Global Calcium Aluminate Market Size, Share, and COVID-19 Impact Analysis, By Type (Pre-Melting and Sintered Type), By Application (Steel Refining, Calcium Aluminate Cement, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Calcium Aluminate Market Insights Forecasts to 2033

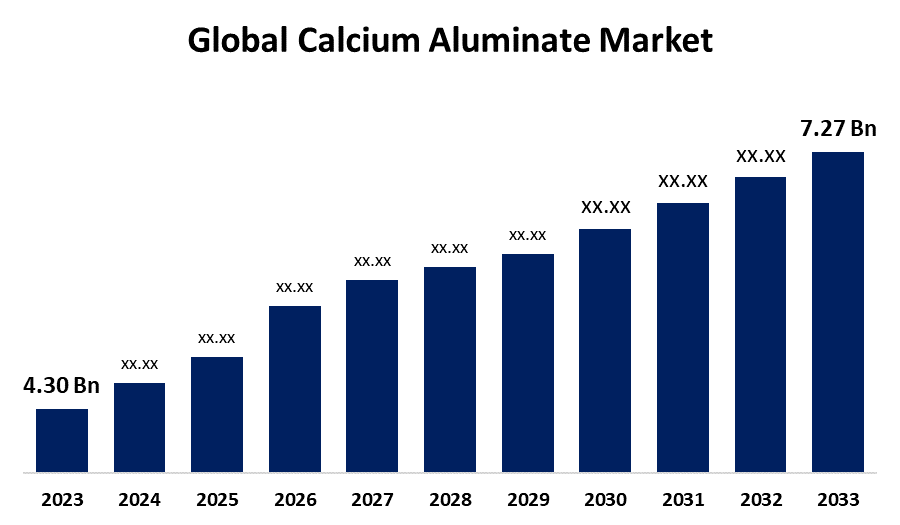

- The Global Calcium Aluminate Market Size was Valued at USD 4.30 Billion in 2023

- The Market Size is Growing at a CAGR of 5.39% from 2023 to 2033

- The Worldwide Calcium Aluminate Market Size is Expected to Reach USD 7.27 Billion by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Calcium Aluminate Market Size is Anticipated to Exceed USD 7.27 Billion by 2033, Growing at a CAGR of 5.39% from 2023 to 2033.

Market Overview

Calcium aluminate is an inorganic compound with the chemical formula Al2CaO4, and the material is nonmetallic, with CaO, Al2O3, SiO2, and water. One of the most prevalent calcium aluminate compounds is calcium aluminate cement (CAC), which is made by heating limestone and bauxite in a rotating kiln. Calcium-aluminate cement are hydraulic cements made by crushing a solidified melt or clinker composed primarily of hydraulic calcium aluminates derived from proportional combinations of aluminous and calcareous elements. Calcium aluminate is noted for its rapid setting capabilities and tolerance to high temperatures. It is excellent for numerous industrial applications, including refractory cement, sewage treatment, and construction materials that require quick setting and strong heat resistance.

Report Coverage

This research report categorizes the market for calcium aluminate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the calcium aluminate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the calcium aluminate market.

Global Calcium Aluminate Marke Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.30 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.39% |

| 2033 Value Projection: | USD 7.27 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Imerys, Harsco Environmental, Refratechnik, American Elements, Ambition Refractories Private Ltd., Nikita Metallurgical Pvt Ltd., Caltra Nederland B.V., BPI Inc., Royal White Cement, Calucem, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The demand for calcium aluminate is bolstered by rapid urbanization in emerging economies, driving the development of residential, commercial, and public infrastructure projects. As cities expand and populations concentrate in metropolitan areas, there is a heightened need for robust construction materials capable of withstanding challenging conditions. Investments in transportation infrastructure, such as roads, bridges, railways, and airports, are crucial for enhancing connectivity and supporting economic growth. Calcium aluminate's properties, including high strength and resilience, play a pivotal role in improving the durability and lifespan of these critical infrastructure projects. Furthermore, as industrialization continues to drive economic activities, there is an increasing focus on constructing and renovating industrial facilities like factories, power plants, and refineries. Calcium aluminate's ability to endure high temperatures, corrosive chemicals, and mechanical stress positions it as an ideal material for industrial construction, further stimulating growth in the calcium aluminate market.

