Brazil Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Confectionery Variant (Milk and White Chocolate, Dark Chocolate, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Retail Stores, Convenience Stores, Online Retail Stores, and Others), and Brazil Chocolate Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesBrazil Chocolate Market Insights Forecasts to 2033

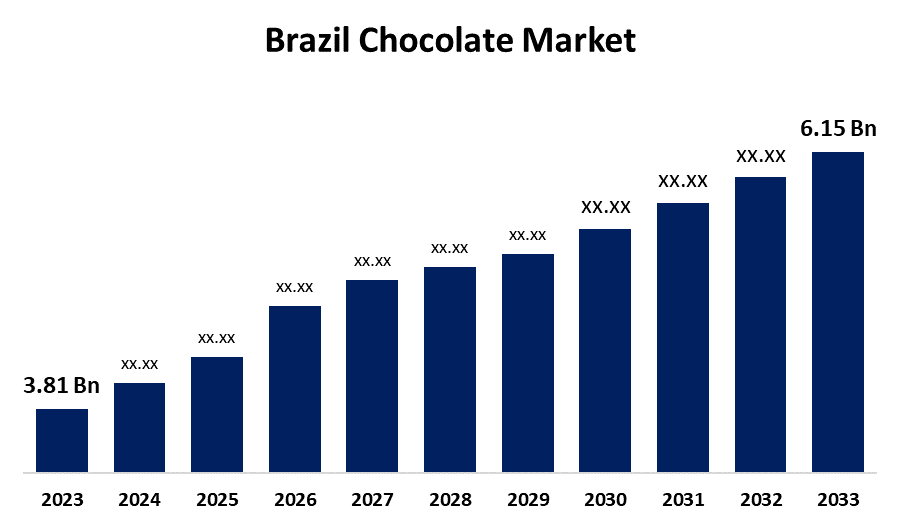

- The Brazil Chocolate Market Size Was Estimated at USD 3.81 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.90% from 2023 to 2033

- The Brazil Chocolate Market Size is Expected to Reach USD 6.15 Billion by 2033

Get more details on this report -

The Brazil Chocolate Market Size is Expected to reach USD 6.15 billion by 2033, Growing at a CAGR of 4.90% from 2023 to 2033

Market Overview

The industry that includes chocolate product manufacturing, distribution, and consumption in Brazil is referred to as the Brazil chocolate market. This contains a range of chocolates to suit different consumer tastes and situations, including milk, dark, white, and premium artisanal chocolates. The region's sizable and varied population offers a sizable consumer base with an increasing demand for chocolate-related goods. The middle class in Brazil has more disposable income, which has increased their purchasing power and raised demand for high-end chocolates and confections. Additionally, customization possibilities are becoming more and more available from chocolate businesses, enabling consumers to design unique chocolate bars using the ingredients and packaging of their choice. This trend increases the loyalty and engagement of customers. Furthermore, the government initiatives aid in the market expansion, for instance, in March 2025, the chocolate business benefited indirectly from the Brazilian government's efforts to promote sustainable cocoa growing, which were started in partnership with foreign organizations.

Report Coverage

This research report categorizes the market for the Brazil chocolate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil chocolate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil chocolate market.

Brazil Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.81 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.90% |

| 023 – 2033 Value Projection: | USD 6.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Confectionery Variant, By Distribution Channel |

| Companies covered:: | Arcor S.A.I.C, Cacau Show, Chocoladefabriken Lindt & Sprüngli AG, Dengo Chocolates SA, Dori Alimentos SA, Nestlé SA, Nugali Chocolates, The Hershey Company, The Peccin SA, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The Brazil chocolate market's expansion is due to strong consumer engagement evident in the Brazilian chocolate sector, which is marked by changing consumption trends and a growing demand for high-end chocolate goods. Additionally, manufacturers are putting more emphasis on being transparent about the origin and processing of ingredients, and many are implementing clean label strategies to satisfy consumer demands for healthier satisfaction options. In addition, personalized shopping experiences and mobile applications are among the advanced digital solutions that retailers are putting into place to adapt to changing consumer preferences.

Restraining Factors

The Brazil chocolate market faces challenges due to rising manufacturing costs and high inflation, chocolate prices are rising, which reduces consumer purchasing power and hinders the expansion of the Brazilian chocolate market. In addition, changing cocoa prices and the cost of importing high-end goods make it difficult for manufacturers to remain affordable.

Market Segmentation

The Brazil chocolate market share is classified into confectionery variant and distribution channel.

- The milk and white chocolate segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the confectionery variant, the Brazil chocolate market is divided into milk and white chocolate, dark chocolate, and others. Among these, the milk and white chocolate segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Brazilian consumers strongly favor these types as well-liked snack options, which account for their major share of the market. In addition, the market is expanding due to consumer desire for guilt-free indulgence items, which is pushing producers to create healthier alternatives such as plant-based, low-fat, and low-sugar products.

- The supermarkets and hypermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the Brazil chocolate market is classified into supermarkets and hypermarkets, specialty retail stores, convenience stores, online retail stores, and others. Among these, the supermarkets and hypermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because of its wide selection of products and well-placed shelves, which encourage impulsive purchases, this channel is considered to be the best. In addition, large retailers like Casino Supermarkets, Carrefour, and Assai have set up statewide networks that make it simple to get both popular and local chocolate goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil chocolate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arcor S.A.I.C

- Cacau Show

- Chocoladefabriken Lindt & Sprüngli AG

- Dengo Chocolates SA

- Dori Alimentos SA

- Nestlé SA

- Nugali Chocolates

- The Hershey Company

- The Peccin SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, the Brazilian snack company Dori Alimentos, which sells a range of chocolate and sugar confectionery brands like Dori, Pettiz, and Jubes, was acquired by Ferrara Candy Co., Ferrero's sister company.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil chocolate market based on the below-mentioned segments

Brazil Chocolate Market, By Confectionery Variant

- Milk and White Chocolate

- Dark Chocolate

- Others

Brazil Chocolate Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Retail Stores

- Convenience Stores

- Online Retail Stores,

- Others

Need help to buy this report?