Global Bromine Market Size, Share, and COVID-19 Impact, By Derivative (Organo Bromine, Clear Brine Fluids, Hydrogen Bromide), By Application (Flame Retardants, Oil & Gas Drilling, PTA Synthesis, Water Treatment), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal Bromine Market Insights Forecasts to 2032

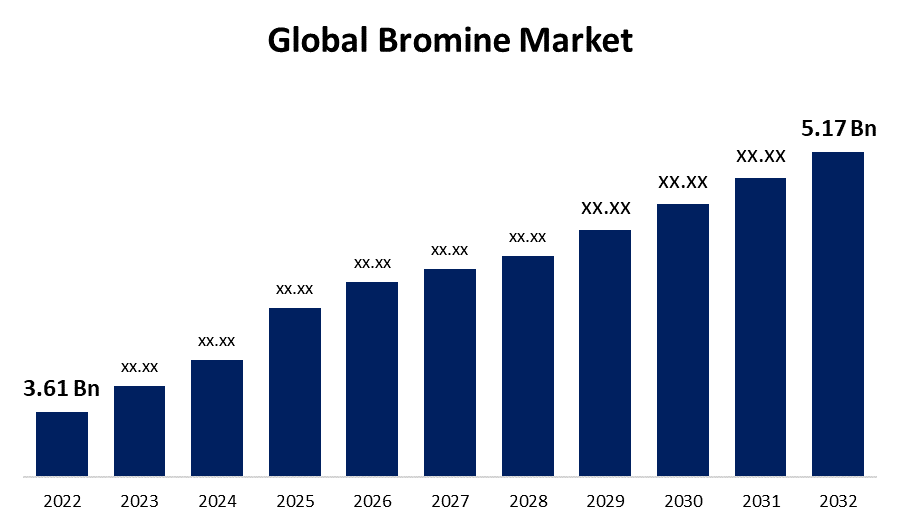

- The Bromine Market Size was valued at USD 3.61 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.89% from 2022 to 2032

- The Worldwide Bromine Market Size is expected to reach USD 5.17 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Bromine Market Size is expected to reach USD 5.17 Billion by 2032, at a CAGR of 5.89% during the forecast period 2022 to 2032.

A red vapour is produced when bromine, a volatile substance, evaporates quickly at ambient temperature. Its density is almost three times more than that of water. Bromine is corrosive and can burn flesh when it comes into touch with it. Additionally, it is easily soluble in organic solvents and has a low boiling point. The use of this type of technology in the workplace and at home is a growing trend. It is largely employed in the manufacture of flame retardants, which are substances that are put to furniture, plastics, and fabrics in order to lower the risk of fire. The manufacture of agricultural chemicals, pharmaceuticals, and water treatment products is done in part by the use of bromine, which is also utilised in the production of a variety of other products. Bromine compounds are also used as catalysts in chemical reactions and in the manufacture of petrol additives.

Impact of COVID 19 On the Global Bromine Market

Lockdowns, travel restrictions, and decreased manufacturing output caused the bromine business, like many other industries, to endure supply chain disruptions on a global scale. These hiccups had negative impact on the transportation and manufacture of bromine and its compounds. Several industries, including flame retardants, oil and gas drilling fluids, water treatment, and pharmaceuticals, have an impact on the demand for bromine and its byproducts. Some industries, like the automotive and construction sectors, had slowdowns and decreased demand during the pandemic, which had an influence on the market for items containing bromine. On the other hand, the pandemic response-driven rise in demand for drugs and chemicals for water treatment may have somewhat offset the fall in other sectors. The pandemic's effects on the supply chain and changes in demand resulted in price instability in the bromine market. Prices for bromine and its derivatives fluctuated as a result of unknown future demand and supply dynamics.

Global Bromine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 3.61 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.89% |

| 2032 Value Projection: | USD 5.17 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Derivative, By Application, By Region |

| Companies covered:: | Albemarle Corporation, Chemada Industries Ltd., Gulf Resources Inc., Hindustan Salts Limited, Honeywell International Inc., ICL Group Ltd., Jordan Bromine Company Limited, Lanxess AG, Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.), Tata Chemicals Limited, TETRA Technologies Inc., Tosoh Corporation |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

Bromine chemicals are popularly employed in water treatment applications because they are powerful disinfectants. They are utilised to clean industrial water systems, swimming pools, and spas. The expansion of the bromine market in the water treatment industry has been attributed to the increased emphasis on water quality and the demand for efficient water treatment techniques. Bromine chemicals are used in the pharmaceutical sector and as chemical building blocks in a number of organic synthesis procedures. The synthesis of pharmaceuticals, insecticides, and other speciality chemicals is done with the help of ad-hocracy. The demand for compounds based on bromine has increased as a result of the expansion of the chemical and pharmaceutical sectors, which has supported the expansion of the bromine market. Additionally, bromine is finding new uses that are fostering market expansion. These include methods of storing energy, such as flow batteries based on bromine, and brominated polymers used in electronics and automobile parts.

