Global Can Coatings Market Size, Share, and COVID-19 Impact, By Type (Epoxy, Acrylic, Polyester), By Application (Food Cans, Beverage Cans, General Line Cans), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Chemicals & MaterialsGlobal Can Coatings Market Insights Forecasts to 2032

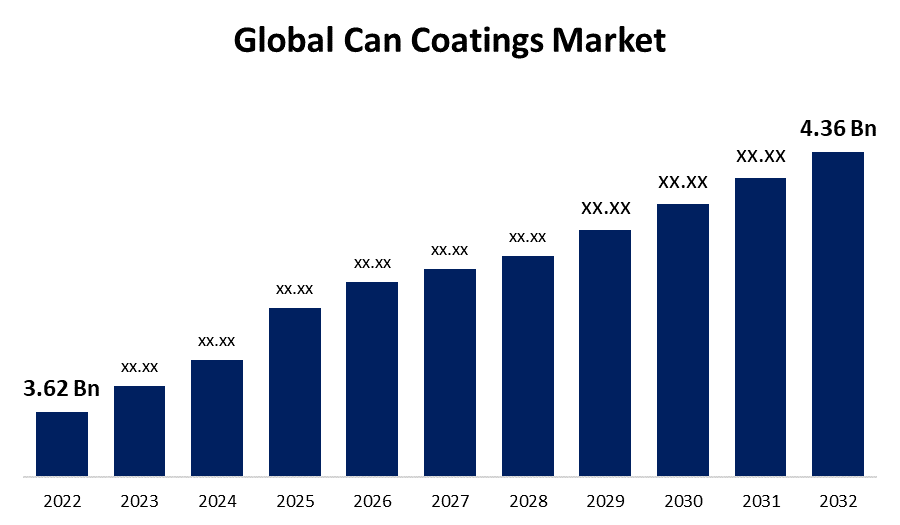

- The Global Can Coatings Market Size was valued at USD 3.62 Billion in 2022.

- The market Size is growing at a CAGR of 5.1% from 2022 to 2032

- The Worldwide Can Coatings Market Size is expected to reach USD 4.36 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Can Coatings Market Size is expected to reach USD 4.36 Billion by 2032, at a CAGR of 5.1% during the forecast period 2022 to 2032.

Can coatings, commonly referred to as can linings, are substances applied to the interior of metal cans or other containers to shield the contents from the metal's potentially hazardous effects. These coatings serve as a barrier between the can's contents and the metal surface, stopping any chemical reactions or interactions that can impair the packaged product's quality, flavour, or safety. Beer, fruits, vegetables, soups, soft drinks, and other food and beverage items are frequently stored in metal cans. Without the coating, the metal can corrode or react with the contents, causing contamination and the leaching of potentially dangerous compounds into the finished product. Epoxy resins, which offer excellent protection against corrosion and have high adherence to metal surfaces, are used to create the most prevalent type of can coating. Depending on the unique needs of the packaged product, polyester, oleoresins, and polyolefins are other materials utilised for can coatings.

Impact of COVID-19 On the Global Can Coatings Market

The epidemic caused global supply chains to be disrupted, which had an impact on the supply of raw materials and manufacturing components for can coatings. This can have resulted in manufacturing delays and compromised product supply. During the epidemic, there were swings in the demand for canned items, including food and drinks. Canned food demand initially increased as a result of stockpiling and lockdown procedures. Demand patterns, however, might have changed if constraints were loosened and consumer behaviour changed. The demand for canned goods used in the food service industry was impacted by the closure of restaurants and other food service businesses in several regions. The closing of bars and limits on gatherings and events had an impact on the beverage business, which is primarily dependent on metal cans. As a result, several markets saw a decline in demand for canned beverages.

Global Can Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.62 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.1% |

| 2032 Value Projection: | USD 4.36 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application, By Region, and COVID-19 Impact |

| Companies covered:: | Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, RPM International Inc., AZTRON TECHNOLOGIES, LLC, Axalta Coating Systems, BALL CORPORATION, A.W. Chesterton Company., KC Jones Plating Company., OM Sangyo Co.,Ltd., Poeton, Endura Coatings, Twin City Plating, Nickel Composite Coatings, Inc., SURTECKARIYA Co., Ltd., Sharretts Plating Company, Integer Holdings Corporation, Interplate LTD, Composite Coatings, Inc., and Hunger International GmbH And Others Key Venders |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

The demand for convenient and long-lasting packaged food and beverages is increasing along with the worldwide population, which encourages the usage of metal cans and, in turn, the demand for can coatings. Demand for eco-friendly and sustainable packaging has grown as a result of consumers' growing environmental awareness, which could have an impact on the creation and use of ecologically friendly can coatings. The market for can coatings has benefited from the rise of the middle class in developing nations, which has increased packaged-goods consumption. Metal cans with appropriate coatings are being employed in some applications in place of conventional packaging materials like glass or plastic, which is fostering market expansion.

