Brazil Diabetes Drugs Market Size, Share, and COVID-19 Impact Analysis, By Type (Insulins, Non-Insulin Injectable Drugs, Oral Anti-diabetic Drugs, and Combination Drugs), By Distribution Channels (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, and Others), and Brazil Diabetes Drugs Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareBrazil Diabetes Drugs Market Insights Forecasts to 2033

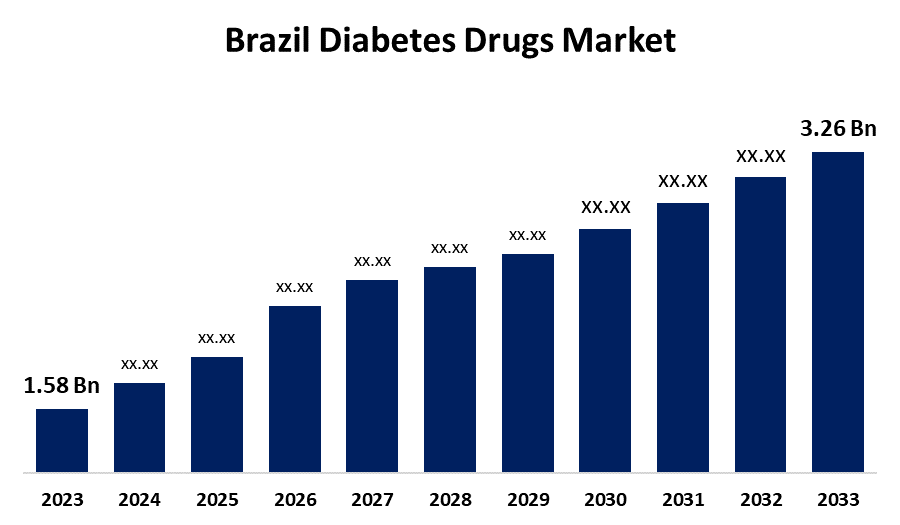

- The Brazil Diabetes Drugs Market Size Was Estimated at USD 1.58 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.51% from 2023 to 2033

- The Brazil Diabetes Drugs Market Size is Expected to Reach USD 3.26 Billion By 2033

Get more details on this report -

The Brazil Diabetes Drugs Market Size is Expected to reach USD 3.26 Billion By 2033, Growing at a CAGR of 7.51% from 2023 to 2033

Market Overview

The pharmaceutical industry that specializes in treating diabetes mellitus, including insulin and non-insulinotropic medications like GLP-1 receptor agonists and DPP-4 inhibitors, is part of the Brazilian diabetes drugs market. This industry is also driven by healthcare access initiatives and the rising prevalence of diabetes. The market for diabetic drugs in Brazil is being driven by rising diabetes prevalence, which is causing more people to be diagnosed with the condition and a growing need for improved treatment options. A rise in obesity rates, poor eating habits, and shifting lifestyles are some of the factors contributing to the rise in the incidence of diabetes. Additionally, the Brazilian government has played a significant role in the growth of the diabetic drug market by expanding access to medications and medical treatment. For instance, the SUS increases the amount of diabetes management medications used in the nation by giving low-income people free or subsidized access to insulin.

Report Coverage

This research report categorizes the market for the Brazil diabetes drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing Brazil diabetes drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil diabetes drugs market.

Brazil Diabetes Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.58 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.51% |

| 2033 Value Projection: | USD 3.26 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Type, By Distribution Channels and COVID-19 Impact Analysis |

| Companies covered:: | Novo Nordisk A/S, Takeda, Pfizer, Bristol Myers Squibb, Novartis, Sanofi Aventis, Eli Lilly, Janssen Pharmaceuticals, Astellas, Boehringer Ingelheim, Merck And Co., AstraZeneca, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for diabetic drugs in Brazil is growing as a result of rising healthcare expenditures since they make diabetes treatment and management more accessible. The market for diabetic drugs is growing as a result of increased public awareness of the negative effects of diabetes and growing healthcare costs, which highlight the importance of prompt diagnosis and treatment. Additionally, Brazil's diabetes drugs market is undergoing a shift towards personalized medicine, utilizing genomics and biotechnology to tailor treatments based on individual genetic factors, comorbidities, and patient responses.

Restraining Factors

The market for diabetes drugs in Brazil faces obstacles like exorbitant treatment costs that prevent low-income groups from accessing them. Additionally, medicine distribution is restricted in rural areas due to a lack of adequate healthcare infrastructure. Market expansion is further hampered by regulatory obstacles and drug approval delays.

Market Segmentation

The Brazil diabetes drugs market share is classified into type and distribution channel.

- The insulins segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the Brazil diabetes drugs market is divided into insulins, non-insulin injectable drugs, oral anti-diabetic drugs, and combination drugs. Among these, the insulins segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to insulin delivery system innovations, including insulin pumps, smart pens, and continuous glucose monitoring devices, which are increasing patient convenience, accuracy, and efficiency. The demand for insulin drugs is increased by these devices, which also help sustain improved blood glucose control, decrease the frequency of injections, and improve patient compliance.

- The retail pharmacies segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the Brazil diabetes drugs market is classified into retail pharmacies, hospital pharmacies, online pharmacies, and others. Among these, the retail pharmacies segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is driven by preventing stockouts and boosting availability, pharmacists can have a consistent supply of diabetes medications due to improved inventory management systems. This reduces expenses, increases accessibility, and boosts sales by conserving time and resources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil diabetes drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk A/S

- Takeda

- Pfizer

- Bristol Myers Squibb

- Novartis

- Sanofi Aventis

- Eli Lilly

- Janssen Pharmaceuticals

- Astellas

- Boehringer Ingelheim

- Merck And Co.

- AstraZeneca

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, the Brazilian division of Boehringer Ingelheim partnered with Farmanguinhos/Fiocruz to develop a generic variant of Jardiance® (empagliflozin 10 mg and 25 mg). The product will be submitted for registration with the Brazilian Health Regulatory Agency (Anvisa) as part of the collaboration. Improved glucose control, lower cardiovascular risks, and a delayed loss in renal function are all benefits of using Jardiance® to treat type 2 diabetes, heart failure, and kidney disease.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil diabetes drugs market based on the below-mentioned segments

Brazil Diabetes Drugs Market, By Type

- Insulins

- Non-Insulin Injectable Drugs

- Oral Anti-diabetic Drugs

- Combination Drugs

Brazil Diabetes Drugs Market, By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Others

Need help to buy this report?