Brazil Energy Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Drinks, Shots, and Mixers), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, and Others), and Brazil Energy Drinks Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesBrazil Energy Drinks Market Insights Forecasts to 2033

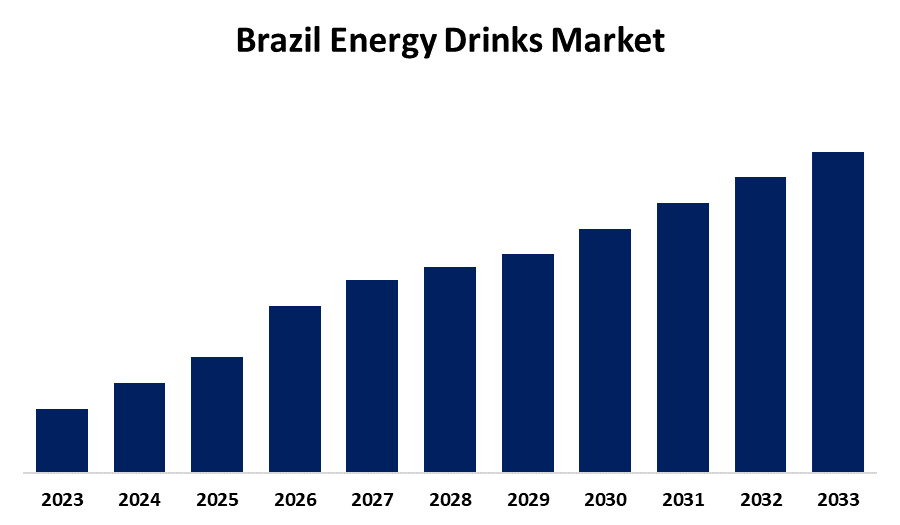

- The Market is Growing at a CAGR of 4.55% from 2023 to 2033

- The Brazil Energy Drinks Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Brazil Energy Drinks Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.55% from 2023 to 2033.

Market Overview

Energy drinks are referred to as a type of beverage that contains high levels of stimulants, typically caffeine, along with sugar and other ingredients like vitamins or amino acids. These drinks are marketed to boost mental alertness and physical performance. Modern lifestyle has a change in food patterns and an increase in home workouts especially among young people, increased rate and quantity of energy drink consumption. Urbanization, increasing disposable income, and enhanced health consciousness among consumers are a key driver for Brazil energy drinks market.

Report Coverage

This research report categorizes the market for the Brazil energy drink market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil energy drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil energy drinks market.

Brazil Energy Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.55% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Red Bull, Monster Beverage Corp, Ambev, Petropolis Group, Budweiser, Skol Drinks, The Coca Cola Company, Fresubinus Kabi and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A vibrant and dynamic lifestyle specifically in urban areas of the country contributes to enhanced demand for energy-boosting products consequently propelling Brazil energy drinks market. Influencing popularity for sports and fitness activities propelling demand for energy drinks between athletes and fitness enthusiasts. Due to continuous innovations, companies are launching a wide range of products focused on natural ingredients and reduced sugar options, driving the market of Brazil energy drinks market.

Restraining Factors

Stiff competition among key players and rising awareness related to health issues caused by excessive coffee consumption constraining the Brazil drinks market. The addition of excessive flavoring agents and coloring agents can restrain the market.

Market Segmentation

The Brazil Energy Drink Market share is classified into product type and distribution channel.

- The drinks segment accounted for the largest revenue share over the forecast period.

The Brazil energy drinks market is segmented by product type into drinks, shots, and mixers. Among these, the drinks segment accounted for the largest revenue share over the forecast period. Wider accessibility and regulation of non-alcoholic beverages, increasing product preference, and rising use of non-alcoholic beverages drive the drinks segment.

- The supermarkets/ hypermarkets segment is expected to lead Brazil energy drinks market during the forecast period.

Based on the distribution channel, the Brazil energy drinks market has been divided into supermarkets/hypermarkets, convenience stores, specialist shops, and others. Among these, the supermarkets/ hypermarkets segment is expected to lead Brazil energy drinks market during the forecast period. Growth of this segment is due to containing a broad range of energy drinks including both popular and niche brands. Frequently offering promotions, discounts, and multi-pack deals on energy drinks drives the supermarkets/ hypermarket segments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil energy drinks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Red Bull

- Monster Beverage Corp

- Ambev

- Petropolis Group

- Budweiser

- Skol Drinks

- The Coca Cola Company

- Fresubinus Kabi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, NotCo, Latin America's plant-based food technology firm, known for its NotMilk and NotBurger, introduced New Zero Sugar Protein Drinks in Brazil. The new product line includes exclusive tastes, including Banana Pancakes with Cinnamon and Strawberry with Dates, as well as classics like chocolate, coffee caramel, and vanilla with coconut.

- In January 2022, PepsiCo released Baya, a ready-to-drink energy beverage, through a collaborative venture with Starbucks. Baya is the newest product to hit the worldwide market in the fast-growing energy drink category, as people want more functional qualities in the foods and beverages they eat.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil energy drinks market based on the below-mentioned segments:

Brazil Energy Drinks Market, By Product Type

- Drinks

- Shots

- Mixers

Brazil Energy Drinks Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Shops

- Others

Need help to buy this report?