Brazil Dental Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (General and Diagnostic Equipment, Dental Consumables, and Others), By End-user (Clinics, Hospitals, and Others), and Brazil Dental Equipment Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareBrazil Dental Equipment Market Insights Forecasts to 2033

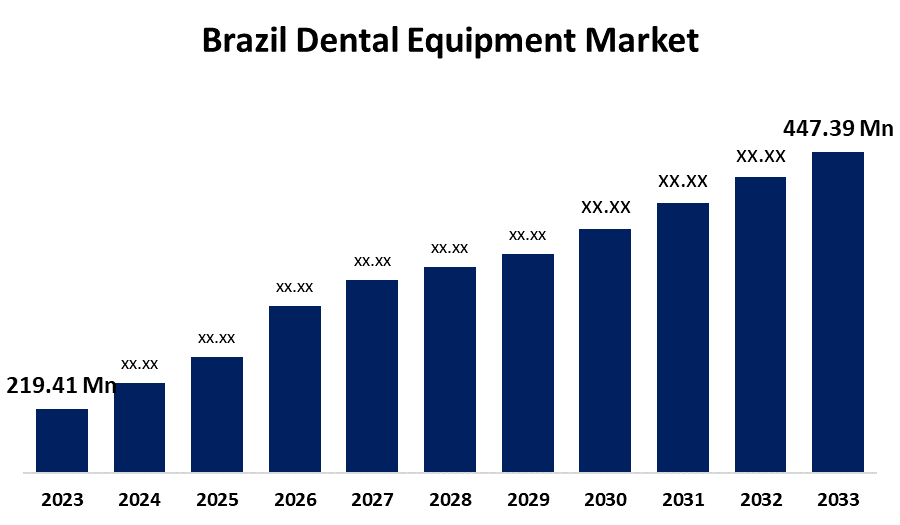

- The Brazil Dental Equipment Market Size Was Estimated at USD 219.41 Million in 2023.

- The Market Size is Growing at a CAGR of 7.38% from 2023 to 2033

- The Brazil Dental Equipment Market Size is Expected to Reach USD 447.39 Million by 2033

Get more details on this report -

The Brazil Dental Equipment Market Size is expected to reach USD 447.39 million by 2033, Growing at a CAGR of 7.38% from 2023 to 2033

Market Overview

The industry centered on the manufacturing, distribution, and use of instruments and equipment used by dental practitioners to identify, treat, and prevent oral illnesses and disorders is referred to as the Brazilian dental equipment market. Equipment such as dental chairs, imaging systems, dental lasers, handpieces, CAD/CAM systems, and hygiene maintenance tools are all part of this sector. The market for dental devices in Brazil is largely driven by the rising prevalence of dental conditions like cavities, periodontal disease, and tooth decay. Preventive treatment and aesthetic dentistry are receiving more attention as a result of the public's increasing awareness of oral health issues. The frequency of oral conditions including cavities, gum disease, and tooth loss is another important factor, especially for the elderly population, who need more specialized dental treatment. Furthermore, government initiatives aid in market expansion, for instance, the "Smiling Brazil" initiative in Brazil places a strong emphasis on promoting oral health, preventing disease, and providing rehabilitation, especially in underprivileged communities. In addition, the government promotes dental care subsidies and public oral health initiatives, which fuel market expansion.

Report Coverage

This research report categorizes the market for the Brazil dental equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing Brazil dental equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil dental equipment market.

Brazil Dental Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 447.39 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.38% |

| 023 – 2033 Value Projection: | USD 447.39 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Product, By End-user |

| Companies covered:: | Angelus Indústria de Produtos Odontológicos S/A, Bicon Dental Implants, Coltene Brasil, Institut Straumann AG, S.I.N. Implant System, SDI Limited, ZimVie Inc., Dentsply Sirona, Dérig Implantes do Brasil, EDLO, Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The market for dental equipment in Brazil is growing as a result of the country's rising dental clinics and healthcare infrastructure making dental services more accessible, which encourages the use of novel devices. Additionally, Brazil is a major dental tourism destination, providing top-notch care at comparatively cheaper prices than developed countries. This has increased demand for cutting-edge dental technology and drawn in patients from abroad. In addition, the advancement of technology in dental equipment, like digital imaging, CAD/CAM systems, and minimally invasive treatment tools, is transforming the field by enhancing accuracy and patient outcomes. To increase market growth, several businesses are concentrating on strategic alliances and service expansion.

Restraining Factors

The Brazilian dental equipment market is facing challenges due to the high upfront expenditures of cutting-edge dental technology is one of the issues facing the Brazilian dental equipment market, making them inaccessible to smaller practitioners. Adoption is also hampered by insufficient reimbursement guidelines for dental operations and supplies. Market expansion is further hampered by rural areas' low awareness and economic shifts.

Market Segmentation

The Brazil dental equipment market share is classified into product and end-user.

- The general and diagnostic segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the Brazil dental equipment market is divided into general and diagnostic equipment, dental consumables, and others. Among these, the general and diagnostic segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing because they are crucial to the provision of complete dental care. These instruments are essential in dentistry offices and hospitals because they are essential for precise diagnosis, treatment planning, and patient comfort. In addition, investments in contemporary equipment have surged in response to the increasing need for effective diagnostic solutions and better patient experiences, propelling growth and maintaining a significant market share.

- The hospitals segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the end-user, the Brazil dental equipment market is classified into clinics, hospitals, and others. Among these, the hospitals segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is expanding due to they provide complete dental care for complicated cases that frequently demand sophisticated surgical and diagnostic equipment. In addition, Brazil's public hospitals treat underprivileged people, which raises the need for a variety of dental equipment. The market for dental equipment depends heavily on hospitals because of their accessibility and capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil dental equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Angelus Indústria de Produtos Odontológicos S/A

- Bicon Dental Implants

- Coltene Brasil

- Institut Straumann AG

- S.I.N. Implant System

- SDI Limited

- ZimVie Inc.

- Dentsply Sirona

- Dérig Implantes do Brasil

- EDLO

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Osstem Implant purchased the third-largest dental implant manufacturer in Brazil, Implacil De Bortoli. Osstem Implant agreed to pay US$89.8 million to purchase a 100% share in the business. The Brazilian company Implacil De Bortoli was established in 1982 and produces a variety of 15 tapered, straight, bone-level, and tissue-level implants.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil dental equipment market based on the below-mentioned segments

Brazil Dental Equipment Market, By Product

- General and Diagnostic Equipment

- Dental Consumables

- Others

Brazil Dental Equipment Market, By End-user

- Clinics

- Hospitals

- Others

Need help to buy this report?