Brazil Bariatric Surgery Market Size, Share, and COVID-19 Impact Analysis, By Device (Assisting Devices, Implantable Devices, and Others), By Type (Gastric Bypass, Sleeve Gastrectomy, Adjustable Gastric Band, and Biliopancreatic Diversion with Duodenal Switch), and Brazil Bariatric Surgery Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareBrazil Bariatric Surgery Market Insights Forecasts to 2033

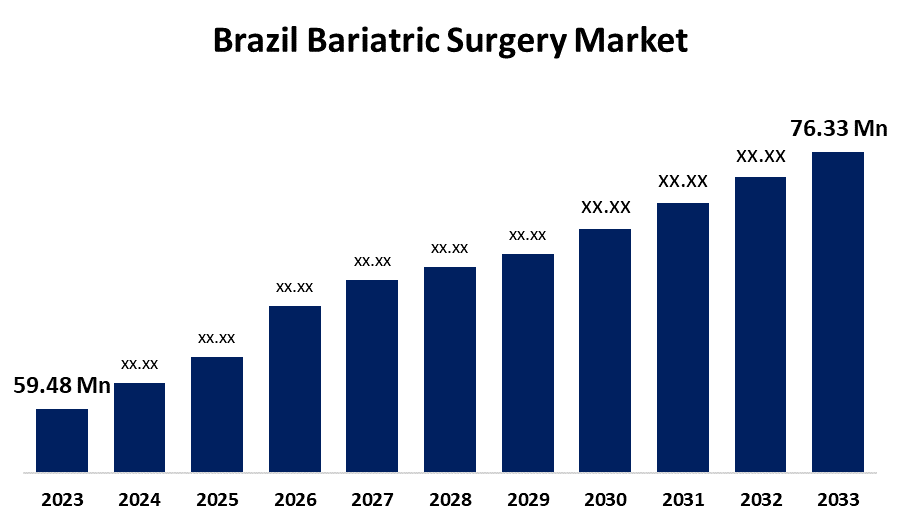

- The Brazil Bariatric Surgery Market Size was valued at USD 59.48 Million in 2023.

- The Market Size is Growing at a CAGR of 2.53% from 2023 to 2033

- The Brazil Bariatric Surgery Market Size is Expected to Reach USD 76.33 Million by 2033

Get more details on this report -

The Brazil Bariatric Surgery Market Size is Anticipated to Reach USD 76.33 Million by 2033, Growing at a CAGR of 2.53% from 2023 to 2033

Market Overview

The Brazil bariatric surgery market includes medical procedures that help people who are extremely obese lose weight. Gastric bypass, sleeve gastrectomy, and gastric banding are among the procedures used in bariatric surgery that alter the digestive tract to reduce body weight. People with a body mass index (BMI) of over 40 or those with a BMI of 35 or higher who also have health problems connected to obesity are most frequently recommended for these operations. It is commonly known in Brazil that bariatric surgery improves quality of life and lowers comorbidities of conditions like diabetes, high blood pressure, and heart disease. The market is driven by Brazil's rising obesity rate, which has increased significantly in recent years. The Brazil bariatric surgery market is a growing sector aimed at reducing body weight through surgical procedures like gastric bypass, sleeve gastrectomy, and gastric banding. These surgeries are recommended for individuals with a BMI over 40 or 35, often linked to obesity-related health issues. The market is driven by rising obesity prevalence, sedentary lifestyles, poor diets, and high processed food intake. Government policies, guidelines from the Brazilian Health Regulatory Agency, and the growing medical tourism industry have boosted the market.

Report Coverage

This research report categorizes the market for the Brazil bariatric surgery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil bariatric surgery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil bariatric surgery market.

Brazil Bariatric Surgery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 59.48 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.53% |

| 2033 Value Projection: | USD 76.33 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Device, By Type |

| Companies covered:: | Apollo Endosurgery Inc., Johnson and Johnson (Ethicon), Spatz FGIA Inc., B. Braun Melsungen A, Medtronic, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rising prevalence of obesity is the main driver of the Brazilian bariatric surgery market, while there are other causes as well. Demand for bariatric surgery has increased as more people struggle with weight-related health issues, particularly as they search for long-term weight management treatments. The market is growing as more people learn about the benefits of bariatric surgery in lowering comorbid conditions like diabetes, hypertension, and sleep apnea. Additionally, medical tourists are being drawn to Brazil due to its competitive healthcare system and stellar reputation for providing high-quality surgeries at lower costs than other regions.

Restraining Factors

The cost of surgeries in Brazil, despite being lower than in many developed nations, may pose a challenge for some, particularly those without good insurance. Risks and potential complications, such as nutrient deficiencies and ongoing monitoring, may deter others from undergoing surgery. Insufficient post-surgery care could also hinder treatment effectiveness.

Market Segmentation

The Brazil bariatric surgery market share is classified into device and type.

- The assisting devices segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Brazil bariatric surgery market is segmented by device into assisting devices, implantable devices, and others. Among these, the assisting devices segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Laparoscopic instruments, robotic surgery equipment, and endoscopic devices are crucial in bariatric surgeries like gastric bypass and sleeve gastrectomy. The use of minimally invasive surgical methods, relying on these support devices, is increasing due to their advantages like shorter recovery periods, fewer complications, and smaller cuts. The demand for sophisticated surgeries and advanced medical technology has further boosted the assisting devices segment in Brazil.

- The sleeve gastrectomy segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the Brazil bariatric surgery market is divided into gastric bypass, sleeve gastrectomy, adjustable gastric band, and biliopancreatic diversion with duodenal switch. Among these, the sleeve gastrectomy segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. A sleeve gastrectomy is a popular bariatric procedure in Brazil due to its ability to induce weight loss, low risk, and lack of long-term adaptation. This procedure removes a significant portion of the stomach, reducing its volume and allowing patients to shed significant weight. The procedure's positive results, short recovery time, and low risk of complications contribute to its growing popularity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil bariatric surgery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apollo Endosurgery Inc.

- Johnson and Johnson (Ethicon)

- Spatz FGIA Inc.

- B. Braun Melsungen A

- Medtronic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Dom Joaquim Hospital in Sombrio performed the first-ever bariatric surgeries in Santa Catarina, Brazil, using video laparoscopy. The procedure, under the Unified Health System (SUS), expanded healthcare access for eligible patients, highlighting the hospital's contribution to expanding bariatric surgery services in southern Brazil. This innovative solution addresses obesity and related health issues, highlighting the growth of bariatric surgery services in the region.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil bariatric surgery market based on the below-mentioned segments:

Brazil Bariatric Surgery Market, By Device

- Assisting Devices

- Implantable Devices

- Others

Brazil Bariatric Surgery Market, By Type

- Gastric Bypass

- Sleeve Gastrectomy

- Adjustable Gastric Band

- Biliopancreatic Diversion with Duodenal Switch

Need help to buy this report?