Global Buy Now Pay Later Market Size, Share, and COVID-19 Impact Analysis, By Channel (Point of Sale (POS), Online), By End user (BFSI, Consumer Electronics, Fashion & Garment, Healthcare, Retail, Media & Entertainment, Others), By Enterprise Type (SME, Large Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Banking & FinancialGlobal Buy Now Pay Later Market Size Insights Forecasts to 2032

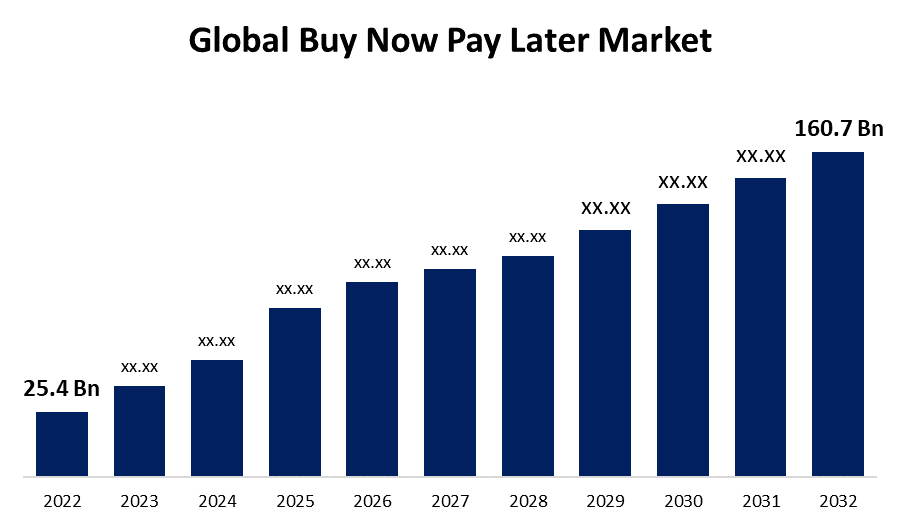

- The Global Buy Now Pay Later Market Size was valued at USD 25.4 Billion in 2022.

- The Market Size is Growing at a CAGR of 20.2% from 2022 to 2032

- The Worldwide Buy Now Pay Later Market Size is expected to reach USD 160.7 Billion by 2032

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Buy Now Pay Later Market Size is expected to reach USD 160.7 Billion by 2032, at a CAGR of 20.2% during the forecast period 2022 to 2032.

Buy now pay later PayPal offers four interest-free payments utilizing an online payment method in the major regions. The services provided by industry leaders cover a number of sectors, including travel and tourism, consumer electronics, e-commerce and retail, healthcare insurance, and banking and financial services. The biggest companies in the sector also supply buy now pay later electronics and buy now pay later travel for use in this business. Customers can purchase goods and services using buy now pay later services without making an instant payment, increasing their financial flexibility and relieving them of the strain of up-front costs. The market for buy now pay later products has Grown dramatically as a result of the Growth of e-commerce. Customers anticipate quick and easy payment options as online shopping becomes more common. Buy now pay later options have gained popularity as e-commerce platforms have Grown and the use of digital wallets among consumers and businesses has increased. Governments and banking regulators in various nations have accepted buy now pay later services as a legal payment method, increasing their validity and boosting consumer confidence. By encouraging providers of buy now pay later services to diversify their offerings and expand into new markets, the regulatory environment has helped the industry Grow.

Global Buy Now Pay Later Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 25.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 20.2% |

| 2032 Value Projection: | USD 160.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Channel, By End user, By Enterprise Type, By Region and COVID-19 Impact. |

| Companies covered:: | Affirm Holdings Inc., Quadpay, Sezzle, Splitit, Paypal, Perpay Inc, Klarna Bank AB (publ), Laybuy Group Holdings Limited, Payl8r, Billie, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

The global point of sale installment loans industry has Grown as a result of the increased usage of online payment methods in industries including banking, health insurance, retail & consumer goods, and others. According to the survey, 60-65% of consumers globally had recently made online purchases using a digital payment method. Additionally, there is a huge demand for buy now pay later services due to the Growth of e-commerce globally. The buy now pay later payment sector is Growing rapidly due to the increased use of online payment methods around the world. People's use of online payment technology is mostly being driven by the availability of high-speed internet connection, the rise in smartphone use, and the increased awareness of digital payment services. Buy now pay later companies give businesses appealing partnerships and incentives in addition to customer perks. Working with buy now pay later systems can help retailers to increase conversion rates, attract new customers, and build customer loyalty.

Restraining Factors

However, a lack of service awareness and the widespread availability of different payment choices are projected to hamper the expansion of the buy now pay later market. There are numerous different payment methods available, including credit card and debit card loans, postdated cheques, and others. Furthermore, as the popularity of buy now pay later services develops, there is concern that buyers will be encouraged to overspend, resulting in an untenable buildup of debt. In order to overcome this constraint and maintain ethical financial practices, BNPL providers should conduct stringent credit checks and evaluate each customer's viability before providing their services.