Key Market Challenges

Traditionally, many can coatings have been produced with the use of potentially hazardous environmental ingredients, such as specific kinds of epoxy resins. There is increased demand on the industry to create more sustainable and eco-friendly coating solutions as environmental awareness rises. Some producers might find it difficult to afford the additional expenses associated with creating and implementing new, safer, and more environmentally friendly can coatings. It might be challenging to balance the price of coatings with the demands of compliance and safety. Other packaging materials like glass, plastic, and flexible pouches compete with metal cans. Can coatings must demonstrate their superiority in terms of food preservation, shelf life, and environmental effect because every style of packaging has benefits and drawbacks. Like many other industries, the can coatings business is susceptible to changes in prices, shortages of raw materials, and supply chain disruptions. These hiccups may cause production to be delayed and costs to rise.

Market Segmentation

Type Insights

Epoxy coatings segment is dominating the market over the forecast period

On the basis of type, the global can coatings market is segmented into Epoxy, Acrylic, Polyester, and Others. Among these, epoxy coatings segment is dominating the market over the forecast period. When made and applied properly, epoxy coatings, which have a long history of use in can linings, are thought to be safe for contact with food. The transfer of potentially dangerous substances from the metal can into the packaged food or beverage is effectively stopped by them as a trustworthy barrier. Epoxy coatings are essential for meeting the packaging requirements of diverse products, and there has been a steady increase in the demand for canned food and beverages. In addition, epoxy coatings have a long history of usage in the canning business, and there is ample evidence of both their efficacy and dependability. Both producers and customers have faith in this well-established technology.

Application Insights

Beverage segment accounted the largest market share over the forecast period

Based on the application, the global can coatings market is segmented into Food Cans, Beverage Cans, General Line Cans, Aerosol Cans, and Others. Among these, the beverage segment accounted the largest market share over the forecast period. For a variety of reasons, more and more beverages, including soft drinks, beer, energy drinks, and ready-to-drink beverages, are being packaged in metal cans, which is boosting the market for can coatings in this industry. Beverage firms can display their products attractively on retail shelves and in marketing campaigns thanks to the considerable surface space that cans provide for branding and marketing messages. Craft beers, ready-to-drink (RTD) beverages, and niche goods are becoming more and more popular, which has increased demand for cans because they are ideal for storing and advertising these kinds of beverages.

Regional Insights

North America accounted the largest market share over the forecast period

Get more details on this report -

Among all other regions, North America accounted the largest market share over the forecast period. Metal cans are frequently used to package a wide range of products in North America since there is a significant market for packaged food and beverages. To assure food safety and the integrity of the product, this need has increased the requirement for can coatings proportionally. Can products, particularly beverages like soft drinks and beer, are a popular choice among customers in the area due to their ease, portability, and long shelf life.

Asia Pacific region is witnessing the fastest market share over the forecast period. Due to the region's sizable and quickly expanding population as well as its developing urbanisation, there is a greater need for packaged foods and drinks, which has increased the usage of metal cans and, consequently, can coatings. Many Asia Pacific nations have seen changes in consumer tastes as a result of rising disposable income levels, including a rise in the desire for convenience goods and beverages, which has raised the need for can coatings.

Recent Market Developments

- In August 2022, PPG Industries, Inc. has introduced PPG INNOVEL PRO, an improved internal spray coating for aluminium beverage cans that is infinitely recyclable and uses no bisphenol-A (BPA) or bisphenol starting ingredients.

List of Key Companies

- Akzo Nobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- RPM International Inc.

- AZTRON TECHNOLOGIES, LLC

- Axalta Coating Systems

- BALL CORPORATION

- A.W. Chesterton Company.

- KC Jones Plating Company.

- OM Sangyo Co.,Ltd.

- Poeton

- Endura Coatings

- Twin City Plating

- Nickel Composite Coatings, Inc.

- SURTECKARIYA Co., Ltd.

- Sharretts Plating Company

- Integer Holdings Corporation

- Interplate LTD

- Composite Coatings, Inc.

- Hunger International GmbH

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Can Coatings Market based on the below-mentioned segments:

Can Coatings Market, Type Analysis

- Epoxy

- Acrylic

- Polyester

Can Coatings Market, Application Analysis

- Food Cans

- Beverage Cans

- General Line Cans

- Aerosol Cans

- Others

Can Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?