Brazil Cashew Market Size, Share, and COVID-19 Impact Analysis, By Form (Roasted & Salted, Whole, Powder, Paste, and Splits), By Distribution Channel (Supermarkets, Online Stores, Retailers, and Others), and Brazil Cashew Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesBrazil Cashew Market Insights Forecasts to 2033

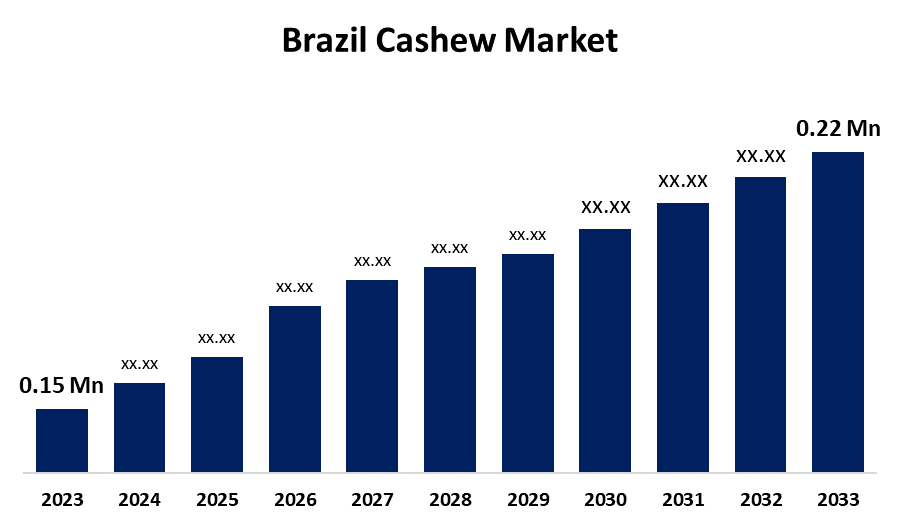

- The Brazil Cashew Market Size Was Estimated at USD 0.15 Million in 2023.

- The Market Size is Growing at a CAGR of 3.90% from 2023 to 2033

- The Brazil Cashew Market Size is Expected to Reach USD 0.22 Million by 2033

Get more details on this report -

The Brazil Cashew Market Size is Expected to reach USD 0.22 Million by 2033, Growing at a CAGR of 3.90% from 2023 to 2033

Market Overview

The cashew market in Brazil is the industry that includes cashew nut and related product production, distribution, processing, and trading in Brazil. In Brazil, cashews are an important agricultural product that is prized for both their nutritional worth and their many culinary uses. The cashew, a perennial tree indigenous to Brazil, plays a major role in the world market for cashew nuts. Additionally, the tropical environment of northeastern Brazil, which includes Ceara, Piaui, and Rio Grande do Norte, produces copious amounts of cashew nuts due to its high temperatures and sufficient rainfall, which supports the market’s expansion. In addition, the market is anticipated to develop throughout the forecast period due to the rising demand for Brazilian cashew exports and production. Furthermore, cashew nuts are becoming more and more popular as more people choose healthy meat and dairy substitutes and adopt a vegan diet. Moreover, the market is expected to increase as a result of favorable government regulations governing cashew nut farming and the easy availability of products in flavored forms.

Report Coverage

This research report categorizes the market for the Brazil cashew market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil cashew market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil cashew market.

Brazil Cashew Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 0.15 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.90% |

| 023 – 2033 Value Projection: | USD 0.22 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Form, By Distribution Channel |

| Companies covered:: | Cajuina Sao Geraldo, Alphonsa Cashew Industries, Achal Cashew Nuts, Cajuina Sao Geraldo Industria e Comercio de Alimentos Ltda., Gode Castanha do Brasil, Ki Delicia Castanhase Derivados Ltda., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The Brazil cashew market is growing because changes in lifestyles and growing awareness of cashew nuts' high protein content will lead to novel growth opportunities. In addition, due to customer demand for healthier diets and increased use of cashew nuts in prepared foods, the cashew nut sector is growing quickly. Additionally, the growing popularity of vegan diets and the growth in consumption of plant-based meals have led to a significant boost in market profitability. In addition, the cashew nut market is anticipated to increase in the coming years due to the thriving retail and e-commerce industries.

Restraining Factors

The market for cashews in Brazil is challenged by factors such as farmers may have financial difficulties due to the price of labor, fertilizer, and other supplies.

Market Segmentation

The Brazil cashew market share is classified into form and distribution channel.

- The whole segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the form, the Brazil cashew market is divided into roasted & salted, whole, powder, paste, and splits. Among these, the whole segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to whole cashews remaining in their natural state, still encased in their shells, and retaining their original flavor and shape. In addition, they are utilized in a wide range of items, including milk products, cereals, drinks, snacks, bars, and baked goods.

The supermarkets segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the Brazil cashew market is classified into supermarkets, online stores, retailers, and others. Among these, the supermarkets segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The manufacturers' allocation of shelf space in supermarkets, as well as increased product advertising, are responsible for this expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil cashew market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cajuina Sao Geraldo

- Alphonsa Cashew Industries

- Achal Cashew Nuts

- Cajuina Sao Geraldo Industria e Comercio de Alimentos Ltda.

- Gode Castanha do Brasil

- Ki Delicia Castanhase Derivados Ltda.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, the beverage firm Cajuina Sao Geraldo, based in Ceara, northeastern Brazil, partnered up with CANPACK to launch their signature cashew soda, Sao Geraldo, in recyclable aluminum cans for the first time. The northeastern states of Brazil are devotees of Cajuína Sao Geraldo, a beverage that contains 5% juice from local cashew fruits. The cashew fruit itself, not the more well-known cashew nuts, is what gives it its unique flavor.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil cashew market based on the below-mentioned segments

Brazil Cashew Market, By Form

- Roasted & Salted

- Whole

- Powder

- Paste

- Splits

Brazil Cashew Market, By Distribution Channel

- Supermarkets

- Online Stores

- Retailers

- Others

Need help to buy this report?