Global Blown Oil Base Oil Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Mineral Oil, Synthetic Oil, Bio-based Oil), By Application (Automotive, Industrial, Marine, Aviation, and Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Blown Oil Base Oil Market Insights Forecasts to 2033

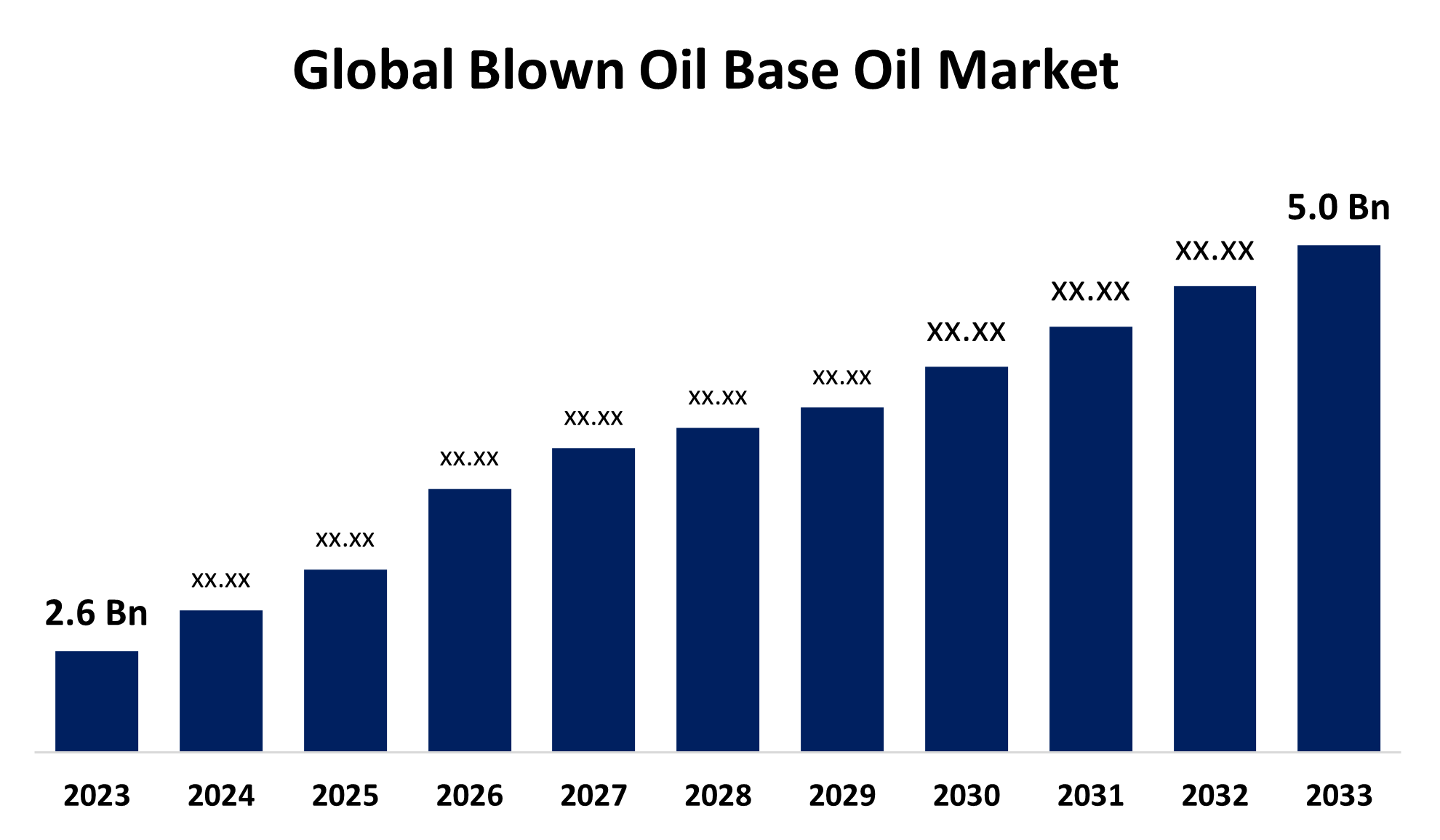

- The Global Blown Oil Base Oil Market Size was Valued at USD 2.6 Billion in 2023