Restraining Factors

The calcium aluminate market faces significant competition from various substitutes and alternative materials across different industries. These substitutes include traditional Portland cement, which is preferred for its lower cost and widespread availability despite lacking certain specialized properties of calcium aluminate cement (CAC) such as rapid setting and high early strength. Additionally, fluctuations in raw material prices and availability, such as bauxite and limestone, affect the overall cost structure of CAC. Competition from cheaper alternative cementitious materials and sustainability concerns due to the energy-intensive production process further constrain its market growth.

Market Segmentation

The calcium aluminate market share is classified into type and application.

- The sintered type segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the calcium aluminate market is classified into pre-melting and sintered type. Among these, the sintered type segment is estimated to hold the highest market revenue share through the projected period. Sintered calcium aluminate is a specific type of calcium aluminate, which is normally made up of calcium oxide and aluminate oxide. The sintered type is widely utilized in industries such as refractories, ceramics, and cement manufacturing because of its high melting point, resistance to corrosion and thermal shock, and other desirable properties. Investments in infrastructure projects such as construction, transportation, and energy necessitate the use of high-performance materials such as sintered calcium aluminate in refractories, cement manufacture, and building materials. Furthermore, severe environmental rules and standards are projected to push the adoption of sintered calcium aluminate in industries like steelmaking and cement production.

- The calcium aluminate cement segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the calcium aluminate market is divided into steel refining, calcium aluminate cement, and others. Among these, the calcium aluminate cement segment is anticipated to hold the largest market share through the forecast period. The substance is utilized in cement manufacture as a significant component in the formulation of high-alumina cement (HAC), also known as CAC. CAC is very resistant to chemical assault, making it ideal for use in areas where concrete is exposed to acidic conditions. This includes applications for sewage systems, chemical processing plants, and industrial floors. The demand for cement products is being driven by an increase in construction projects such as infrastructure development, commercial buildings, and residential construction.

Regional Segment Analysis of the Calcium Aluminate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the calcium aluminate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the calcium aluminate market over the predicted timeframe. The Asia Pacific region often leads in various industrial markets due to its large population, rapid urbanization, and extensive industrialization. These factors contribute to a higher demand for construction materials like calcium aluminate, which is used in various applications including construction, refractories, and wastewater treatment. The anticipated growth in infrastructure projects and industrial activities in Asia Pacific would indeed support the largest share of the calcium aluminate market in the predicted timeframe

North America NBottom of FormN Nis expected to grow at the fastest CAGR growth of the calcium aluminate market during the forecast period. This growth forecast reflects increased demand in a variety of industries, including construction, refractories, and wastewater treatment, where calcium aluminate products are valued for their high heat resistance and rapid setting capabilities. Infrastructure development, technology improvements, legislative considerations favoring sustainable materials, and market competitive dynamics all contribute to growth. Furthermore, the North American government's increased focus on enhancing automotive and industrial production operations is expected to promote market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the calcium aluminate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Imerys

- Harsco Environmental

- Refratechnik

- American Elements

- Ambition Refractories Private Ltd.

- Nikita Metallurgical Pvt Ltd.

- Caltra Nederland B.V.

- BPI Inc.

- Royal White Cement

- Calucem

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Runaya, a leader in sustainable manufacturing and recycling, announced the opening of its cutting-edge calcium aluminate plant in Jharsuguda.

- In November 2023, Refratechnik Group has been growing its business operations to satisfy the global requirements of customers and has now built a state-of-the-art greenfield plant and a high-alumina monolithic facility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the calcium aluminate market based on the below-mentioned segments:

Global Calcium Aluminate Market, By Type

- Pre-Melting

- Sintered Type

Global Calcium Aluminate Market, By Application

- Steel Refining

- Calcium Aluminate Cement

- Others

Global Calcium Aluminate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the calcium aluminate market over the forecast period?The calcium aluminate market is projected to expand at a CAGR of 5.39% during the forecast period.

-

2. What is the market size of the calcium aluminate market?The Global Calcium Aluminate Market Size is Expected to Grow from USD 4.30 Billion in 2023 to USD 7.27 Billion by 2033, at a CAGR of 5.39% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the calcium aluminate market?Asia Pacific is anticipated to hold the largest share of the calcium aluminate market over the predicted timeframe.

Need help to buy this report?