Global Blind Spot Solutions Market Size, Share, and COVID-19 Impact Analysis, By Technology (Camera-based system, Radar-based system, Ultrasonic-based system), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Truck, Bus), By Sales Channel (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023-2033

Industry: Automotive & TransportationGlobal Blind Spot Solutions Market Insights Forecasts to 2033

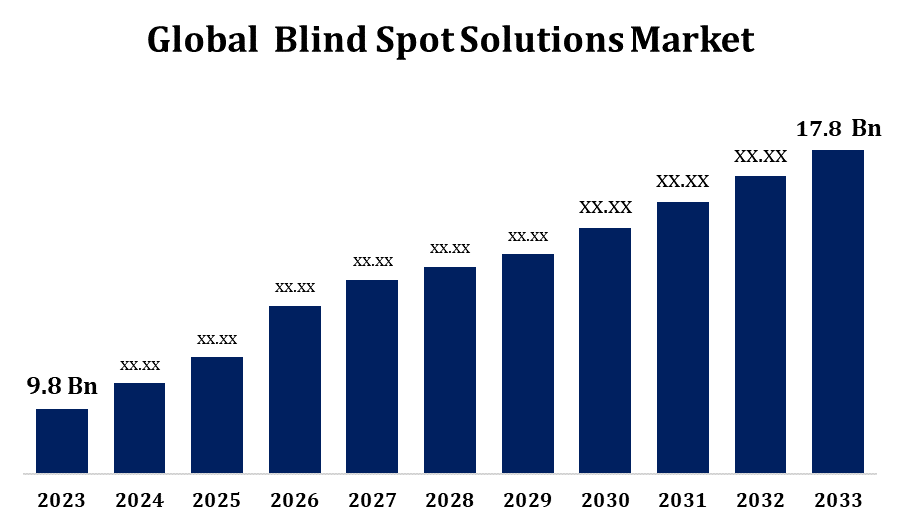

- The Blind Spot Solutions Market Size was Valued at USD 9.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.15% from 2023 to 2033.

- The Global Blind Spot Solutions Market Size is Expected to reach USD 17.8 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Blind Spot Solutions Market Size is Expected to reach USD 17.8 Billion by 2033, at a CAGR of 6.15% during the forecast period 2023 to 2033.

The Global Blind Spot Solutions Market is witnessing steady Growth, driven by the rising demand for enhanced vehicle safety and advanced driver-assistance systems (ADAS). As road safety awareness increases, more automotive manufacturers are integrating technologies like radar, cameras, and ultrasonic sensors to detect vehicles or obstacles in blind spots. The market is further supported by stricter government regulations mandating the inclusion of safety features in vehicles. North America and Europe currently lead the market due to early adoption of safety technologies and supportive regulatory environments. Meanwhile, the Asia-Pacific region is rapidly emerging, propelled by growing vehicle production and urbanization. Despite challenges such as high installation costs and limited consumer awareness in some regions, technological advancements and increasing emphasis on vehicle safety are expected to sustain market momentum in the coming years.

Blind Spot Solutions Market Value Chain Analysis

The value chain of the Blind Spot Solutions market involves several key stages, starting with raw material suppliers providing components like sensors, cameras, and control units. These are followed by technology developers who design and engineer blind spot detection systems using radar, ultrasonic, or camera-based technologies. Next, system integrators and manufacturers incorporate these solutions into vehicles, often in collaboration with automotive OEMs. Tier-1 suppliers play a crucial role in customizing and assembling systems for different vehicle models. Distribution channels include direct sales to automakers and aftermarket suppliers for retrofit applications. Aftermarket service providers handle installation, maintenance, and upgrades. The final stage includes end-users, such as individual consumers and commercial fleet operators. Regulatory bodies and industry standards also influence the value chain by guiding compliance and safety requirements throughout product development and deployment.

