Brazil Rigid Polyurethane Foam Market Size, Share, and COVID-19 Impact Analysis, By Product (Slabstock Polyether, Slabstock Polyester, and Molded Foam Parts), By Application (Electrical & Electronics, Automotive, and Building & Construction), and Brazil Rigid Polyurethane Foam Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsBrazil Rigid Polyurethane Foam Market Insights Forecasts to 2033

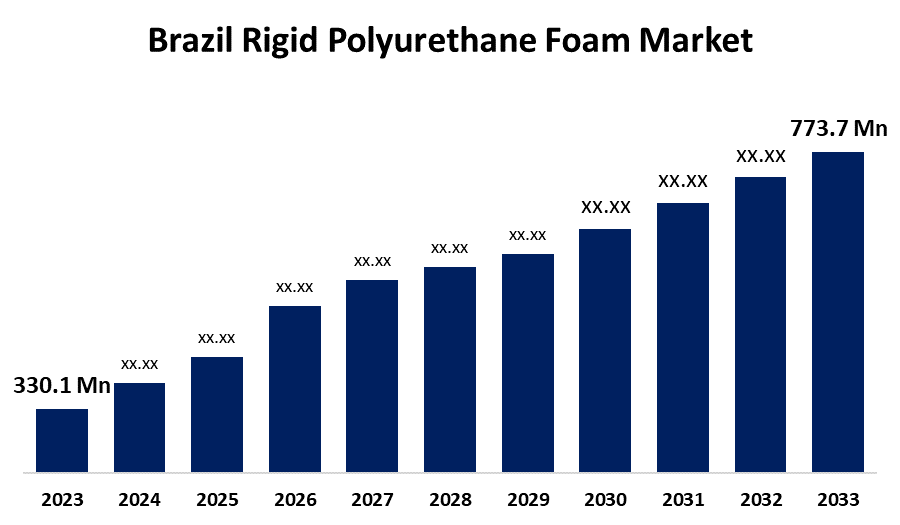

- The Brazil Rigid Polyurethane Foam Market Size was valued at USD 330.1 Million in 2023.

- The Market Size is growing at a CAGR of 8.89% from 2023 to 2033

- The Brazil Rigid Polyurethane Foam Market Size is Expected to Reach USD 773.7 Million by 2033

Get more details on this report -

The Brazil Rigid Polyurethane Foam Market Size is Anticipated to Exceed USD 773.7 Million by 2033, Growing at a CAGR of 8.89% from 2023 to 2033.

Market Overview

The Brazil rigid polyurethane foam market comprises the sector focused on the production and application of rigid polyurethane foam, a high-performance material known for its superior thermal insulation and structural strength. This foam is extensively utilized across multiple industries, including construction, automotive, refrigeration, and packaging, owing to its energy efficiency, lightweight nature, and durability. Several key factors contribute to the growth of this market. The rising emphasis on energy efficiency in the construction sector is a major driver, as rigid polyurethane foam is widely used in building insulation to reduce energy consumption and enhance thermal performance. The expanding automotive industry in Brazil further accelerates market demand, given the material’s application in vehicle manufacturing to improve fuel efficiency and structural integrity. Additionally, the growing refrigeration sector relies on polyurethane foam for its superior insulation properties in commercial and domestic cooling systems. Government initiatives aimed at sustainability and energy conservation play a crucial role in fostering market expansion. Policies promoting green building materials, stricter energy efficiency regulations, and incentives for adopting advanced insulation technologies are expected to further strengthen the demand for rigid polyurethane foam across various industries. These strategic developments position Brazil as a key player in the global rigid polyurethane foam market, ensuring long-term growth and innovation.

Report Coverage

This research report categorizes the market for the Brazil rigid polyurethane foam market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil rigid polyurethane foam market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil rigid polyurethane foam market.

Brazil Rigid Polyurethane Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 330.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.89% |

| 2033 Value Projection: | USD 773.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 143 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Covestro AG, Dow, Honeywell International Inc., Evonik Industries AG, BASF, Trelleborg AB (publ), SEKISUI CHEMICAL CO., LTD., Saint-Gobain S.A., Rogers Corporation, Recticel S.A., and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil rigid polyurethane foam market is driven by several key factors. The increasing demand for energy-efficient building materials has significantly boosted the adoption of rigid polyurethane foam in the construction sector, where it enhances insulation and reduces energy consumption. The expanding automotive industry further contributes to market growth, as manufacturers seek lightweight and durable materials to improve vehicle efficiency. Additionally, the refrigeration sector relies on polyurethane foam for its superior thermal insulation properties. Rising industrialization, coupled with advancements in sustainable manufacturing technologies, supports market expansion. Government policies promoting energy conservation and green building practices further accelerate market growth.

Restraining Factors

The Brazil rigid polyurethane foam market faces challenges such as fluctuating raw material costs, environmental concerns related to foam disposal, stringent regulatory requirements, and the availability of alternative insulation materials, which may hinder market growth.

Market segmentation

The Brazil rigid polyurethane foam market share is classified into product and application.

- The slabstock polyether segment is expected to hold the largest market share through the forecast period.

The Brazil rigid polyurethane foam market is segmented by product into slabstock polyether, slabstock polyester, and molded foam parts. Among these, the slabstock polyether segment is expected to hold the largest market share through the forecast period. Slabstock polyether is a premium insulation material extensively utilized in the construction industry to enhance energy efficiency and reduce heating and cooling costs. Its superior thermal insulation properties and cost-effectiveness contribute to its dominant position in the market.

- The building & construction segment is expected to hold the largest market share through the forecast period.

The Brazil rigid polyurethane foam market is segmented by application into electrical & electronics, automotive, and building & construction. Among these, the building & construction segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the material's superior thermal insulation properties, which are essential for energy-efficient building designs. The increasing focus on sustainable construction practices and stringent energy efficiency regulations further bolster the demand for rigid polyurethane foam in this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil rigid polyurethane foam market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Covestro AG

- Dow

- Honeywell International Inc.

- Evonik Industries AG

- BASF

- Trelleborg AB (publ)

- SEKISUI CHEMICAL CO., LTD.

- Saint-Gobain S.A.

- Rogers Corporation

- Recticel S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, BASF launched a novel polyurethane foam technology called ‘Design-for-recycling’, enabling the easier and more scalable recycling of PU foam. The recycled material was subsequently incorporated into foam formulations designed for easy recycling.

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil rigid polyurethane foam market based on the below-mentioned segments:

Brazil Rigid Polyurethane Foam Market, By Product

- Slabstock Polyether

- Slabstock Polyester

- Molded Foam Parts

Brazil Rigid Polyurethane Foam Market, By Application

- Electrical & Electronics

- Automotive

- Building & Construction

Need help to buy this report?