Global Bone Broth Market Size, Share, and COVID-19 Impact Analysis, By Type (Chicken, Beef, Turkey, and Others), By Distribution Channel (Food Service and Retail), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Bone Broth Market Insights Forecasts to 2033

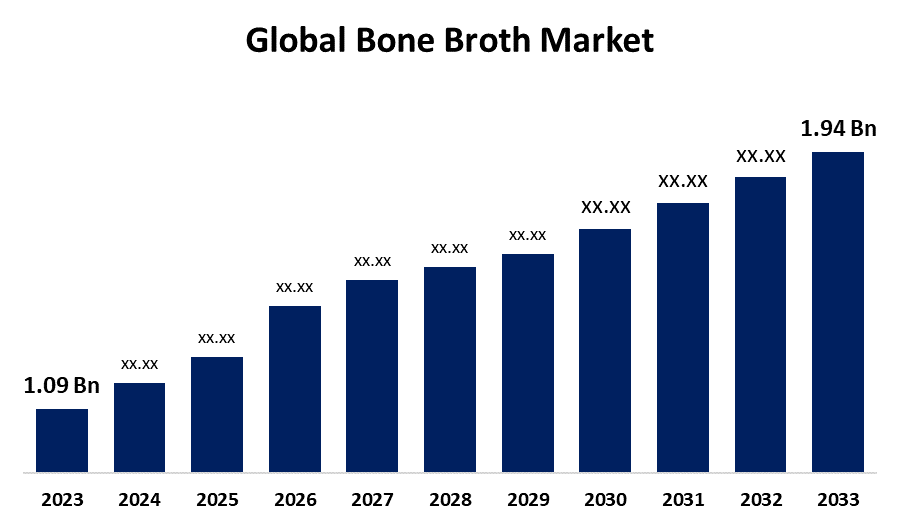

- The Global Bone Broth Market Size was Valued at USD 1.09 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.93% from 2023 to 2033

- The Worldwide Bone Broth Market Size is Expected to Reach USD 1.94 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Bone Broth Market Size is anticipated to exceed USD 1.94 Billion by 2033, growing at a CAGR of 5.93% from 2023 to 2033.

Market Overview

The bone broth market refers to the industry that produces, distributes, and sells brain broth, a nutrient-dense substance made from animal bone, cartilage, and connective tissues. This creates a wholesome stock that may be used to make sauces, gravies, stews, soups, and more. Bone broth provides a lot of health benefits and also adds a different taste to various dishes. Bone broth has several health benefits to humans and babies also, such as providing readily absorbed minerals (calcium, silicon, magnesium, and phosphorus), which increases the high demand for bone-based broths. Additionally, bone broth is beneficial for curing babies from the common cold effortlessly, and also supports to betterment of the baby's immune system. Furthermore, many companies shifted their focus on developing or introducing a protein-packed product that combines with bone broth, which further drives the growth and development of the bone broth market. For instance, in October 2022, a new nutrient-rich bone-broth puree pouch for infants (11+ months of age) was introduced in October 2021 by the American children's food company Cerebelly. In addition to meeting protein needs, the new food would help promote the best possible brain growth.

Report Coverage

This research report categorizes the global bone broth market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global bone broth market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global bone broth market.

Global Bone Broth Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.09 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.93% |

| 2033 Value Projection: | USD 1.94 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channel and By Region |

| Companies covered:: | Campbell Soup Company, Del Monte Foods, Inc. (College Inn), Brodo, Ossa Organic, Australian Bone Broth Co, Left Coast Performance, Ancient Nutrition, NOW Foods, Barebones Ventures, LLC, Organixx, Nutra Organics Pty Ltd, Peak Performance, Kettle Tonic, Goofy Tails, and Others. |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding due to increasing public awareness of the consumption of organic food, which is helping the market for bone broth protein grow. One of the important factors that drives the growth and development of the bone broth market is rising health awareness among consumers which focuses more on nutrient food for a healthy lifestyle. The market for bone broth is also boosted by the rising application of bone broth protein in the food industry. Therefore, it is expected that the growing demand for organic products and the rising use of dietary supplements will drive the bone broth market's growth throughout the forecast year. Furthermore, according to an Ipsos Mori survey, between 91 and 92 percent of people worldwide are non-vegetarians, which means they are neither vegans nor ovo-lacto-vegetarians. The market for bone broth is being further stimulated by the notable rise in the number of people eating non-vegetarian diets. Additionally, the prevalence of arthritis rose with age in 2022, rising from 3.6% among those aged 18–34 to 53.9% among those aged 75 and above. The significant increase in bone-related illnesses including arthritis and other related ailments is propelling the market for bone broth.

Restraints & Challenges

People's purchase decisions are significantly influenced by pricing. Meat consumption is restricted due to rising wholesale and retail prices, which has an immediate impact on the creation of bone broth. Bone broths' short shelf life makes it more difficult to move them over long distances or store them in pantries, which presents a number of logistical issues. For bone soups to stay fresh, they frequently need to be frozen or kept in the refrigerator.