Blind Spot Solutions Market Opportunity Analysis

The Blind Spot Solutions market presents significant opportunities amid the global push for enhanced road safety and the proliferation of advanced driver-assistance systems (ADAS). Stricter safety regulations in regions like North America and Europe are compelling automakers to integrate blind spot detection technologies into a broader range of vehicles, including mid-range and economy models. Emerging markets, particularly in Asia-Pacific, are experiencing rapid growth due to urbanization, increased vehicle ownership, and rising consumer awareness about vehicle safety. Technological advancements, such as the integration of artificial intelligence and machine learning, are enhancing the accuracy and reliability of these systems. Furthermore, the growing adoption of electric and autonomous vehicles necessitates sophisticated safety features, including blind spot monitoring. Collaborations between automotive manufacturers and tech companies are fostering the development of innovative, integrated safety solutions.

Global Blind Spot Solutions Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.15% |

| 2033 Value Projection: | USD 17.8 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Sales, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Autoliv Inc., Continental AG, Delphi Automotive LLP, Denso Corporation, Robert Bosch GmbH, Magna International Inc., Hella KGaA Hueck & Co., Valeo SA, Samvardhana Motherson Reflected, Ficosa International S.A., Gentex Corporation, ZF Friedrichshafen AG, Mobileye N.V., Stoneridge, Inc., Quanergy Systems, Inc., Hitachi Automotive Systems Ltd., Muth Mirror Systems, LLC, WABCO Holdings Inc., Preco Electronics, Inc., Aptiv PLC and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Market Dynamics

Blind Spot Solutions Market Dynamics

Growing consumer preference for advanced vehicle safety technologies

The Blind Spot Solutions market is experiencing robust growth, driven by the growing consumer preference for advanced vehicle safety technologies. As drivers become more aware of the risks associated with blind spots, demand for systems that enhance situational awareness and prevent collisions is rising. Automakers are increasingly integrating blind spot detection and monitoring features into vehicles across all segments, including compact and mid-range models. Technological advancements such as AI-based detection, sensor fusion, and real-time alerts are further improving system accuracy and reliability. Additionally, the rise in road accidents and stricter government regulations mandating safety features are pushing manufacturers to adopt these solutions. The expanding electric and autonomous vehicle market also presents new opportunities, as these vehicles require comprehensive safety systems. This increasing emphasis on safety is expected to fuel continuous market expansion globally.

Restraints & Challenges

The Blind Spot Solutions market faces several challenges that could impede its growth. High implementation costs, due to advanced sensors and radar technologies, limit adoption, especially in price-sensitive segments. Integration into existing vehicle architectures, particularly older models, poses technical difficulties, requiring significant modifications. Sensor performance can be compromised by adverse weather conditions, affecting system reliability. Rapid technological advancements necessitate continuous investment in research and development, straining resources for smaller manufacturers. Navigating diverse regulatory landscapes across regions adds complexity, potentially delaying product launches. Supply chain disruptions, such as semiconductor shortages, can hinder production and increase costs. Additionally, consumer awareness and understanding of blind spot technologies remain limited in some markets, affecting demand. Addressing these challenges is crucial for sustained market expansion.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Blind Spot Solutions Market from 2023 to 2033. In the U.S. and Canada, heightened awareness of road safety and a preference for premium vehicles equipped with state-of-the-art safety technologies are propelling market expansion. The U.S. government is implementing regulations that mandate advanced safety features in new vehicles, further boosting the demand for blind spot detection systems. Radar-based technologies dominate the market due to their effectiveness in various driving conditions. The commercial vehicle segment, particularly heavy trucks, is also witnessing increased adoption of blind spot detection systems to enhance safety and comply with regulatory standards. Technological advancements, including AI-powered detection systems, are enhancing vehicle safety and contributing to market growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, and Japan are at the forefront, with a surge in demand for advanced driver-assistance systems (ADAS) in both passenger and commercial vehicles. Radar-based technologies dominate the market, offering reliable performance across diverse driving conditions. The proliferation of electric vehicles (EVs) further amplifies the need for sophisticated safety features, including blind spot detection systems. Original Equipment Manufacturers (OEMs) are leading the market, integrating these solutions into new vehicle models to meet regulatory standards and consumer expectations.