- The Market Size is Growing at a CAGR of 6.76% from 2023 to 2033

- The Worldwide Blown Oil Base Oil Market Size is Expected to Reach USD 5.0 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Blown Oil Base Oil Market Size is anticipated to exceed USD 5.0 Billion by 2033, growing at a CAGR of 6.76% from 2023 to 2033. Growing demand in the automotive, industrial, and manufacturing sectors along with sustainability trends is driving the blown oil base oil market. Growth in emerging regions, advancement in technology, and more environmentally friendly solutions, especially in bio-based oils, will further boost the market expansion.

Market Overview

Oil-blown base oils form one of the modified versions of base oils obtained upon processing in combination with air-heating natural oil such as heating castor oil, soybean, and linseed oil under air-oxygen streams. The blown oil increases viscosity, better oxidation, and film-strength oxidation stability. Thus, it forms a product that is more useful by improving lubricants and applied in different automotive industries. Moreover, these lubricating oils are used across industries, such as automotive, industrial machinery, metalworking, and coatings due to their performance benefits and environmental characteristics. Growing industrialization, automotive growth, and demand for heavy machinery push the requirement for high-performance lubricants. For instance, in March 2023, Exxon Mobil Corporation made an investment of nearly INR 900 crore or USD 110 million to develop a lubricant manufacturing plant at Maharashtra Industrial Development Corporation's Isambe Industrial Area in Raigad. The new plant would produce 159,000 kiloliters of finished lubricants per year. Commercial start-up is anticipated by 2025. Eco-friendly and biodegradable properties of blown oils follow sustainability trends, whereas improvements in air-blowing advance quality and versatility. Emerging markets and customization capabilities expand applications, supported by regulatory policies favoring bio-based products, which presents a huge opportunity for growth in the blown oil base oil market. For instance, in August 2020, Chevron Products Company and Novvi LLC announced the successful production of the first 100% renewable base oil at Novvi's Deer Park facility in Houston, which represents a major milestone in the sustainable manufacture of lubricants.

Report Coverage

This research report categorizes the global blown oil base oil market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global blown oil base oil market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global blown oil base oil market.

Global Blown Oil Base Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.6 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.76% |

| 023 – 2033 Value Projection: | USD 5.0 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 249 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Product Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | ExxonMobil Corporation, Royal Dutch Shell PLC, Chevron Corporation, TotalEnergies SE, SABIC (Saudi Basic Industries Corporation), Hindustan Petroleum Corporation Limited (HPCL), BP PLC, Lubrizol Corporation, Neste Corporation, Indian Oil Corporation Limited (IOCL), SK Innovation Co., Ltd., Castrol Limited (BP Group), and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing industrial automation, a higher focus on energy-efficient machinery, and a growing demand for sustainable lubricants drive market growth. The blown oils' unique viscosity and thermal stability meet evolving industrial requirements. Expanding applications in diverse sectors coupled with innovations in manufacturing processes and favorable environmental regulations further drive the demand, especially in developing economies looking for advanced solutions. For instance, in September 2023, Petronas agreed with Pertamina to explore the possibility of the companies building a base oil plant at Pertamina's fuels refinery in Cilacap, Indonesia.

There are numerous investments and developments in business practices that are enhancing the demand for engine oil, which can help increase the market for base oil. For instance, in April 2023, Brakes India announced that it would be entering the lubricants segment through the Revia brand. The company is thus diversifying into the engine oil space, catering to the passenger car and commercial vehicle segments.

Restraints & Challenges

The market is facing risks, including raw material price instability owing to reliance on natural oils, synthetic alternatives based on cost and performance value, and severe environmental policies. Limited awareness in growing markets and a high-cost entry for high-tech manufacturing technology further hamper growth in the market.

Market Segmentation

The global blown oil base oil market share is classified into product type and application.

- The bio-based oil segment is expected to hold the largest share of the global blown oil base oil market during the forecast period.

