Brazil Infrastructure Market Size, Share, and COVID-19 Impact Analysis, By Type (Social Infrastructure, Extraction Infrastructure, Transportation Infrastructure, Utilities Infrastructure, and Manufacturing Infrastructure), By Key Cities (Sao Paulo, Rio de Janeiro, and Salvador), and Brazil Infrastructure Market Insights, Industry Trend, Forecasts to 2033.

Industry: Construction & ManufacturingBrazil Infrastructure Market Insights Forecasts to 2033

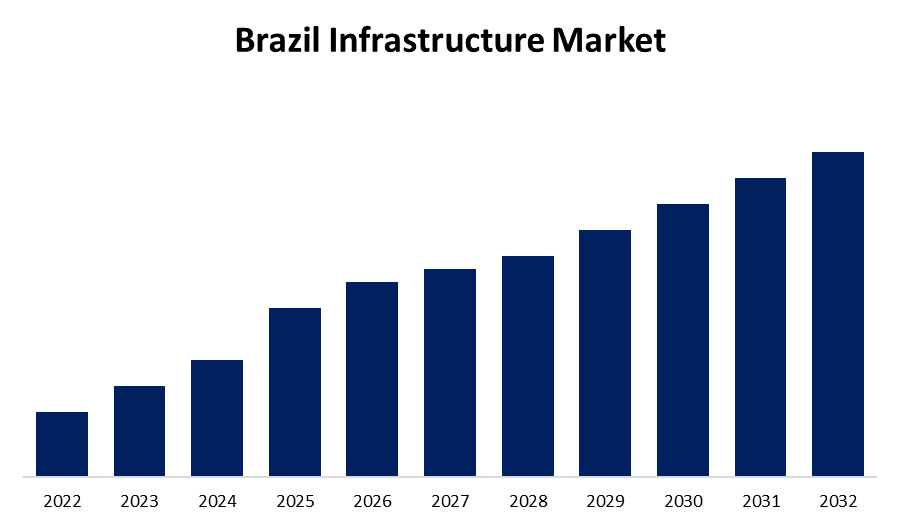

- The Market is Growing at a CAGR of 5.2% from 2023 to 2033

- The Brazil Infrastructure Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Brazil Infrastructure Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 5.2% from 2023 to 2033.

Market Overview

The fundamental physical and organizational structures and facilities required for the operation and enterprise. It contains important systems such as transportation systems which include roads, bridges and railways, communication systems, power plants water supply, and sewage systems. In 2021, an 18-month engagement program was implemented between the Global Infrastructure Hub and the Brazilian government the agenda of the program was to draw more private sector investment to infrastructure and to bring bankable projects. Foreign investors increasing confidence in the investment in the infrastructure of Brazil, driving the market. It reduces the impact of disasters leading to an increase in the recovery rate and decreasing social vulnerabilities. It improves productivity reduces mitigation costs and attracts investment. These factors are expected to boost the Brazil Infrastructure Market over the forecast period.

Report Coverage

This research report categorizes the market for the Brazil infrastructure market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil infrastructure market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil infrastructure market.

Brazil Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Key Cities and COVID-19 Impact Analysis |

| Companies covered:: | COBRA Group, Tabocas, Construtora Queiroz Galvao, Novonor, Construcap, OEC, Andrade Gutierrez, Camargo Correa Infra Construcoes, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing foreign investment in the Brazil infrastructure segment driving the market. The growth in the market is driven by the transportation infrastructure segment. Brazil's government implemented new policies and introduced new reforms which ultimately reduced the cost of doing business driving the market. Brazil is the ninth-largest energy consumer and producer country hence energy sector is key to driving Brazil infrastructure market. Increasing public-private partnerships for flawless execution and management of projects consequently driving the market.

Restraining Factors

Political instability leads to economic constraints hence restraining Brazil infrastructure market. Increasing regulation related to environmental stability can cause delays in project completion and increase project cost consequently restraining the market.

Market Segmentation

The Brazil infrastructure market share is classified into type and key cities.

- The social infrastructure segment accounted for the largest market share over the forecast period.

The Brazil infrastructure market is segmented by type into social infrastructure, extraction infrastructure, transportation infrastructure, utilities infrastructure, and manufacturing infrastructure. Among these, the social infrastructure segment accounted for the largest market share over the forecast period. The healthcare and school sectors have experienced significant growth after the pandemic. Healthcare sector growth is due to pandemic conditions. Community needs and social advocacy for the need for educational institutes push the government to establish new schools or colleges hence propelling the social infrastructure.

- The Sao Paulo is expected to dominate the Brazil infrastructure market during the forecast period.

Based on the key cities, the Brazil infrastructure market is divided into Sao Paulo, Rio de Janeiro, and Salvador. Among these, the Sao Paulo is expected to dominate the Brazil infrastructure market during the forecast period. The growth in this city is due to extensive development in major sectors such as transportation, utilities, and industrial parks. The presence of large industries in Sao Paulo enhances demand for infrastructure hence propelling the infrastructure segment in Sau Paulo.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil Infrastructure Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- COBRA Group

- Tabocas

- Construtora Queiroz Galvao

- Novonor

- Construcap

- OEC

- Andrade Gutierrez

- Camargo Correa Infra Construcoes

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, merger between 3R Petroleum and Enauta, this merger is set to create the second–largest oil producer in Brazil, this merger is part of a broder trend of consolidation in Brazil infrastructure and energy sector.

- In August 2023, Brazilian President Luiz Inácio Lula da Silva unveiled a significant infrastructure plan known as the Growth Acceleration Program (GAP). This plan includes projects such as new highways, ports, and transportation over the next four years.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil infrastructure market based on the below-mentioned segments

Brazil Infrastructure Market, By Type

- Social Infrastructure

- Extraction Infrastructure

- Transportation Infrastructure

- Utilities Infrastructure

- Manufacturing Infrastructure

Brazil Infrastructure Market, By Key Cities

- Sao Paulo

- Rio de Janeiro

- Salvador

Need help to buy this report?