Brazil Functional Flour Market Size, Share, and COVID-19 Impact Analysis, By Source (Cereals and Legumes), By Application (Bakery, Savory Snacks, Soups & Sauces, Ready-to-Eat (RTE) Products, and Others), and Brazil Functional Flour Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesBrazil Functional Flour Market Insights Forecasts to 2033

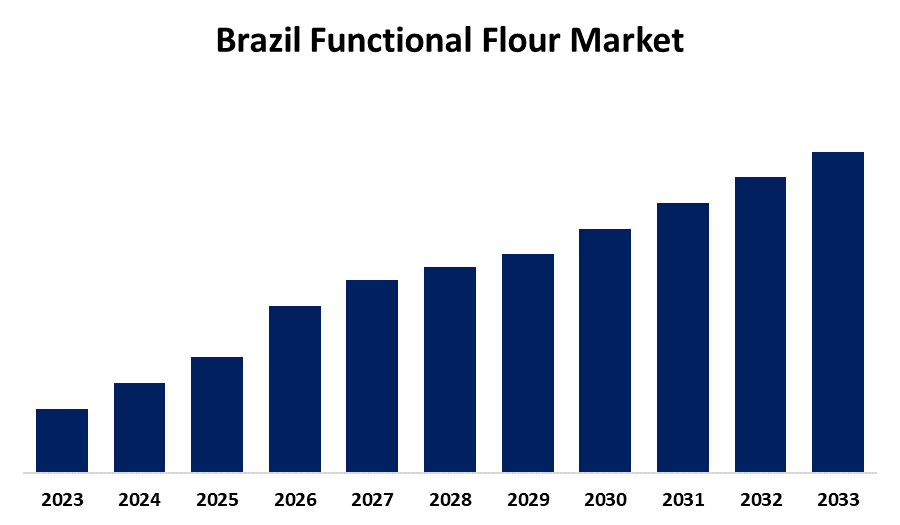

- The Brazil Functional Flour Market is Growing at a CAGR of 4.9% from 2023 to 2033

- The Brazil Functional Flour Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Brazil Functional Flour Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.9% from 2023 to 2033

Market Overview

Brazil functional flour market is that portion of the flour industry that manufactures flours supplemented with extra nutrients or functional ingredients designed to deliver some health benefits over and above nutrition. Vitamins, minerals, fiber, protein, and other bioactive ingredients are frequently added to these flours to meet the growing customer desire for healthier diets. Because of their versatility and nutritional advantages, functional flours are used in a wide range of baked goods, snacks, gluten-free foods, and other processed foods. The Brazil functional flour market is growing largely due to rising consumer wellness and health consciousness. Brazilians are becoming more health conscious, thus they are searching for foods that have practical advantages like improved digestion, weight management, and boosted vitality. The Brazil functional flour market is driven by the growing demand for gluten-free and allergen-free foods, as well as the popularity of vegetarian diets and protein-intense foods. Government policies, such as enhancing food product health content and encouraging appropriate dietary habits, are crucial for market growth. The government is also supportive of food fortification activities, especially in poor communities, where functional flours can help counteract nutritional deficiencies. These activities, combined with rising research and development in the food sector, are expected to drive further market expansion. The Brazilian government launched programs to encourage the use of functional additives in food items to improve nutrition and public health. These programs have pushed food producers to include functional flours in their product lines to meet the rising demand from consumers for wholesome and useful foods.

Report Coverage

This research report categorizes the market for the Brazil functional flour market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil functional flour market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil functional flour market.

Brazil Functional Flour Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Bunge Brasil, Cargill Brazil, Moinho Globo, Granos, Industrias Alimenticias LALA, Vitamix, Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The need for nutrient-dense, healthier food products is the main factor driving the Brazil functional flour market. Functional foods that offer extra advantages like better digestion, weight control, and increased energy are becoming more and more popular as consumer knowledge of health and wellbeing continues to rise. This trend is further exacerbated by the growing popularity of plant-based and gluten-free diets, for which functional flours make excellent substitutes for traditional wheat flour. Market expansion is also being driven by consumer desire for clean-label foods that are high in fiber, protein, and other micronutrients. Furthermore, the rising prevalence of lifestyle disorders like diabetes and obesity has prompted consumers to choose healthier foods, which has increased the use of functional flours.

Restraining Factors

Functional flours are expensive and require specialized processing methods and ingredients to enhance their nutritional content, increasing production costs. Consumer skepticism over their efficacy and benefits, limited distribution of specific ingredients, and complexity of food fortification regulatory approvals can deter widespread use.

Market Segmentation

The Brazil functional flour market share is classified into source and application.

- The cereals segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Brazil functional flour market is segmented by source into cereals and legumes. Among these, the cereals segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The primary sources of functional flours are grains such as wheat, rice, maize, and oats due to their affordability, availability, and versatility in a range of culinary applications. These grains are typically ground into flour that are fortified with additional nutrients, such as fiber, vitamins, and minerals to meet the rising demand from consumers for healthier diets. Additionally, grains provide gluten-free varieties, which are particularly popular among people who are intolerant to gluten.

- The bakery segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the Brazil functional flour market is divided into bakery, savory snacks, soups & sauces, ready-to-eat (RTE) products, and others. Among these, the bakery segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The demand for healthier bakery food, including bread, cakes, biscuits, and pastries, has led to the development of functional flours. With a growing preference for clean-label foods and health benefits from functional ingredients like fiber, protein, and vitamins, functional flours are being used to improve the nutritional quality of bakery products. Low-calorie and gluten-free options also contribute to this demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil functional flour market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bunge Brasil

- Cargill Brazil

- Moinho Globo

- Granos

- Industrias Alimenticias LALA

- Vitamix

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, the BHB Festival in São Paulo, which focused on innovation and the future of healthy eating in Brazil, was sponsored by Duas Rodas. In addition to showcasing the increased interest in functional ingredients and healthier food options, the event brought together professionals to discuss trends and advancements in the food business.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil functional flour market based on the below-mentioned segments

Brazil Functional Flour Market, By Source

- Cereals

- Legumes

Brazil Functional Flour Market, By Application

- Bakery

- Savory Snacks

- Soups & Sauces

- Ready-to-Eat (RTE) Products

- Others

Need help to buy this report?