Based on product type, the global blown oil base oil market is categorized as mineral oil, synthetic oil, bio-based oil. Among these, bio-based oil segment is expected to hold the largest share of the global blown oil base oil market during the forecast period. This dominance can be attributed to their eco-friendliness and biodegradable properties, coupled with increasing environmental regulations and sustainability initiatives. The growing interest in renewable resources in industrial applications has further increased the demand for bio-based oils against their mineral and synthetic counterparts.

- The automotive segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global blown oil base oil market is categorized as automotive, industrial, marine, aviation, and others. Among these, the automotive segment is expected to grow at the fastest CAGR during the forecast period. This growth is due to increased vehicle production, higher consumer demand for high-performance lubricants, and stringent emission regulations that require advanced lubrication solutions. The ever-expanding automotive industry with technological advancement contributes to accelerated growth.

Regional Segment Analysis of the Global Blown Oil Base Oil Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global blown oil base oil market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global blown oil base oil market over the forecast period. This is because of rapid industrialization, especially in the automotive, manufacturing, and machinery industries, where high demand for advanced lubricants is observed. The increasing production of automobiles in the region, particularly in China and India, along with government initiatives towards sustainability, increases the adoption of high-performance, eco-friendly oils, which makes APAC the market leader. For instance, according to the data that has been published by the National Bureau of Statistics, China's industrial output increased by 4.5% year-on-year in April 2024. Additionally, large-scale lubricant manufacturers in Japan are banking on long-term supply contracts to supply base oil within the domestic market. Recently, for instance, in October 2023, Idemitsu Kosan Co. Ltd entered an MoU for long-term stable procurement of group III base oil.

North America is expected to grow at the fastest CAGR growth of the global blown oil base oil market during the forecast period. This growth is driven by strong automotive and industrial sectors in the U.S. and Canada, driving the demand for high-performance lubricants. Additionally, North America leads in technological advancements and R&D for specialized oils. Stringent environmental regulations promoting eco-friendly, bio-based oils further support the adoption of blown oil base oils, positioning the region as a key growth contributor. Moreover, North America is also a leader in technology, which supports the development of advanced synthetic and bio-based oils. Though the region is a mature market, environmental regulations and electric vehicle trends are likely to influence growth in the future.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global blown oil base oil market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Corporation

- Royal Dutch Shell PLC

- Chevron Corporation

- TotalEnergies SE

- SABIC (Saudi Basic Industries Corporation)

- Hindustan Petroleum Corporation Limited (HPCL)

- BP PLC

- Lubrizol Corporation

- Neste Corporation

- Indian Oil Corporation Limited (IOCL)

- SK Innovation Co., Ltd.

- Castrol Limited (BP Group)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In January 2024, Shell Deutschland GmbH decided to convert the Wesseling site's hydrocracker into a unit for producing Group III base stock. The oils are used in high-quality lubricants, such as engine oils and transmission fluids. The hydrocracker converts heavy, low-quality hydrocarbons into lighter, high-quality products through a high-pressure, high-temperature reaction with hydrogen in the presence of a catalyst.

- In February 2023, PKN Orlen S.A. committed $312 million to put all the finishing touches together into its API Group II and III base stock plant being built in Gdansk, Poland. The group then has more plans involving raising safety at a terminal coupled with a supply security upgrade.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global blown oil base oil market based on the below-mentioned segments:

Global Blown Oil Base Oil Market, By Product Type

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

Global Blown Oil Base Oil Market, By Application

- Automotive

- Industrial

- Marine

- Aviation

- Others

Global Blown Oil Base Oil Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global blown oil base oil market over the forecast period?The global blown oil base oil market size is expected to grow from USD 2.6 billion in 2023 to USD 5.0 billion by 2033, at a CAGR of 6.76% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global blown oil base oil market?Asia Pacific is projected to hold the largest share of the global blown oil base oil market over the forecast period.

-

3. Who are the top key players in the global blown oil base oil market?ExxonMobil Corporation, Royal Dutch Shell PLC, Chevron Corporation, TotalEnergies SE, SABIC (Saudi Basic Industries Corporation), Hindustan Petroleum Corporation Limited (HPCL), BP PLC, Lubrizol Corporation, Neste Corporation, Indian Oil Corporation Limited (IOCL), SK Innovation Co., Ltd., Castrol Limited (BP Group), and Others.

Need help to buy this report?