Brazil Maize Market Size, Share, and COVID-19 Impact Analysis, By Nature (Organic Maize and Conventional Maize), By End-use (Food & Beverage, Ethanol Production, Industrial Use, and Animal Feed), and Brazil Maize Market Insights, Industry Trend, Forecasts to 2033.

Industry: AgricultureBrazil Maize Market Insights Forecasts to 2033

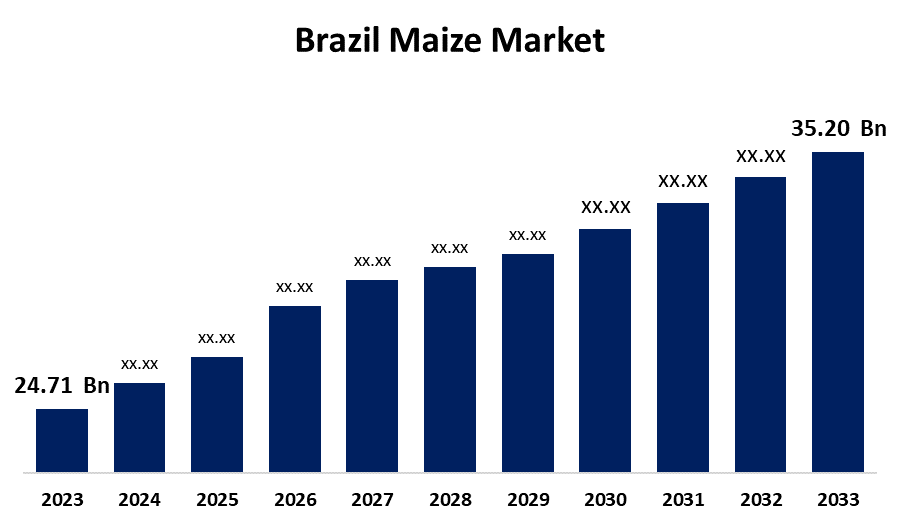

- The Brazil Maize Market Size Was Estimated at USD 24.71 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.60% from 2023 to 2033

- The Brazil Maize Market Size is Expected to Reach USD 35.20 Billion by 2033

Get more details on this report -

The Brazil Maize Market Size is Expected to reach USD 35.20 Billion by 2033, Growing at a CAGR of 3.60% from 2023 to 2033

Market Overview

The market of the Brazilian economy that deals with the production, distribution, and trade of maize, also referred to as corn, is known as the Brazil maize market. In Brazil, maize is an essential crop that is used in food goods, livestock feed, and industrial processes including the manufacturing of ethanol. Brazil is one of the top producers and exporters of maize worldwide, with Mato Grosso, Goiás, and Paraná being its main producing regions. Additionally, Brazil's growing meat industry is driving demand for cereals, particularly maize, due to its high protein content and vital role in livestock feed. In addition, the market is being driven by the use of maize as animal feed because of the strong demand for meat products in this country. Additionally, Brazil's maize market is expected to expand due to the country's increasing exports of maize and its increasing use in a variety of applications. Furthermore, the Brazilian government takes measures to aid maize producers. For instance, in 2017, the FPMA (Food Price Monitoring and Analysis) the government intended to use an option contract auction to buy up to 1 million tons of maize from Mato Grosso, guaranteeing that growers would be able to sell at a certain price.

Report Coverage

This research report categorizes the market for the Brazil maize market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil maize market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil maize market.

Brazil Maize Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 24.71 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.60% |

| 2033 Value Projection: | USD 35.20 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Nature, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Archer-Daniels-Midland (ADM), Cargill, Inc., CHS Inc., Monsanto, Corteva Agriscience, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Brazil maize market is growing since maize is a major ingredient in all kinds of animal feed, the maize market is developing as a result of increasing demand for animal-based protein sources. Additionally, maize is an essential component in many diets, and a substantial amount of the country’s maize crop is used for human consumption as food, sweetener, and cooking oil. In addition, the demand for maize is anticipated to increase in the upcoming years due to the broad need for the commodity across several end-user industries, such as food processing, feed production, ethanol generation, pharmaceuticals, and cosmetics.

Restraining Factors

The market for maize in Brazil is challenged by factors such as shifting demand everywhere, unfavorable weather that reduces crop yields, and competition from other commodities like soybeans. Furthermore, reliance on export markets, high transportation costs, and logistical inefficiencies might limit expansion, affecting the sector's stability and profitability.

Market Segmentation

The Brazil maize market share is classified into nature and end-use.

- The conventional segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on nature, the Brazil maize market is divided into organic maize and conventional maize. Among these, the conventional segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding due to the conventional strategy being widely employed due to its economic practicality, particularly in large-scale commercial farming operations. Additionally, standardized inputs and technology can help farmers and agribusinesses minimize expenses and streamline operations.

- The food & beverage segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the end-use, the Brazil maize market is classified into food & beverage, ethanol production, industrial use, and animal feed. Among these, the food & beverage segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to the food and beverage industry contributes significantly because maize is a key component of numerous dishes, such as pasta, bread, pastries, and breakfast cereals. In addition, contributing to its high demand are its nutritional content, affordability, and versatility in producing a wide range of food items.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil maize market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer-Daniels-Midland (ADM)

- Cargill, Inc.

- CHS Inc.

- Monsanto

- Corteva Agriscience

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, the Nobre VIP3 maize hybrid was introduced by the Brazilian business Produce. This hybrid provides enhanced nutrient absorption, protection from certain insect pests, and resistance to fungal infections.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil maize market based on the below-mentioned segments:

Brazil Maize Market, By Nature

- Organic Maize

- Conventional Maize

Brazil Maize Market, By End-use

- Food & Beverage

- Ethanol Production

- Industrial Use

- Animal Feed

Need help to buy this report?