Global C9 Hydrocarbon Resin Market Size, Share, and COVID-19 Impact Analysis, By Type (Modified C9 Resins and Unmodified C9 Resins), By Application (Adhesives, Coatings, Inks, and Rubber Compounding), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal C9 Hydrocarbon Resin Market Insights Forecasts to 2033

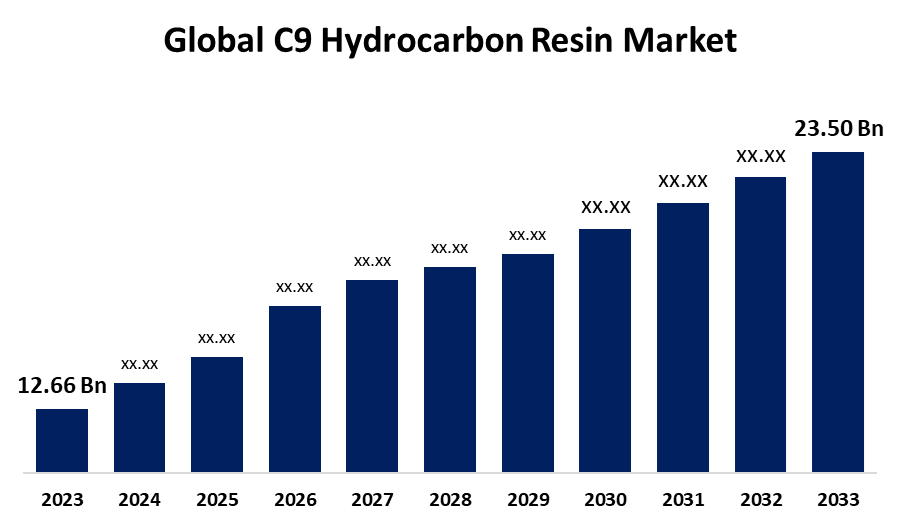

- The Global C9 Hydrocarbon Resin Market Size was estimated at USD 12.66 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 6.38% from 2023 to 2033

- The Worldwide C9 Hydrocarbon Resin Market Size is Expected to Reach USD 23.50 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global C9 Hydrocarbon Resin Market Size is expected to cross USD 23.50 Billion by 2033, growing at a CAGR of 6.38% from 2023 to 2033. In large part due to the growing demand from a variety of sectors and applications, the market for C9 hydrocarbon resin offers a plethora of opportunities for expansion and advancement.

Market Overview

Manufacturing and trading in C9 hydrocarbon resins, a kind of synthetic resin made from petroleum, is known as the C9 hydrocarbon resin market. Aromatic compounds that are usually obtained from the C9 part of the petrochemical industry make up the majority of the C9 hydrocarbon resins market. Industries that need these particular qualities in their products are served by the production, distribution, and sale of C9 hydrocarbon resins. The market for C9 hydrocarbon resin is anticipated to keep growing due to increased demand from important sectors like adhesives, paints, coatings, and the automotive industry. The adhesives, coatings, and rubber industries' growing demand has been driving the market's recent significant expansion. The growth of the construction, automotive, and packaging sectors is driving the demand for these goods. The factors that are driving the growth of the C9 hydrocarbon resin market include the demand for adhesives and sealants, the expansion of the automotive industry, and the expansion of the packaging industry.

Report Coverage

This research report categorizes the C9 hydrocarbon resin market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the C9 hydrocarbon resin market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the C9 hydrocarbon resin market.