Key Market Challenges

Due to a variety of reasons, including shifting supply and demand dynamics, generalised economic conditions, and changes in the price of raw materials, the bromine market may experience price volatility. Pricing uncertainty can be a problem for producers and consumers in the bromine market, affecting their profitability and ability to plan. The use of a computerised system to generate electricity is a common practise. For instance, there is increasing interest in substitute flame retardants that are thought to be safer and more ecologically friendly in the market for flame retardants. The market for bromine is challenged by the emergence of substitute products and technologies, necessitating creative problem-solving and industry adaptation. Bromine market stability may be impacted by changes in the supply of brine and supply-chain interruptions.

Market Segmentation

Derivative Insights

Organo bromine holds the highest market share over the forecast period

Based on the derivative insights, the global bromine market is segmented into Organo Bromine, Clear Brine Fluids, and Hydrogen Bromide. Among these, organo bromine holds the highest market share over the forecast period. The usage of organo bromine compounds as flame retardants is widespread in a number of sectors, including textiles, electronics, automotive, and construction. They work well to make materials less flammable and to increase fire safety. The use of organo bromine flame retardants has increased, fueling the expansion of the organo bromine segment, as a result of tightening fire safety laws and rising consumer demand for products with flame resistance. Flame retardant materials are required by the electronics sector for a variety of parts and gadgets. Organo bromine compounds are ideal for this use because they provide reliable fire protection without sacrificing functionality. The organo bromine market has expanded as a result of the rise of the electronics segment and rising consumer demand for electronic products.

Application Insights

Flame retardants segment is dominating the market over the forecast period

On the basis of application, the global bromine market is segmented into Flame Retardants, Oil & Gas Drilling, PTA Synthesis, Water Treatment, and Others. Among these, flame retardants segment is dominating the market over the forecast period. Due to the tremendous industrialisation, urbanisation, and infrastructure development occurring in emerging countries like Asia-Pacific and Latin America, there is an increasing demand for flame retardants. The demand for flame retardants is also being driven by newly developed applications, including textiles, wire and cable coatings, electrical and electronic devices, and wire and cable. Major customers of flame retardant materials include the building and automotive industries. Flame retardants are now more necessary than ever to ensure fire safety in structures and automotive parts due to the expansion of these industries, which is being fueled by urbanisation, the construction of infrastructure, and rising car demand. The flame retardants segment has expanded as a result.

Regional Insights

Asia Pacific region is dominating the market with the largest market share

Get more details on this report -

Among all other regions, Asia Pacific region is dominating the market with the largest market share. Some of the top bromine producers are located in Asia-Pacific, including China, which is the world's largest bromine producer. South Korea, Japan, and India are a few additional notable producers in the area. These producers give the bromine market in Asia-Pacific a competitive edge in terms of cost-effectiveness and supply chain efficiency.

North America, on the other hand is witnessing the fastest market growth over the forecast period. Automotive, construction, electronics, textiles, oil and gas, and other industries are all well represented in the area. These sectors are major consumers of flame retardants, drilling fluids, water treatment chemicals, and pharmaceutical intermediates, among other items based on bromine. The bromine market has expanded in North America as a result of these industries' consistent growth.

Recent Market Developments

- In September 2019, Israel Chemicals Ltd. intended to raise manufacturing capacity to about 25000 tonnes. A 50 million dollar investment is anticipated, but it might bring in as much as 110 million dollars. This choice was made in the midst of contracts being inked with numerous clients across Asia.

List of Key Companies

- Albemarle Corporation

- Chemada Industries Ltd.

- Gulf Resources Inc.

- Hindustan Salts Limited

- Honeywell International Inc.

- ICL Group Ltd.

- Jordan Bromine Company Limited

- Lanxess AG

- Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.)

- Tata Chemicals Limited

- TETRA Technologies Inc.

- Tosoh Corporation

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Bromine Market based on the below-mentioned segments:

Bromine Market, Derivative Analysis

- Organo Bromine

- Clear Brine Fluids

- Hydrogen Bromide

Bromine Market, Application Analysis

- Flame Retardants

- Oil & Gas Drilling

- PTA Synthesis

- Water Treatment

- Others

Bromine Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of Bromine Market?The global Bromine Market is expected to grow from USD 3.61 Billion in 2022 to USD 5.17 Billion by 2032, at a CAGR of 5.89% during the forecast period 2022-2032.

-

2. Who are the key market players of Bromine Market?Some of the key market players of Albemarle Corporation, Chemada Industries Ltd., Gulf Resources Inc., Hindustan Salts Limited, Honeywell International Inc., ICL Group Ltd., Jordan Bromine Company Limited, Lanxess AG, Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.), Tata Chemicals Limited, TETRA Technologies Inc. and Tosoh Corporation.

-

3. Which segment hold the largest market share?Flame retardants segment holds the largest market share is going to continue its dominance.

-

4. Which region is dominating the Bromine Market?Asia Pacific is dominating the Bromine Market with the highest market share.

Need help to buy this report?