Segmentation Analysis

Insights by Technology

The radar-based system segment accounted for the largest market share over the forecast period 2023 to 2033. Radar systems outperform camera and ultrasonic technologies by effectively detecting objects in low visibility scenarios such as fog, rain, or darkness. This reliability has led to widespread adoption in both passenger and commercial vehicles, with radar being the leading technology in the global blind spot detection system market. Technological advancements, including the development of 77GHz sensors, have enhanced detection capabilities, making radar systems more efficient and cost-effective. Additionally, the integration of radar-based systems with other advanced driver-assistance systems (ADAS) features, such as adaptive cruise control and lane-keeping assist, is enhancing overall vehicle safety. The growing emphasis on vehicle safety, coupled with regulatory mandates for advanced safety features, is further propelling the demand for radar-based blind spot detection systems.

Insights by Vehicle Type

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. This growth is driven by heightened consumer awareness of road safety and a preference for vehicles equipped with advanced driver-assistance systems (ADAS). Automakers are responding by integrating blind spot detection systems into a wider range of passenger vehicles, including mid-range models, to meet consumer expectations and differentiate their products in a competitive market . Additionally, regulatory initiatives mandating the inclusion of safety features in vehicles are further boosting the adoption of blind spot detection systems in the passenger car segment. As a result, the passenger cars segment is poised for continued expansion, contributing significantly to the overall growth of the Blind Spot Solutions market.

Insights by Sales Channel

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Automakers are increasingly offering blind spot detection systems as standard or optional features to meet consumer demand for enhanced safety and comply with regulatory standards. With growing consumer awareness of road safety, OEMs are responding by equipping a wider range of vehicles, including mid-range and economy models, with blind spot monitoring systems. Additionally, the rise in autonomous and semi-autonomous vehicles is further accelerating the adoption of these systems. Regulatory mandates requiring the inclusion of advanced driver-assistance systems (ADAS) in vehicles are also pushing OEMs to incorporate blind spot detection technologies into their offerings, thereby driving market growth in the OEM segment.

Recent Market Developments

- In January 2022, GILLIG LLC and RR.AI have formed a partnership to develop next-generation Advanced Driver Assistance Systems (ADAS) and SAE Level 4 Autonomous Vehicle (AV) technology for GILLIG’s transit buses across North America.

Competitive Landscape

Major players in the market

- Autoliv Inc.

- Continental AG

- Delphi Automotive LLP

- Denso Corporation

- Robert Bosch GmbH

- Magna International Inc.

- Hella KGaA Hueck & Co.

- Valeo SA

- Samvardhana Motherson Reflected

- Ficosa International S.A.

- Gentex Corporation

- ZF Friedrichshafen AG

- Mobileye N.V.

- Stoneridge, Inc.

- Quanergy Systems, Inc.

- Hitachi Automotive Systems Ltd.

- Muth Mirror Systems, LLC

- WABCO Holdings Inc.

- Preco Electronics, Inc.

- Aptiv PLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Blind Spot Solutions Market, Technology Analysis

- Camera-based system

- Radar-based system

- Ultrasonic-based system

Blind Spot Solutions Market, Vehicle Type Analysis

- Passenger Cars

- Light Commercial Vehicles

- Truck

- Bus

Blind Spot Solutions Market, Sales Channel Analysis

- OEM

- Aftermarket

Blind Spot Solutions Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Blind Spot Solutions Market?The global Blind Spot Solutions Market is expected to grow from USD 9.8 billion in 2023 to USD 17.8 billion by 2033, at a CAGR of 6.15% during the forecast period 2023-2033.

-

2. Who are the key market players of the Blind Spot Solutions Market?Some of the key market players of the market are Autoliv Inc., Continental AG, Delphi Automotive LLP, Denso Corporation, Robert Bosch GmbH, Magna International Inc., Hella KGaA Hueck & Co., Valeo SA, Samvardhana Motherson Reflected, Ficosa International S.A., Gentex Corporation, ZF Friedrichshafen AG, Mobileye N.V., Stoneridge, Inc., Quanergy Systems, Inc., Hitachi Automotive Systems Ltd., Muth Mirror Systems, LLC, WABCO Holdings Inc., Preco Electronics, Inc., Aptiv PLC.

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?