Global Bunker Fuel Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), Liquefied Natural Gas (LNG), and Others), By Vessel Type (Containers, General Cargo, Oil Tankers, Bulk Carriers, and Other Vessel Types), By Fuel Grade(IFO 380, IFO 180, MGO/MDO), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Bunker Fuel Market Insights Forecasts to 2033

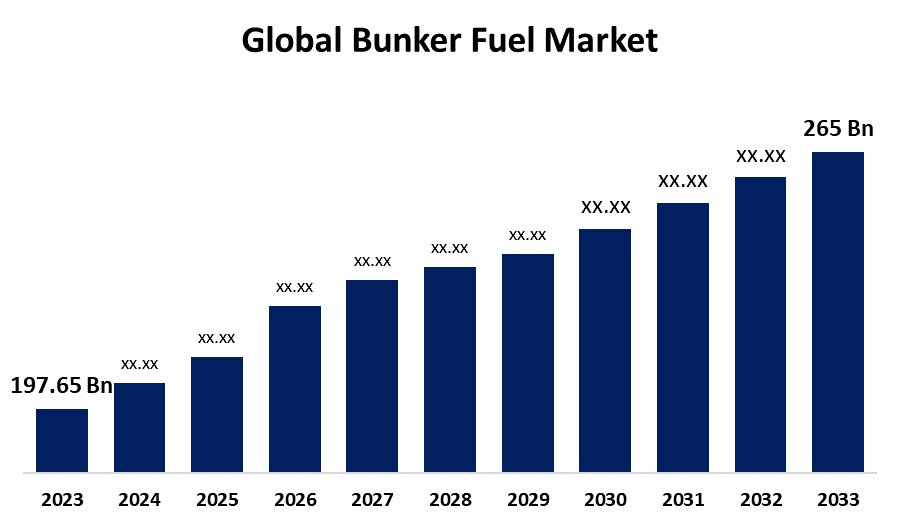

- The Global Bunker Fuel Market Size was Valued at USD 197.65 Billion in 2023

- The Market Size is Growing at a CAGR of 2.62% from 2023 to 2033

- The Worldwide Bunker Fuel Market Size is Expected to Reach USD 256 Billion by 2033

- The Middle East and Africa is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Bunker Fuel Market Size is Anticipated to Exceed USD 256 Billion by 2033, Growing at a CAGR of 2.62% from 2023 to 2033.

Market Overview

Bunker fuel or marine fuel is a type of fuel oil specifically designed for use in ship engines. It is a heavy and thick oil derived from the residue of the distillation process in crude oil refining. The primary benefit of bunker fuel is its cost-effectiveness. Due to its high density and lower refinement requirements, it is cheaper than more refined fuels like diesel or gasoline, making it a preferred choice for the shipping industry to reduce operational costs. Additionally, bunker fuel has a high energy density, enabling ships to travel long distances without frequent refueling. This makes it beneficial for long-haul voyages. Moreover, the infrastructure for bunker fuel is already well-established in major ports worldwide, ensuring accessibility and reliability for shipping operations.

Report Coverage

This research report categorizes the market for the global bunker fuel market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global bunker fuel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global bunker fuel market.

Global Bunker Fuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 197.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.62% |

| 2033 Value Projection: | USD 256 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Fuel Type, By Vessel Type, By Fuel Grade, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Exxon Mobil Corporation, Royal Dutch Shell Plc, Gazpromneft Marine Bunker LLC, TotalEnergies SE, Chemoil Energy Limited, Aegean Marine Petroleum Network, Inc., World Fuel Services Corporation, Gulf Agency Company Ltd., BP Marine Ltd., Bunker Holding A/S, Lukoil, Sinopec Group, Chevron Corporation, PETRONAS, Neste, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the global bunker fuel market is driven by the expansion of international trade, which necessitates extensive maritime transportation. Additionally, the increasing size and number of commercial vessels enhance the need for reliable and cost-effective energy sources. Regulatory frameworks, such as the IMO 2020 sulfur cap, also boost market growth by encouraging the adoption of lower-sulfur and cleaner fuels.

The innovation and advancement in ship engines promote higher fuel efficiency. The availability of alternative fuels like LNG and biofuel, and the ongoing infrastructural development at major ports stimulate market expansion by providing more sustainable and efficient fueling options.

Restraining Factors

The growth of the global bunker fuel market is constrained by factors, including environmental concerns related to the high sulfur content and emissions associated with traditional bunker fuels. Strict regulations, such as the IMO 2020 sulfur cap, impose additional compliance costs and operational changes for shipping companies. Fluctuations in crude oil prices create uncertainty and volatility in bunker fuel pricing. Furthermore, the growing emphasis on sustainability, renewable energy sources, and alternative, cleaner fuels like LNG and biofuels are diverting demand from conventional bunker fuels.

Market Segmentation

The global bunker fuel market share is classified into fuel type, vessel type, and fuel grade.

- The liquefied natural gas (LNG) segment is expected to hold the largest share of the global bunker fuel market during the forecast period.

