Brazil Food Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Type (Carbohydrases, Lipases, Proteases, and Others), By Application (Bakery, Confectionery, Meat Poultry and Seafood Products, Dairy and Frozen Desserts, Beverages, and Others), and Brazil Food Enzymes Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesBrazil Food Enzymes Market Insights Forecasts to 2033

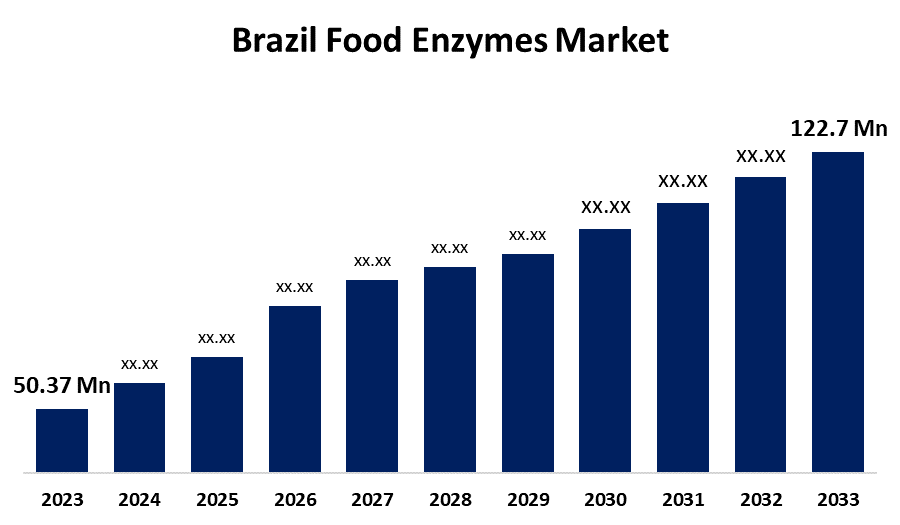

- The Brazil Food Enzymes Market Size Was Estimated at USD 50.37 Million in 2023.

- The Market Size is Growing at a CAGR of 6.60% from 2023 to 2033.

- The Brazil Food Enzymes Market Size is Expected to Reach USD 95.40 Million by 2033.

Get more details on this report -

The Brazil Food Enzymes Market Size is Expected to Reach USD 95.40 Million by 2033, Growing at a CAGR of 6.60% from 2023 to 2033.

Market Overview

The market for food enzymes in Brazil is the sector that focuses on the manufacture, distribution, and use of enzymes in food processing. These enzymes, which include lipases, carbohydrases, and proteases, are employed to support sustainable production practices, increase food quality, and extend shelf life. The Brazil's food sector is growing quickly as individual's busy lifestyles and urbanization drive them to eat more processed and easy foods. The country's growing demand for processed foods and the numerous uses of enzymes in the processed food sector are fueling the market's explosive expansion. Further propelling the market are the nation's advancements in food technology and the rising awareness of higher-quality products made with enzymes. Additionally, government initiatives aid in the market expansion, for instance, in November 2024, applications of enzymes in food production will indirectly benefit from a $1.6 billion program that the World Bank launched in partnership with the federal and state governments of Brazil to promote sustainable agrifood systems.

Report Coverage

This research report categorizes the market for the Brazil food enzymes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil food enzymes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil food enzymes market.

Brazil Food Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 50.37 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.60% |

| 023 – 2033 Value Projection: | USD 95.40 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Novozymes Brasil Ltda, Dupont Nutrition & Biosciences, Hansen Industria e Comercio Ltda, Enzyme Developments Ltda, AB Enzymes Brasil, DSM Brazil Ltda, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The Brazil food enzymes market's expansion is due to manufacturers implementing enzyme-based solutions as a result of health-conscious consumers' preference for natural and identifiable substances over synthetic additives. Additionally, the need for food enzymes to enhance texture, shelf life, and nutritional quality has increased due to urbanization and shifting consumer habits, which have also led to a growth in the consumption of processed and convenience foods. In addition, the market for food enzymes is being driven by the growing presence of organized retail in both urban and rural areas. The market is being driven by the food industry's rising demand, waste reduction and energy conservation, and environmentally friendly production methods.

Restraining Factors

The Brazil food enzymes market faces challenges due to the high costs of enzyme production, specialized fermentation processes, raw materials, and advanced biotechnology, making enzyme-based food products less competitive and limiting market adoption for small and medium-sized producers.

Market Segmentation

The Brazil food enzymes market share is classified into type and application.

- The carbohydrases segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the Brazil food enzymes market is divided into carbohydrases, lipases, proteases, and others. Among these, the carbohydrates segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding due to carbohydrates, including amylases, cellulases, and lactases, improving texture, sweetness, and digestibility in bread, fiber modification, and lactose-free dairy production, driven by customer preference for clean-label products and sugar reduction.

- The bakery segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the Brazil food enzymes market is classified into bakery, confectionery, meat poultry and seafood products, dairy and frozen desserts, beverages, and others. Among these, the bakery segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because the bakery segment improves product quality, shelf life, and manufacturing efficiency, it significantly contributes to the demand for food enzymes in Brazil. In addition, enzyme adoption is being driven by the increase in customer demand for clean-label, gluten-free, and high-fiber baked goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil food enzymes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novozymes Brasil Ltda

- Dupont Nutrition & Biosciences

- Hansen Industria e Comercio Ltda

- Enzyme Developments Ltda

- AB Enzymes Brasil

- DSM Brazil Ltda

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Cargill and BinSentry Collaborated to offer AI-powered feed management technologies to Brazil, advancing pork and poultry output. Bins entry sensors, which have a 99% accuracy rate in feed bin monitoring, were to be distributed by Cargill. Brazil's position as the world's top exporter of beef is cemented by this innovation, which increases productivity and reduces waste. Higher demand for feed additives, such as food enzymes that improve digestion and nutritional absorption, is anticipated as a result of this endeavor.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil food enzymes market based on the below-mentioned segments

Brazil Food Enzymes Market, By Type

- Carbohydrases

- Lipases

- Proteases

- Others

Brazil Food Enzymes Market, By Application

- Bakery

- Confectionery

- Meat Poultry and Seafood Products

- Dairy and Frozen Desserts

- Beverages

- Others

Need help to buy this report?