Brazil Bioplastics Market Size, Share, and COVID-19 Impact Analysis, By Type (Biodegradable and Non-biodegradable), By Application (Automotive and Assembly Operations, Flexible Packaging, Agriculture and Horticulture, Rigid Packaging, Construction, Textiles, Electrical and Electronics, and Others), and Brazil Bioplastics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsBrazil Bioplastics Market Insights Forecasts to 2033

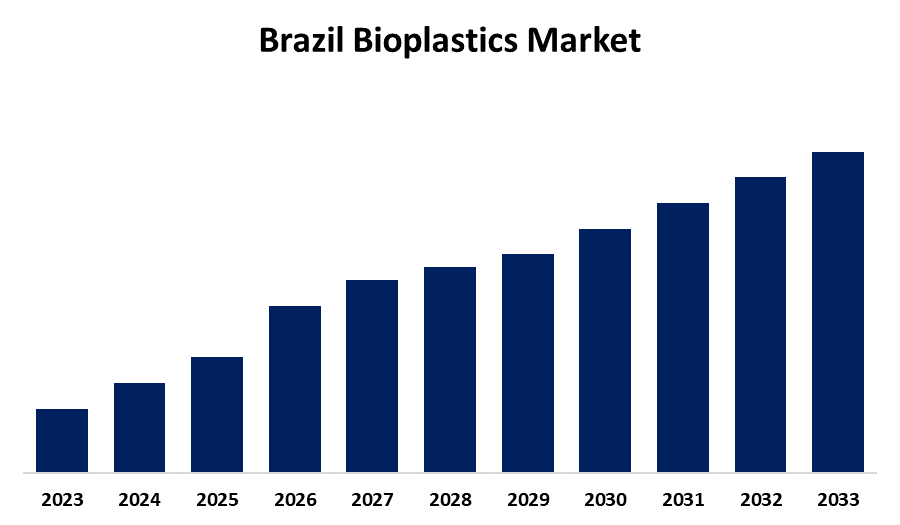

- The Brazil Bioplastics Market Size is Growing at a CAGR of 10.61% from 2023 to 2033

- The Brazil Bioplastics Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Brazil Bioplastics Market Size is Expected to hold a significant share by 2033, Growing at a CAGR of 10.61% from 2023 to 2033

Market Overview

The bioplastics market in Brazil is centered on plastics made from renewable resources such as microorganisms, plants, and agricultural waste. These materials are environmentally friendly substitutes for conventional polymers derived from fossil fuels. The market is expanding due in large part to the growing demand from the flexible packaging sector and the growing emphasis on the development of bioplastics in Brazil. The primary driver propelling the market's expansion is the growing prohibitions on the use of single-use, non-biodegradable plastics. Additionally, bioplastics are being used more often to make plastic bags since they are environmentally friendly and to make organic waste collection bags, which are mostly utilized in homes, businesses, hotels, and restaurants as well as hospitals. Furthermore, the Brazil governments can be essential in advancing bioplastics by implementing laws that provide incentives for both their manufacture and use. In addition, governments can aid in building the infrastructure for bioplastics by funding research and development, making raw materials more accessible, and encouraging the development of biorefineries.

Report Coverage

This research report categorizes the market for the Brazil bioplastics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil bioplastics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil bioplastics market.

Brazil Bioplastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.61% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Braskem, Cardia Bioplastics, Bioreset Biotecnologia Ltda, Novamont SpA, Natureworks LLC, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market is anticipated to be driven by the growing demand for bioplastics in industrial, food and beverage, and household care packaging due to customer preferences for sustainable packaging with growing landfill problems across borders. Additionally, bioplastics are becoming more and more popular as an alternative to traditional plastics as people seek healthier and less environmentally harmful products. In addition, the development of bio-based polymers has been fueled by growing worries about petrochemical-related harmful issues and the depletion of crude oil sources. Furthermore, the adoption of bioplastics, especially biodegradable plastics in the plastics sector, is anticipated to be further encouraged by government laws that limit the use of petrochemicals in specific applications, such as food packaging and medical devices.

Restraining Factors

The Brazil bioplastics market faces challenges because cheaper substitutes for conventional plastics are probably going to limit the market's expansion. Additionally, the biodegradability of bioplastics may be limited by the rising demand for the composting process. Furthermore, because bioplastics are made from natural raw ingredients, their production costs are roughly 20–30% greater than those of conventional plastics. Therefore, the Brazil bioplastics market is being restrained by the rising consumer interest in buying compost and the higher price of bioplastics.

Market Segmentation

The Brazil bioplastics market share is classified into type and application.

- The biodegradable segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the Brazil bioplastics market is divided into biodegradable and non-biodegradable. Among these, the biodegradable segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment's expansion is expected to be fueled by the growing demand for bio-based plastics across a variety of end-use industries over the projected period. Demand for biodegradable plastics has increased due to post-pandemic preference for packaged foods and the growing need for personal protective equipment (PPE).

- The rigid packaging segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the Brazil bioplastics market is classified into automotive and assembly operations, flexible packaging, agriculture and horticulture, rigid packaging, construction, textiles, electrical and electronics, and others. Among these, the rigid packaging segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to materials like PLA, bio-PE, or bio-PET are stiff bioplastics used in beverage bottles and cosmetics packaging for lipsticks and creams. In addition, the demand for sustainable packaging is driven by consumers' preference for eco-friendly materials and designs that minimize their impact on the environment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil bioplastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Braskem

- Cardia Bioplastics

- Bioreset Biotecnologia Ltda

- Novamont SpA

- Natureworks LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Braskem invested $87 million to increase its ability to produce 30% more bio-based ethylene in order to satisfy the increasing demand for environmentally friendly goods.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil bioplastics market based on the below-mentioned segments:

Brazil Bioplastics Market, By Type

- Biodegradable

- Non-biodegradable

Brazil Bioplastics Market, By Application

- Automotive and Assembly Operations

- Flexible Packaging

- Agriculture and Horticulture

- Rigid Packaging

- Construction

- Textiles

- Electrical and Electronics

- Others

Need help to buy this report?