Brazil Flexfuel Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Gasoline, Ethanol, Flex Fuel, and Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers, and Others), and Brazil Flexfuel Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsBrazil Flexfuel Market Insights Forecasts to 2033

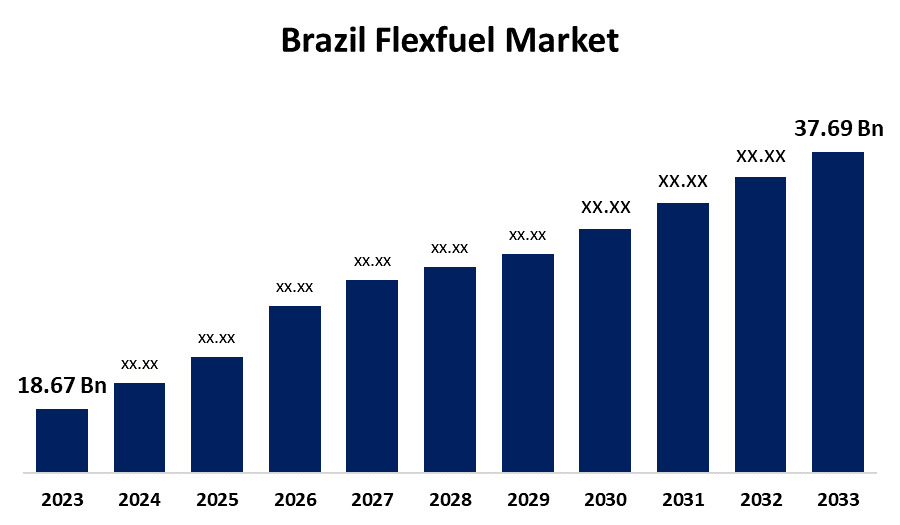

- The Brazil Flexfuel Market Size was valued at USD 18.67 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.28% from 2023 to 2033

- The Brazil Flexfuel Market Size is Expected to Reach USD 37.69 Billion by 2033

Get more details on this report -

The Brazil Flexfuel Market is Anticipated to Reach USD 37.69 Billion by 2033, growing at a CAGR of 7.28% from 2023 to 2033

Market Overview

The Brazil flexfuel market is a growing industry involving automobiles and engines that can use flexible fuel, such as ethanol, gasoline, or a blend of both. Flexfuel cars (FFVs) offer consumers the flexibility to switch between different levels of fuel, making them more economical. Brazil, a major ethanol producer and consumer, is driving the market's expansion due to its abundant sugarcane production, which provides ethanol as a renewable and sustainable alternative to gasoline. The adoption of FFVs has also been fueled by the increased focus on energy security and carbon reduction. Furthermore, flexfuel technology, which offers both financial and environmental benefits, is being adopted by businesses and consumers due to the growing cost of fuel and concerns about environmental sustainability. The market has been significantly shaped by government policy. Through initiatives like the Proálcool Program (also known as the Pro-Alcohol Program), which encourages the use of ethanol-blend fuels, Brazil has historically supported the ethanol industry. The government has also implemented tax breaks, subsidies, and regulations requiring ethanol and gasoline to be blended in specific ratios to further boost the market development of flexfuel vehicles. These regulations, along with Brazil's initiatives to invest in renewable energy, have significantly increased demand for flexfuel vehicles, positioning the country as a global leader in the flexfuel sector.

Report Coverage

This research report categorizes the market for the Brazil flexfuel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil flexfuel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil flexfuel market.

Brazil Flexfuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 18.67 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.28% |

| 023 – 2033 Value Projection: | USD 37.69 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Fuel Type, By Vehicle Type |

| Companies covered:: | Fiat Chrysler Automobiles, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Hyundai Motor Company, Renault SA, Toyota Motor Corporation, Volkswagen AG, BMW AG, Daimler AG, Nissan Motor Co., Ltd., Mazda Motor Corporation, Mitsubishi Motors Corporation, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The massive production of ethanol from sugarcane in the nation, which makes it a more affordable and sustainable fuel source than gasoline, is one of the main factors propelling the growth of the Brazil flexfuel market. The use of flexfuel vehicles (FFVs) has also increased as a result of the growing demand for more environmentally friendly forms of transportation and government incentives for ethanol consumption. The popularity of FFVs among customers, particularly during periods of unpredictable fuel costs, has been aided by regulations mandating the use of blended gasoline and tax credits. Growing environmental consciousness and a desire to reduce carbon emissions are further factors driving the need for flexfuel technology.

Restraining Factors

The affordability of flexfuel vehicles in Brazil may be affected by ethanol price volatility and less advanced distribution infrastructure. The rising popularity of electric vehicles (EVs) and higher upfront costs may deter some consumers from switching. Despite these challenges, Brazil's focus on renewable energy and ecological objectives has led to robust market growth for flexfuel vehicles, despite potential challenges from price volatility and the potential for higher upfront costs.

Market Segmentation

The Brazil flexfuel market share is classified into fuel type and vehicle type.

- The flex fuel segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Brazil flexfuel market is segmented by fuel type into gasoline, ethanol, flex fuel, and others. Among these, the flex fuel segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Flex fuel vehicles are designed to run on a blend of gasoline and ethanol, and based on the cost and availability of the fuels, customers can select the most affordable or readily available fuel. Flex fuel vehicles were popular among consumers because Brazil produces a lot of ethanol, especially from sugarcane.

- The passenger cars segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the vehicle type, the Brazil flexfuel market is divided into passenger cars, light commercial vehicles, heavy commercial vehicles, two-wheelers, and others. Among these, the passenger cars segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Brazil uses flexible fuel technology extensively, making flexfuel passenger cars the most sought-after vehicle type there. Brazil has an expanding market for these vehicles because to tax cuts, government subsidies, and the use of ethanol as an inexpensive and environmentally friendly fuel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil flexfuel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fiat Chrysler Automobiles

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Renault SA

- Toyota Motor Corporation

- Volkswagen AG

- BMW AG

- Daimler AG

- Nissan Motor Co., Ltd.

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, General Motors (GM) plans to produce its first hybrid-flex vehicle in Brazil, combining gasoline or ethanol with electricity. The project, which will cost 5.5 billion reais, is part of a larger investment strategy to boost Brazil's electric vehicle portfolio and aid in decarbonization efforts.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil flexfuel market based on the below-mentioned segments

Brazil Flexfuel Market, By Fuel Type

- Gasoline

- Ethanol

- Flex Fuel

- Others

Brazil Flexfuel Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two-Wheelers

- Others

Need help to buy this report?