Brazil Cane Sugar Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid Sugar and Crystallized Sugar), By Application (Food and Beverage, Industry, Pharmaceuticals, and Others), and Brazil Cane Sugar Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesBrazil Cane Sugar Market Insights Forecasts to 2033

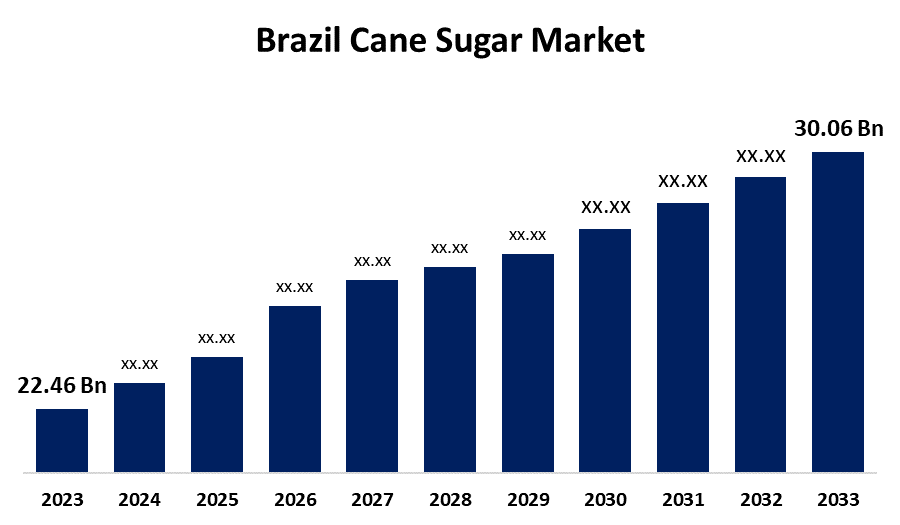

- The Brazil Cane Sugar Market Size Was Estimated at USD 22.46 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.96% from 2023 to 2033

- The Brazil Cane Sugar Market Size is Expected to Reach USD 30.06 Billion by 2033

Get more details on this report -

The Brazil Cane Sugar Market Size is expected to reach USD 30.06 Billion by 2033, Growing at a CAGR of 2.96% from 2023 to 2033

Market Overview

The Brazil cane sugar market involves the production, processing, and sale of sugar from sugarcane, including cultivation, processing, and sale to sectors like food, beverages, and biofuels. The market is facilitated by a favorable climate, advanced agricultural practices, and government policies favoring biofuel production and export. The production, processing, and distribution of sugar from sugarcane in Brazil are all included in the Brazil cane sugar market. Brazil is one of the world's top producers and exporters of sugar, and the sugar sector makes a significant economic contribution to the nation. Brazil is a major player in the global market because sugarcane sugar is used in food products, biofuels, and numerous other industries. Brazil's climate and improved agricultural techniques drive the expansion of the cane sugar market. The country's extensive sugarcane plantations and productive mills ensure a steady supply of sugar, boosting domestic and export demand. The increasing demand for ethanol, a renewable fuel made from sugarcane, also fuels the sugar sector, further driving the market. Brazil's government policies significantly impact the cane sugar market, particularly through the Proálcool Program, which aimed to boost sugarcane production of biofuel, specifically ethanol. This program, initiated in the 1970s, has continued to invest in ethanol production and infrastructure. Additionally, regulations and subsidies have made Brazil a global leader in the sugar industry.

Report Coverage

This research report categorizes the market for the Brazil cane sugar market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil cane sugar market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil cane sugar market.

Brazil Cane Sugar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 22.46 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 2.96% |

| 023 – 2033 Value Projection: | USD 30.06 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Cosan Limited, Copersucar, Sao Martinho SA, Tereos SA, Tate & Lyle PLC, DWL International Food Inc, Vjco- Brazil Commodities, Agro Betel, Louis Dreyfus Company, Cevasa, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The Brazil cane sugar market's expansion is due to one of the factors driving the market is the increased preference for natural sweeteners in a variety of food types. Additionally, industries' demand for sugarcane led to an increase in production, which in turn became a significant factor driving the cane sugar market. The market for cane sugar is also being driven by improvements in ordinary sugar as well as the availability of unique and improved flavors and smells. In addition, the rising demand from various industries such as food & beverage, chemicals, pharmaceuticals, and others have driven the market growth.

Restraining Factors

The market for cane sugar in Brazil faces off with issues such growing production costs, yield-affecting weather, and competition from substitute sweeteners. Growth is also hampered by government initiatives that prioritize the production of ethanol over sugar, and the business is further burdened financially by shifting sugar prices worldwide.

Market Segmentation

The Brazil cane sugar market share is classified into type and application.

- The crystallized sugar segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the Brazil cane sugar market is divided into liquid sugar and crystallized sugar. Among these, the crystallized sugar segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding due to its extensive use in the food and beverage sector and longer shelf life than liquid sugar, it has a dominant position in the market. In addition, it is still the best option for several uses, such as desserts, baked goods, and packaged foods.

- The food and beverage segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the Brazil cane sugar market is classified into food and beverage, industry, pharmaceuticals, and others. Among these, the food and beverage segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This is mostly because it is widely used in the manufacturing of packaged foods, baked goods, confections, and beverages. In addition, this segment's position in the market was further reinforced by the rising consumption of sugary beverages and the growing demand for processed foods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil cane sugar market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cosan Limited

- Copersucar

- Sao Martinho SA

- Tereos SA

- Tate & Lyle PLC

- DWL International Food Inc

- Vjco- Brazil Commodities

- Agro Betel

- Louis Dreyfus Company

- Cevasa

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, in Brazil, Syngenta introduced FRONDEO, a novel insecticide intended to manage the sugarcane borer.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil cane sugar market based on the below-mentioned segments

Brazil Cane Sugar Market, By Type

- Liquid Sugar

- Crystallized Sugar

Brazil Cane Sugar Market, By Application

- Food and Beverage

- Industry

- Pharmaceuticals

- Others

Need help to buy this report?