be developed. This new technology must eventually protect the customer, and the financial system represents a chance for bitcoin to scale to the masses. During the forecast period, these regulations are expected to drive significant growth in the bitcoin payment ecosystem market.

Restraining Factors

Market Segmentation

The volatility of bitcoin prices is one of the main factors impeding the growth of the bitcoin payment ecosystem market. Bitcoin prices are extremely volatile, rapidly rising and falling. Many speculators around the world want to profit from it, but genuine investors see it as too risky, discouraging users from investing in bitcoins. This factor tends to hamper the market growth of the bitcoin payment ecosystem.

By Type Insights

The hardware segment dominates the market with the largest revenue share over the forecast period.

On the basis of type, the global bitcoin payment ecosystem market is segmented into hardware, software, and services. Among these, the hardware segment is dominating the market with the largest revenue share over the forecast period. The reality of thousands of hardware devices running the bitcoin application or program all over the world. The hardware segment includes a variety of equipment such as operating systems, power sources, and other components that work together to operate and solve cryptography. This hardware is made up of thousands of miners that are used to power computers all over the world. This hardware is intended to validate blocks and hashes by locating the crypto.

By Application Insights

The trading marketplaces segment is witnessing significant growth over the forecast period.

On the basis of application, the global bitcoin payment ecosystem market is segmented into decentralized identity, decentralized organization, smart contacts, ATMs, analytics and big data, trading marketplaces, and others. Among these, the trading marketplaces segment is witnessing significant growth over the forecast period. The growing demand for business-related security, fraud prevention, regionalized networks, low prices, customer payroll safety, and quick foreign transactions is expected to drive the bitcoin payment gateway market in trading marketplace applications. A bitcoin payment gateway provides transactions regardless of amount or destination, making it the most widely used payment gateway solution for trading marketplace applications.

By End User Insights

The enterprise segment is expected to hold the largest share of the global bitcoin payment ecosystem market during the forecast period.

Based on the end user, the global bitcoin payment ecosystem market is classified into government, enterprises, and others. Among these, the enterprise segment is expected to hold the largest share of the Bitcoin Payment Ecosystem Market during the forecast period. Bitcoin and other digital assets are being used by an increasing number of businesses around the world for a variety of investment, operational, and transactional purposes. Bitcoin payments are now accepted by major retailers for everything from groceries to airline tickets. It is expected to capture market growth over the forecast period.

Regional Insights

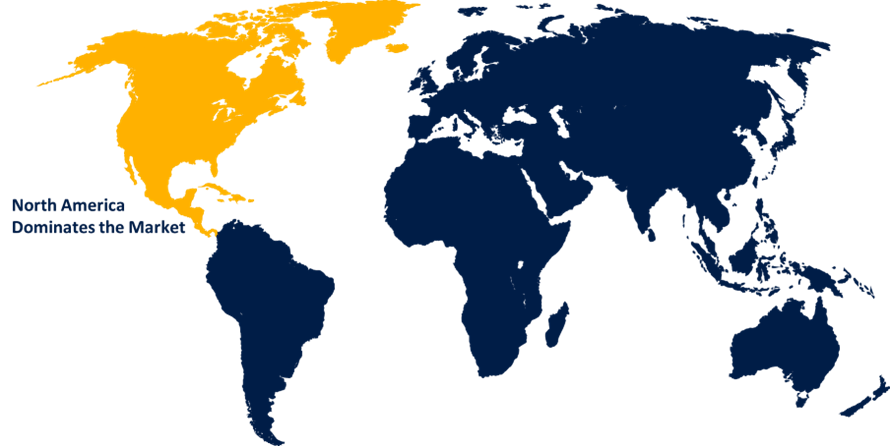

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with the largest market share over the forecast period. The bitcoin payment ecosystem market developed as a result of the early acceptance of bitcoin as a means of exchange for payment rather than currency purposes across a wide range of applications. Government regulations to legalise the use of bitcoin for various transaction and trading applications is one of the major factors driving the bitcoin payment ecosystem market in the North America region. The market is being driven by consumer and retailer acceptance of digital currencies. Furthermore, the success of bitcoin mining and the involvement of several major players dominate the North American market.

Asia Pacific is expected to grow the fastest during the forecast period. The advantages that Bitcoin has over conventional payment methods are what are driving its increasing demand and acceptance in Asia Pacific. Faster transaction speeds, lower fees, enhanced security, greater transparency, and global reach are among the benefits. These characteristics are valued by both businesses and consumers, propelling bitcoin adoption as a mainstream payment option. Furthermore, technological advancements are a major driver of the Asia Pacific market. With advanced payment solutions and a surge in bitcoin acceptance, Asia Pacific is expected to capture a sizable share of the market.

List of Key Market Players

- BitPay

- Avalon

- Mt. Gox

- Coinsetter

- BitcoinX

- Nvidia

- Butterfly labs

- Coinbase

- ATI

- Bitcoin Foundation

Key Market Developments

- In September 2023, the world's leading financial technology company, MoneyGram International, Inc. announced plans to introduce its own non-custodial digital wallet live at the Stellar Development Foundation Annual Meridian conference.

- In October 2023, TICPAY, a UK-based e-wallet provider, partnered with Binance Pay to streamline cryptocurrency payments within its e-wallet platform. The collaboration aims to increase STICPAY users' access to various top cryptocurrencies. Essentially, STICPAY users can now deposit funds easily using Binance Pay.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global bitcoin payment ecosystem market based on the below-mentioned segments:

Bitcoin Payment Ecosystem Market, Type Analysis

- Hardware

- Software

- Services

Bitcoin Payment Ecosystem Market, Application Analysis

- Decentralize Identity

- Decentralize Organization

- Smart Contacts

- ATMs

- Analytics and Big data

- Trading Marketplaces

- Others

Bitcoin Payment Ecosystem Market, End-User Analysis

- Government

- Enterprises

- Others

Bitcoin Payment Ecosystem Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?