Market Segmentation

By Channel Insights

The point of sale (POS) segment is witnessing significant CAGR Growth over the forecast period.

Based on channel, the global buy now pay later market is segmented into point of sale (POS) and online. Among these, the point of sale (POS) segment is dominating the market with the largest revenue share of more than 38.6% over the forecast period; the POS industry is Growing substantially. The ease of using buy now pay later services directly at the POS increases the appeal of this payment option as more people choose to shop in physical stores and online. With the help of POS, consumers can make decisions about purchases right away without waiting for preapproval or doing a credit check, making transactions quick and easy, owing to the adoption of e-commerce applications and the surge in online payment. Since its perfect integration with the shopping experience.

By End-user Insights

The healthcare segment dominates the market with the largest revenue share over the forecast period.

Based on end user, the global buy now pay later market is segmented into BFSI, consumer electronics, fashion & garment, healthcare, retail, media & entertainment, and others. Among these, the healthcare segment is witnessing significant CAGR Growth over the forecast period. The healthcare sector is seeing an increase in the use of buy now pay later payment systems, which provide a low-friction alternative to credit cards. Furthermore, users choose BNPL payment options over credit cards to avoid costly compounding interest and hidden costs. Moreover, rising treatment expenditures for conditions such as cancer, chronic heart disease, and cardiovascular disease are likely to fuel demand for buy now pay later services over the forecast period. The industry is seeing Growth in the use of buy now pay later solutions since they allow clients to simply spread the expense of purchase throughout predetermined and interest-free installments.

By Enterprise Type Insights

The large enterprise segment is expected to hold the largest share of the global buy now pay later market during the forecast period.

Based on enterprise, the global buy now pay later market is classified into SMEs and large enterprises. Among these, the large enterprises segment is expected to hold the largest share of the buy now pay later market during the forecast period. The segment's high demand is driven by several primary drivers, including the extensive use of buy now pay later payment solutions to give their clients with a cheap and convenient payment method for acquiring products with significant value. As a result of buy now pay later, shoppers typically purchase more things due to the simplicity of purchase, resulting in increased sales. Hence, buy now pay later assists large organizations in considerably increasing their client experience.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast. The increased presence of fintech service providers with competitive portfolio offerings has helped to drive demand for buy now pay later services across North America. Furthermore, with rising partnerships among buy now pay later and entertainment service providers across the area, offering consumers attractive discounts, prizes, and loyalty, demand for buy now pay later services is likely to rise over the forecast period.

Europe, on the contrary, is expected to Grow the fastest during the forecast period. Europe is fast expanding as a result of a boom in service use among internet shoppers. According to the World Pay study, the buy now pay, later fintech company in the United Kingdom, such as Afterpay, Klarna, Affirm, and others, is increasing at a rate of more than 38.6% each year due to an increase in e-commerce sales. Several top corporations are also extending their service offerings in European countries such as Germany, the United Kingdom, France, and others.

Asia-Pacific market is expected to register a substantial CAGR Growth rate during the forecast period. This is due mostly to the Growing use of digital payments such as Amazon Pay, Google Pay, UPI, PayPal, and others. These online payment channels have increased the service's popularity. Furthermore, the Growing popularity of e-commerce online applications has generated a hitherto unseen market potential for important companies.

List of Key Market Players

- Affirm Holdings Inc.

- Quadpay

- Sezzle

- Splitit

- Paypal

- Perpay Inc

- Klarna Bank AB (publ)

- Laybuy Group Holdings Limited

- Payl8r

- Billie

Key Market Developments

- On February 2022: CRED launched the CRED Flash application to enter the buy now, pay later market. CRED Flash would allow users to make payments using the app and over 500 partner retailers such as Urban Company, Zpto, and Swiggy. It allows consumers to pay their bills in 30 days for free.

- In December 2022: Galileo Financial Technologies, LLC, a financial technology firm, introduced a unique buy now pay later solution for fintechs and banks. This idea would make it easier for banks and fintechs to enter the market and allow their clients to spend more.

- In July 2022: In India, Samsung debuted a buy now, pay later option for its foldable smartphones, including the Galaxy Z Flip 3, Galaxy S22 series, and Galaxy Z Fold 3 series. This BNPL option allows Samsung customers to pay 60% of the total amount in 18 interest-free installments, with the remaining 40% due on the 19th installment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Buy Now Pay Later Market based on the below-mentioned segments:

Buy Now Pay Later Market, Channel Analysis

- Point of Sale (POS)

- Online

Buy Now Pay Later Market, End User Analysis

- BFSI

- Consumer Electronics

- Fashion & Garment

- Healthcare

- Retail

- Media & Entertainment

- Others

Buy Now Pay Later Market, Enterprise Type Analysis

- SMEs

- Large Enterprises

Buy Now Pay Later Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?