Brazil Palm Oil Market Size, Share, and COVID-19 Impact Analysis, By Product (RBD Palm Oil, Palm Kernel Oil, Fractional Palm Oil, and Crude Palm Oil), By Application (Personal Care & Cosmetics, Food & Beverage, Biofuel & Energy, Pharmaceuticals, and Others), and Brazil Palm Oil Market Insights, Industry Trend, Forecasts to 2033.

Industry: Specialty & Fine ChemicalsBrazil Palm Oil Market Insights Forecasts to 2033

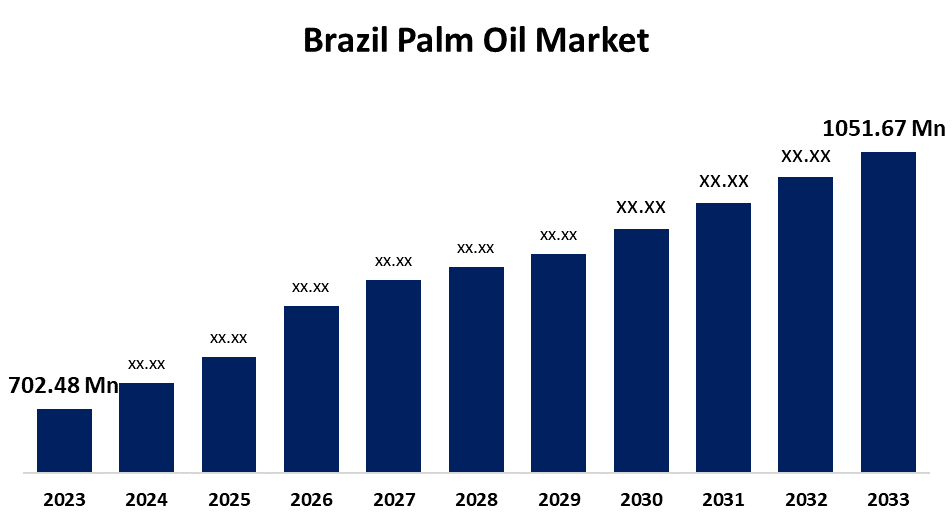

- The Brazil Palm Oil Market Size Was Estimated at USD 702.48 Million in 2023.

- The Market Size is Growing at a CAGR of 4.12% from 2023 to 2033

- The Brazil Palm Oil Market Size is Expected to Reach USD 1051.67 Million by 2033

Get more details on this report -

The Brazil Palm Oil Market Size is Expected to reach USD 1051.67 Million by 2033, Growing at a CAGR of 4.12% from 2023 to 2033

Market Overview

Brazil's palm oil market is the industry that focuses on producing, distributing, and using palm oil in Brazil. The oil palm tree's fruit yields palm oil, a multipurpose vegetable oil. It is extensively utilized in industrial applications, food goods, cosmetics, and biofuels. The countrywide market expansion is mostly being driven by the growing middle class and the rising demand for processed cooking oils. Additionally, because of its affordability and the growing desire from consumers for goods sourced responsibly. Palm oil is a popular choice for manufacturers since it is a versatile, reasonably priced, and high-yielding vegetable oil. In addition, consumers' growing awareness of ethical sourcing and sustainability is pushing businesses to implement ethical practices. Furthermore, the market is expanding as a result of Brazil's sustainable palm oil production in response to customer desires, which strikes a balance between affordability and social and environmental factors. In addition, the Brazilian government established the Abrapalma Association to promote the production of palm oil and is providing incentives to support investments in the industry.

Report Coverage

This research report categorizes the market for the Brazil palm oil market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil palm oil market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil palm oil market.

Brazil Palm Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 702.48 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.12% |

| 2033 Value Projection: | USD 1051.67 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Archer Daniels Midland Company, BELEM BIOENERGIA BRASIL S.A., AgroPalma, Cargill, Kellogg (Kellanova), General Mills Inc., Denpasa, Marborges Agroindústria SA, Grupo BBF (Brasil Biofuels), BIOPALMA, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Brazil palm oil market is growing due to several factors, including the increasing versatility and wide range of products it can be used for, the rapid population growth, the significant economic development, the growing middle class in emerging markets, the cost-effectiveness of it, and growing awareness of its health benefits. In addition, the market's growth is mostly driven by the growing demand for food products like processed meals and cooking oils that contain palm oil. Additionally, the growing use of palm oil in non-food sectors like biofuels and cosmetics is improving the market's outlook, which reflects this. Furthermore, the demand to reduce greenhouse gas emissions and environmental concerns are driving the rising usage of palm oil in biodiesel and other renewable energy sources.

Restraining Factors

The Brazil palm oil market faces challenges because palm oil's high saturated fat content creates health concerns and further limits its broad use, particularly in the food industry, the Brazilian palm oil market confronts difficulties. Furthermore, price volatility caused by global market trends, weather patterns, and geopolitical factors creates uncertainty for both producers and consumers. In addition, competition from other vegetable oils, such as soybean and canola, is threatening palm oil's market dominance.

Market Segmentation

The Brazil palm oil market share is classified into product and application.

- The fractional palm oil segment accounted for the largest share of 36.72% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the Brazil palm oil market is divided into RBD palm oil, palm kernel oil, fractional palm oil, and crude palm oil. Among these, the fractional palm oil segment accounted for the largest share of 36.72% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by its broad range of applications in several industries, especially in biofuels, cosmetics, and food processing. In addition, manufacturers looking for particular functional qualities have found it highly appealing due to its flexibility to be tailored by separating saturated and unsaturated fats.

- The food & beverage segment accounted for the highest share of 58.20% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the Brazil palm oil market is classified into personal care & cosmetics, food & beverage, biofuel & energy, pharmaceuticals, and others. Among these, the food & beverage segment accounted for the highest share of 58.20% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because it is widely used in snacks, processed foods, and cooking oils. Food manufacturers favor palm oil because of its low cost, high adaptability, and extended shelf life. In addition, the booming food sector in Brazil uses palm oil for baking and frying because it is stable at high cooking temperatures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil palm oil market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company

- BELEM BIOENERGIA BRASIL S.A.

- AgroPalma

- Cargill

- Kellogg (Kellanova)

- General Mills Inc.

- Denpasa

- Marborges Agroindústria SA

- Grupo BBF (Brasil Biofuels)

- BIOPALMA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Para formally started monitoring oil palm production, and established new laws to supervise the state's commercialization of palm oil, aiming to ensure sustainable practices and improved industry management.

- In February 2024, the Roundtable on Sustainable Palm Oil (RSPO) and Solidaridad Latin America announced an agreement to facilitate the adoption of regional plans that would assist smallholder oil palm growers in achieving sustainability and certification.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil palm oil market based on the below-mentioned segments:

Brazil Palm Oil Market, By Product

- RBD Palm Oil

- Palm Kernel Oil

- Fractional Palm Oil

- Crude Palm Oil

Brazil Palm Oil Market, By Application

- Personal Care & Cosmetics

- Food & Beverage

- Biofuel & Energy

- Pharmaceuticals

- Others

Need help to buy this report?