Global C9 Hydrocarbon Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.66 Billion |

| Forecast Period: | 2023 – 2033. |

| Forecast Period CAGR 2023 – 2033. : | 6.38% |

| 023 – 2033. Value Projection: | USD 23.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Eastman Chemical Company, Fuxun Huaxing, Total Cray Valley, Zeon Corporation, Puyang Changyu, Kolon Industries, Inc., Jinlin Fuyuan, Lesco Chemical Limited, Daqing Huake, Arakawa Chemical Industries, Ltd., ExxonMobil Corporation, Formosan Union, Neville, Zibo Luhua, and Other Key Players |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing use of C9 hydrocarbon resin in the adhesive and sealant sector is one of the main reasons driving the market's growth. The growing need for a variety of industrial applications, such as printing inks, adhesives, and coatings, is the main driver of the market expansion. The global market demand is also being driven by an increase in building and automobile manufacturing. The market expansion for C9 hydrocarbon resins is supported by the requirement for high-performance adhesive technologies, which is further highlighted by lightweight vehicle designs. E-commerce and the growth of consumer products are the main drivers of the need for packaging materials.

Restraining Factors

Competitors in the market include substitute materials and resins, such as bio-based resins and other synthetic resins that could offer better performance or environmental benefits. The growth of the C9 hydrocarbon resin market can be restricted by the increasing popularity of these alternatives.

Market Segmentation

The C9 hydrocarbon resin market share is classified into type and application.

- The modified C9 resins segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the C9 hydrocarbon resin market is divided into modified C9 resins and unmodified C9 resins. Among these, the modified C9 resins segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Modified C9 resins are chemically modified C9 resins designed to improve certain qualities like flexibility, adhesion, and heat resistance this makes them appropriate for high-performance uses in sealants, adhesives, and coatings.

- The adhesives segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the C9 hydrocarbon resin market is divided into adhesives, coatings, inks, and rubber compounding. Among these, the adhesives segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The adhesive resins improve the curing time, flexibility, and bonding strength of adhesives used in the packaging, automotive, and construction sectors.

Regional Segment Analysis of the C9 Hydrocarbon Resin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the C9 hydrocarbon resin market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the C9 hydrocarbon resin market over the predicted timeframe. The well-established construction and automotive sectors in the region are major users of these resins, with a focus on high-performance materials to satisfy industry requirements. Additionally, producers are being encouraged to create novel resin compositions in response to the increased need for sustainable and eco-friendly solutions, which is driving market expansion.

Asia Pacific is expected to grow at the fastest CAGR growth of the C9 hydrocarbon resin market during the forecast period. Rapid urbanization, infrastructure development, and industrialization are the main drivers of the Asia Pacific C9 hydrocarbon resin market. The region's rapidly expanding construction and automotive industries, which are led by China and India, are major drivers of market expansion. The market's growth in the region is further supported by the presence of a sizable consumer base and advantageous government regulations encouraging industrial development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the C9 hydrocarbon resin market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eastman Chemical Company

- Fuxun Huaxing

- Total Cray Valley

- Zeon Corporation

- Puyang Changyu

- Kolon Industries, Inc.

- Jinlin Fuyuan

- Lesco Chemical Limited

- Daqing Huake

- Arakawa Chemical Industries, Ltd.

- ExxonMobil Corporation

- Formosan Union

- Neville

- Zibo Luhua

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the C9 hydrocarbon resin market based on the below-mentioned segments:

Global C9 Hydrocarbon Resin Market, By Type

- Modified C9 Resins

- Unmodified C9 Resins

Global C9 Hydrocarbon Resin Market, By Application

- Adhesives

- Coatings

- Inks

- Rubber Compounding

Global C9 Hydrocarbon Resin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the C9 hydrocarbon resin market over the forecast period?The C9 hydrocarbon resin market is projected to expand at a CAGR of 6.38% during the forecast period.

-

2. What is the market size of the C9 hydrocarbon resin market?The Global C9 Hydrocarbon Resin Market Size is Expected to Grow from USD 12.66 Billion in 2023 to USD 23.50 Billion by 2033, at a CAGR of 6.38% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the C9 hydrocarbon resin market?North America is anticipated to hold the largest share of the C9 hydrocarbon resin market over the predicted timeframe.

Need help to buy this report?