Market Segmentation

The global bone broth market share is classified into type and application.

- The chicken segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the global bone broth market is categorized as chicken, beef, turkey, and others. Among these, the chicken segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Its cost and ease of availability, as well as its versatility in several cooking methods, all contribute to the rise in demand. Since chicken is regarded as a healthier protein source than other types, it is one of the most popular meats. This increases the potential for bone broth demand to rise.

- The food service segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the global bone broth market is categorized as food service and retail. Among these, the food service segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growing popularity of eating out has had a significant impact on the adoption of products since it has improved the flavor of dishes made with fewer components. In order to enhance the juiciness and aroma of meat, this broth is primarily utilized in processed poultry, pork, and fish products.

Regional Segment Analysis of the Global Bone broth Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

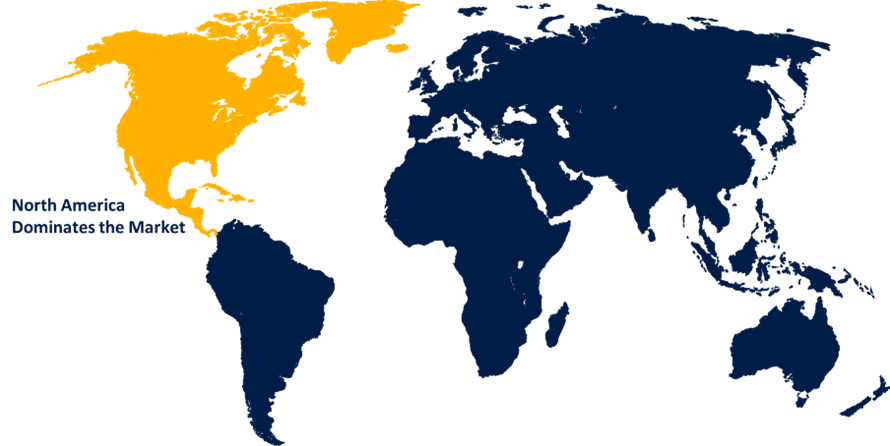

North America is projected to hold the largest share of the global bone broth market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global bone broth market over the forecast period. The market is growing mostly due to factors like the increase in the number of animal rendering factories and the growing consumption of poultry. Nearly 22.1 million pounds of rendered goods are produced annually by about 300 rendering operations, according to the "National Renderers Association." As a result, the likelihood of bone processing is increased, which raises the creation of bone broth. In addition, the increased number of food service establishments increases its use since bone broth is regarded as one of the many nutrient-dense, adaptable foods that offer a variety of health advantages, attracting customers.

Europe is expected to grow at the fastest CAGR growth of the global bone broth market during the forecast period. This is due to a combination of high discretionary income and the growing demand for wholesome, organic foods. The demand for bone-based broths is fueled by the recent substantial trend in the food processing business in Europe. Additionally, European producers are attempting to increase the variety of broths they offer through retail growth. For example, in October 2023, the U.K.-based company Borough Broth introduced its two products, Free Range Organic Chicken Bone-based broth and Grass Fed Organic Beef-based broth, to Waitrose (a supermarket chain) customers in an effort to strategically broaden its market reach.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bone broth market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Campbell Soup Company

- Del Monte Foods, Inc. (College Inn)

- Brodo

- Ossa Organic

- Australian Bone Broth Co

- Left Coast Performance

- Ancient Nutrition

- NOW Foods

- Barebones Ventures, LLC

- Organixx

- Nutra Organics Pty Ltd

- Peak Performance

- Kettle Tonic

- Goofy Tails

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In April 2023, the U.K.-based dog food company Paleo Ridge expanded its product line by introducing three new flavors—chicken, lamb, and beef—to their traditional bone-broth line. With their natural ingredient composition, these items further the goal of promoting a healthy lifestyle through a natural diet.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global bone broth market based on the below-mentioned segments:

Global Bone Broth Market, By Type

- Chicken

- Beef

- Turkey

- Others

Global Bone Broth Market, By Distribution Channel

- Food Service

- Retail

Global Bone Broth Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global bone broth market over the forecast period?The global bone broth market size is expected to grow from USD 1.09 billion in 2023 to USD 1.94 billion by 2033, at a CAGR of 5.93% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global bone broth market?North America is projected to hold the largest share of the global bone broth market over the forecast period.

-

3. Who are the top key players in the global bone broth market?Campbell Soup Company, Del Monte Foods, Inc. (College Inn), Brodo, Ossa Organic, Australian Bone Broth Co, Left Coast Performance, Ancient Nutrition, NOW Foods, Barebones Ventures, LLC, Organixx, Nutra Organics Pty Ltd, Peak Performance, Kettle Tonic, Goofy Tails, and others.

Need help to buy this report?