Brazil Therapeutic Respiratory Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Nebulizer, Oxygen Concentrator, Humidifier, and Others), By Technology (HEPA Filter, Electrostatic, and Others), By Filter (Humidifier Filters, PAP Device Filters, Ventilation Filters, Oxygen Concentrator Filters, and Others), and Brazil Therapeutic Respiratory Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareBrazil Therapeutic Respiratory Devices Market Insights Forecasts to 2033

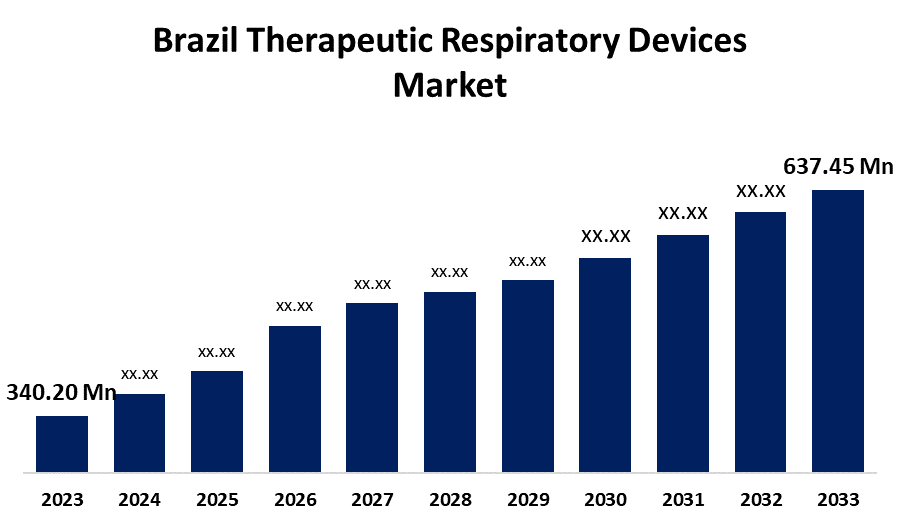

- The Brazil Therapeutic Respiratory Devices Market Size Was Estimated at USD 340.20 Million in 2023.

- The Market Size is Growing at a CAGR of 6.48% from 2023 to 2033

- The Brazil Therapeutic Respiratory Devices Market Size is Expected to Reach USD 637.45 million by 2033

Get more details on this report -

The Brazil Therapeutic Respiratory Devices Market Size is Expected to Reach USD 637.45 Million by 2033, Growing at a CAGR of 6.48% from 2023 to 2033

Market Overview

The market for therapeutic respiratory devices in Brazil is the area of the healthcare sector that deals with equipment that treats respiratory disorders such as pneumonia, asthma, chronic obstructive pulmonary disease (COPD), and other pulmonary diseases. These devices offer a range of treatments, including nebulization, ventilation assistance, and oxygen therapy, to help patients manage their breathing challenges. Nebulizers, ventilators, oxygen concentrators, CPAP (Continuous Positive Airway Pressure) machines, and other respiratory support equipment are merely some of the many products available on the market. The growing number of patients raises the demand for these gadgets. The demand for respiratory devices is also influenced by the aging population since older persons are more prone to COPD. In addition, the market is expanding throughout both clinical and residential settings as a result of technological developments in respiratory care, such as portable oxygen concentrators and smart monitoring systems, which have improved effectiveness, usability, and convenience.

Report Coverage

This research report categorizes the market for the Brazil therapeutic respiratory devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil therapeutic respiratory devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil therapeutic respiratory devices market.

Brazil Therapeutic Respiratory Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 340.20 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.48% |

| 023 – 2033 Value Projection: | USD 637.45 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Product, By Technology, By Filter |

| Companies covered:: | Koninklijke Philips NV, Medtronic, Masimo, Chart Industries, General Electric Company (GE HealthCare), Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited, Hamilton Medical, BD (Becton, Dickinson and Company), ResMed Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The growing geriatric population, government-sponsored initiatives to improve healthcare infrastructure, the prevalence of respiratory diseases like COPD and asthma, the need for home healthcare solutions, the growth of telemedicine, industry innovation, and the integration of IoT and AI in devices are the main factors driving the market. Additionally, product categories like ventilators and nebulizers have a lot of smaller to larger competitors than other markets because they do not require as many drug approvals, which ultimately helps the market grow. Furthermore, the diagnosis and treatment of respiratory disorders are improving as a result of growing awareness about the significance of respiratory health and the available treatments. It is more probable that patients will invest in technology that can enhance their quality of life and seek early treatment.

Restraining Factors

The Brazil therapeutic respiratory devices market faces challenges due to the advanced equipment, such as ventilators and CPAP machines, which can be costly, which may restrict access, especially in Brazil's rural or lower-income areas, even though some therapeutic devices, such as nebulizers and oxygen concentrators, are reasonably priced. In addition, Brazil's economy has experienced periods of volatility, which may restrict public and private healthcare spending. Many people's access to and affordability of therapeutic respiratory equipment may be impacted by economic downturns.

Market Segmentation

The Brazil therapeutic respiratory devices market share is classified into product, technology, and filter.

- The nebulizers segment accounted for the largest share of 20.72% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the Brazil therapeutic respiratory devices market is divided into nebulizer, oxygen concentrator, humidifier, and others. Among these, the nebulizers segment accounted for the largest share of 20.72% in 2023 and is expected to grow at a significant CAGR during the forecast period. The demand for nebulizers is driven by the rising incidence of these disorders and heightened consciousness regarding respiratory health. In addition, the growing number of elderly people and advancements in nebulizer technology, like quieter and portable variants, further support market expansion.

- The electrostatic segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the technology, the Brazil therapeutic respiratory devices market is divided into HEPA filter, electrostatic, and others. Among these, the electrostatic segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to the air quality for patients is improved with electrostatic filters, which use charged particles to capture and remove dust, bacteria, and viruses. This technique improves the functionality of ventilators, oxygen concentrators, and humidifiers.

- The ventilation segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the filter, the Brazil therapeutic respiratory devices market is divided into humidifier filters, PAP device filters, ventilation filters, oxygen concentrator filters, and others. Among these, the ventilation segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding because these filters are essential to maintaining the effectiveness and safety of mechanical ventilation. In addition, the demand for high-quality filters is growing as a result of the rising incidence of respiratory illnesses and the requirement for ventilators, particularly in hospitals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil therapeutic respiratory devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Koninklijke Philips NV

- Medtronic

- Masimo

- Chart Industries

- General Electric Company (GE HealthCare)

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Limited

- Hamilton Medical

- BD (Becton, Dickinson and Company)

- ResMed Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2022, CAIRE Inc., a global manufacturer of oxygen equipment, plans to expand its product line in Latin America. The Brazilian Health Regulatory Agency (Anvisa) approved the Companion 5 and NewLife Intensity 10 stationary oxygen concentrators, which were subsequently released in July.

Market Segment

- This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Brazil therapeutic respiratory devices market based on the below-mentioned segments

Brazil Therapeutic Respiratory Devices Market, By Product

- Nebulizer

- Oxygen Concentrator

- Humidifier

- Others

Brazil Therapeutic Respiratory Devices Market, By Technology

- HEPA Filter

- Electrostatic

- Others

Brazil Therapeutic Respiratory Devices Market, By Filter

- Humidifier Filters

- PAP Device Filters

- Ventilation Filters

- Oxygen Concentrator Filters

- Others

Need help to buy this report?