Brazil Beauty Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Personal Care Products, Skin Care Products, Bath & Shower, Oral Care, Men’s Grooming Products, Deodorants & Antiperspirants, and Cosmetics/Make-up Products), By Category (Mass Products and Premium Products), and Brazil Beauty Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsBrazil Beauty Market Insights Forecasts to 2033

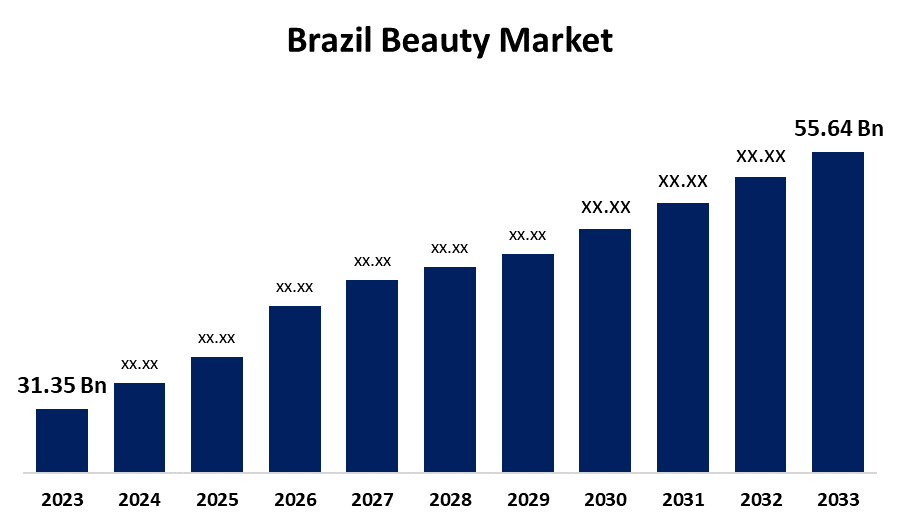

- The Brazil Beauty Market Size was valued at USD 31.35 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.90% from 2023 to 2033

- The Brazil Beauty Market Size is Expected to Reach USD 55.64 Billion by 2033

Get more details on this report -

The Brazil Beauty Market Size is Anticipated to Reach USD 55.64 Billion by 2033, growing at a CAGR of 5.90% from 2023 to 2033

Market Overview

The Brazil beauty market encompasses personal care products, skincare, haircare, fragrances, cosmetics, and beauty tools, catering to both mass-market and premium consumers. The industry is popular globally due to its diverse and dynamic consumer base, driven by local tastes and global trends. The market includes both local and international brands selling affordable and luxury products. Factors driving the market expansion include Brazil's culture of beauty, growing middle-class population, and rising disposable incomes. Social media and influencer-driven trends also influence consumer choices, allowing brands to reach a mass audience through digital marketing. Brazil's climate and focus on skincare are driving demand for sun care and skin protection products. Government policies, such as the Brazilian Health Regulatory Agency (ANVISA), promote the growth of the beauty market by ensuring product safety and quality. Sustainability initiatives, such as eco-friendly packaging and cruelty-free certifications, help maintain consumer confidence and promote ethical business practices within the industry.

Report Coverage

This research report categorizes the market for the Brazil beauty market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil beauty market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil beauty market.

Brazil Beauty Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 31.35 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.90% |

| 2033 Value Projection: | USD 55.64 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Product Type, By Category |

| Companies covered:: | Unilever PLC, L’Oreal SA, Procter & Gamble Company, Beiersdorf AG, Shiseido Company Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Brazil's robust beauty culture, where grooming and self-care are essential aspects of daily life, is the main factor propelling the country's beauty market growth. The demand for beauty goods at all price points is driven by the nation's youthful and diversified population as well as rising disposable income. Influencer marketing and social media also have a role in influencing customer decisions. As a result, the digital world is changing more quickly and trends are being absorbed quickly, mostly in the beauty industry. This also has to do with Brazil's climate, living in the tropics leads to higher use of skincare products like moisturizers, sunscreen, and hair care products tailored to certain hair types.

Restraining Factors

The Brazilian beauty market faces challenges due to economic instability, inflation, intense competition from local and international brands, higher import taxes, and environmental concerns. Consumers become price-sensitive due to economic issues, and companies struggle to retain market share. Despite Brazil's large middle-class population, these factors contribute to the market's challenges in attracting and retaining customers.

Market Segmentation

The Brazil beauty market share is classified into product type and category.

- The skin care products segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Brazil beauty market is segmented by product type into personal care products, skin care products, bath & shower, oral care, men's grooming products, deodorants & antiperspirants, and cosmetics/make-up products. Among these, the skin care products segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The demand for skincare products, including cleansers, moisturizers, sunscreens, and anti-aging treatments, has skyrocketed in recent years. Brazil's tropical climate and rising sun protection consciousness have raised demand for skincare products, particularly those with hydration and UV protection. Brazilian consumers now prioritize skincare due to the rising understanding of self-care and skincare routines.

- The mass products segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the category, the Brazil beauty market is divided into mass products and premium products. Among these, the mass products segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Low-cost mass beauty and personal care products, such as shampoos, conditioners, moisturizers, deodorants, and basic skincare products, are available in this category and are likely to appeal to a wide range of consumers. The extensive, budget-conscious Brazilian population is the mass market's biggest customer base.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil beauty market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever PLC

- L'Oreal SA

- Procter & Gamble Company

- Beiersdorf AG

- Shiseido Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, Grupo Boticário's Smart Lipstick is one of the most intriguing new beauty products to hit the Brazilian market. The first AI-powered lipstick application system in the world was introduced at CES 2025. In less than two minutes, the Smart Lipstick prototype applies color, maps lips, and scans faces using cutting-edge technology. This introduction marks a major advancement in the accessibility and usability of cosmetic products.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil beauty market based on the below-mentioned segments:

Brazil Beauty Market, By Product Type

- Personal Care Products

- Skin Care Products

- Bath & Shower

- Oral Care

- Men's Grooming Products

- Deodorants & Antiperspirants

- Cosmetics/Make-up Products

Brazil Beauty Market, By Category

- Mass Products

- Premium Products

Need help to buy this report?