Based on the fuel type, the global bunker fuel market is divided into high-sulfur fuel oil (HSFO), very low-sulfur fuel oil (VLSFO), marine gas oil (MGO), liquefied natural gas (LNG), and others. Among these, the liquefied natural gas (LNG) segment is expected to hold the largest share of the global bunker fuel market during the forecast period. LNG's dominance is anticipated due to its environmental benefits, including significantly lower sulfur and greenhouse gas emissions than traditional fuels like high sulfur fuel oil (HSFO) and very low sulfur fuel oil (VLSFO). This aligns with international regulations such as the IMO 2020 sulfur cap, which mandates reduced sulfur content in marine fuels. LNG offers higher energy efficiency, so it is highly preferred by shipping companies. Innovations in LNG infrastructure and fueling technology also enhance its accessibility and reliability, making it a preferred choice for modern maritime operations.

- The containers segment is expected to hold the largest share of the global bunker fuel market during the forecast period.

Based on vessel type, the global bunker fuel market is divided into containers, general cargo, oil tankers, bulk carriers, and others. Among these, the containers segment is expected to hold the largest share of the global bunker fuel market during the forecast period. This dominance is expected because large volumes of goods are transported via container ships, the backbone of global trade. These vessels operate on long-haul routes and require significant amounts of bunker fuel to cover the distances efficiently. The container shipping industry benefits from economies of scale, making fuel cost a critical aspect of operational expenditure. Additionally, the rise in global trade networks boosts the demand for bunker fuel in this segment.

- The MGO/ MDO segment is expected to grow at the fastest CAGR in the global bunker fuel market during the forecast period.

Based on fuel grade, the global bunker fuel market is divided into IFO 380, IFO 180, and MGO/MDO. Among these, the MGO/MDO segment is expected to grow at the fastest CAGR in the global bunker fuel market during the forecast period. The rapid growth of this segment is expected because it complies with environmental regulations such as the IMO 2020 sulfur cap, which limits sulfur content in marine fuels. MGO/MDO has a lower sulfur content than traditional heavy fuel oils like IFO 380 and IFO 180, making it more environmentally friendly. It can be used in several marine engines without much modifications.

Regional Segment Analysis of the Global Bunker Fuel Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global bunker fuel market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global bunker fuel market over the predicted timeframe. This dominance is anticipated due to the region's strategic importance in global maritime trade, with major shipping lanes like the South China Sea and the Strait of Malacca having more commercial activities. Countries like China, Japan, South Korea, India, and Singapore have some of the busiest ports in the world, driving the demand for bunker fuel. The rapid industrialization and economic growth in these countries have also led to increased maritime trade volumes. Additionally, Asia-Pacific is a hub for shipbuilding and has several commercial fleets, boosting the need for bunker fuel. Also, the initiatives aimed to enhance port infrastructure and fuel supply chains contribute to the market's growth.

The Middle East and Africa (MEA) is expected to grow at the fastest pace in the global bunker fuel market during the predicted timeframe. The MEA has a strategic location, with maritime corridors like the Suez Canal and the Strait of Hormuz, which play a crucial role in its growth prospects. The region's abundant crude oil resources ensure a stable and cost-effective bunker fuel supply. Moreover, investments in expanding port infrastructure and refinery capabilities drive the market expansion. Economic diversification initiatives and the development of free trade zones boost maritime trade activities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bunker fuel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Exxon Mobil Corporation

- Royal Dutch Shell Plc

- Gazpromneft Marine Bunker LLC

- TotalEnergies SE

- Chemoil Energy Limited

- Aegean Marine Petroleum Network, Inc.

- World Fuel Services Corporation

- Gulf Agency Company Ltd.

- BP Marine Ltd.

- Bunker Holding A/S

- Lukoil

- Sinopec Group

- Chevron Corporation

- PETRONAS

- Neste

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, TotalEnergies Marine Fuels supplied its first B100 biofuel bunker on 5th August in Singapore and made significant expansion in its low-carbon fuels offer as it supports the decarbonization goals of global shipping.

- In July 2024, ABS published a new advisory covering technical and operational challenges in ammonia bunkering from the perspective of both the source and receiving vessel.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global bunker fuel market based on the below-mentioned segments:

Global Bunker Fuel Market, By Fuel Type

- High Sulfur Fuel Oil (HSFO)

- Very Low Sulfur Fuel Oil (VLSFO)

- Marine Gas Oil (MGO)

- Liquefied Natural Gas (LNG)

- Others

Global Bunker Fuel Market, By Vessel Type

- Containers

- General Cargo

- Oil Tankers

- Bulk Carriers

- Others

Global Bunker Fuel Market, By Fuel Grade

- IFO 380

- IFO 180

- MGO/MDO

Global Bunker Fuel Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Exxon Mobil Corporation, Royal Dutch Shell Plc, Gazpromneft Marine Bunker LLC, TotalEnergies SE, Chemoil Energy Limited, Aegean Marine Petroleum Network, Inc., World Fuel Services Corporation, Gulf Agency Company Ltd., BP Marine Ltd., Bunker Holding A/S, Lukoil, Sinopec Group, Chevron Corporation, PETRONAS, Neste, and Others.

-

2. What is the size of the global bunker fuel market?The Global Bunker Fuel Market Size is expected to grow from USD 197.65 Billion in 2023 to USD 256 Billion by 2033, at a CAGR of 2.62% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia-Pacific is anticipated to hold the largest share of the global bunker fuel market over the predicted timeframe.

Need help to buy this report?