Canada Aesthetic Devices Market Size, Share, and COVID-19 Impact Analysis, By Type of Device (Energy-based Aesthetic Device and Non-energy based Aesthetic Device), By Application (Skin Resurfacing & Tightening, Body Contouring & Cellulite Reduction, Hair Removal, Tattoo Removal, Breast Augmentation, and Others), By End-user (Hospitals, Clinics, and Home Settings), and Canada Aesthetic Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Aesthetic Devices Market Insights Forecasts to 2033

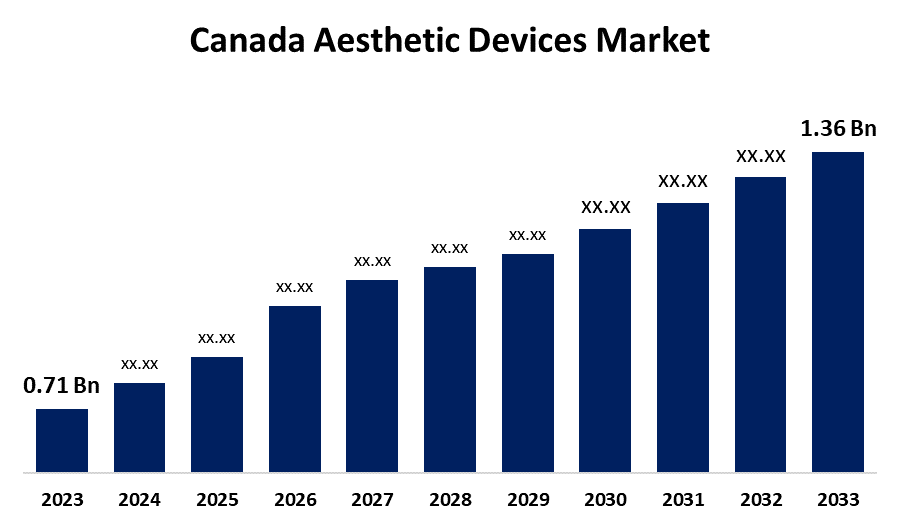

- The Canada Aesthetic Devices Market Size was valued at USD 0.71 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.72% from 2023 to 2033

- The Canada Aesthetic Devices Market Size is Expected to reach USD 1.36 Billion by 2033

Get more details on this report -

The Canada Aesthetic Devices Market Size is anticipated to Exceed USD 1.36 Billion by 2033, Growing at a CAGR of 6.72% from 2023 to 2033. The increasing awareness about aesthetic procedures, obese population, adoption of minimally invasive devices, and technological advancement in devices, are driving the growth of the aesthetic devices market in the Canada.

Market Overview

Aesthetic devices are products used to improve the aesthetic appearance of a person. They are instruments, apparatus, implants, material, or articles, used alone or in combination for different cosmetic procedures, such as skin tightening, anti-aging, aesthetic implants, unwanted hair removal, excess fat removal, plastic surgery, and others, that beautify, correct, and enhance the body. These medical devices provide a desired change in visual appearance. There has been a significant growth in demand for cosmetic surgery and less invasive procedures like dermal fillers and botulinum toxin. Most people are interested in simple, painless ways to seem young and healthy without having to deal with the risks of intrusive cosmetic surgery. Factors including the development of the medical tourism industry, the emergence of tourism medical spas, and the adoption of aesthetic procedures for enhancing physical appearance are anticipated to offer market opportunities for aesthetic devices.

Report Coverage

This research report categorizes the market for the Canada aesthetic devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada aesthetic devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada aesthetic devices market.

Canada Aesthetic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.71 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.72% |

| 2033 Value Projection: | USD 1.36 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type of Device, By Application, By End-user, By End-user |

| Companies covered:: | Allergan PLC, Alma Lasers, Cutera Inc., Bausch & Lomb Incorporated, Syneron Medical Ltd, Hologic Inc., Venus Concept, Galderma SA (Nestle), LUTRONIC, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing popularity of medical aesthetics among Canadians for improving their appearance without undergoing major surgery or recovery times is driving the market. As compared to other nations providing similar treatments, Canadian clinics frequently offer competitive rates because of the country’s relatively lower cost of living. The increasing obese population in the country upsurges the demand for aesthetic procedures like lipoplasty. Further, the adoption of minimally invasive devices owing to their reduced downtime, lesser scarring, lower risks, limited stress, and better patient satisfaction with quicker recovery time are responsible for driving the market growth. The integration of technologies like VR, AR, artificial intelligence (AI), CAD, telemedicine, and IoT in aesthetic devices for improved accuracy and efficiency of medical aesthetic procedures is bolstering market growth.

Restraining Factors

The shortage of experienced professionals and uncertain regulatory frameworks are restraining the market. Further, the poor reimbursement scenario is challenging the Canada aesthetic devices market.

Market Segmentation

The Canada Aesthetic Devices Market share is classified into type of device, application, and end-user.

- The non-energy based aesthetic device segment accounted for the largest market share during the forecast period.

The Canada aesthetic devices market is segmented by type of device into energy-based aesthetic device and non-energy based aesthetic device. Among these, the non-energy based aesthetic device segment accounted for the largest market share during the forecast period. Non-energy based aesthetic devices are non-invasive or minimally invasive aesthetic devices that do not use energy-based technologies. Microdermabrasion, microneedling, threads, and chemical peels are the non-energy-based aesthetic treatments. The increasing number of patient population undergoing botox and dermal filler procedures is responsible for driving the market growth.

- The body contouring & cellulite reduction segment is anticipated to witness the fastest CAGR growth during the forecast period.

The Canada aesthetic devices market is segmented by application into skin resurfacing & tightening, body contouring & cellulite reduction, hair removal, tattoo removal, breast augmentation, and others. Among these, the body contouring & cellulite reduction segment is anticipated to witness the fastest CAGR growth during the forecast period. These devices are used to reshape an area of the body via liposuction surgery or lipolysis including cryo, injection, and radiofrequency lipolysis, thereby reducing visible signs and improving skin texture. The increased prevalence of obesity surges the demand for fat-reduction therapy, thereby driving market growth.

- The hospitals segment dominated the Canada aesthetic devices market with the largest market share in 2023.

Based on the end-user, the Canada aesthetic devices market is divided into hospitals, clinics, and home settings. Among these, the hospitals segment dominated the Canada aesthetic devices market with the largest market share in 2023. The huge availability of innovative medical aesthetic machines and increasing healthcare spending are contributing to propelling the market in the hospitals segment. For instance, in September 2024, Dermapure, Canada’s leading network of aesthetic medicine clinics expanded its presence in Atlantic Canada by joining the Figurra Institute, providing clients with access to some of the most skilled practitioners in the area and the most recent developments in aesthetic medicine.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada aesthetic devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allergan PLC

- Alma Lasers

- Cutera Inc.

- Bausch & Lomb Incorporated

- Syneron Medical Ltd

- Hologic Inc.

- Venus Concept

- Galderma SA (Nestle)

- LUTRONIC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Crescita Therapeutics Inc. signed an exclusive distribution agreement with NanoPass Technologies Ltd. to launch and distribute the MicronJet 600 in Canada. MicronJet is a great addition to the company’s medical aesthetic portfolio, enhancing offerings alongside NCTF 135 HA, Art Filler, and Pliaglis.

- In March 2024, triLift, the groundbreaking Dynamic Muscle Stimulation technology (DMSt) by Lumenis received a Medical Device License (MDL) from Health Canada.

- In June 2023, Venus Concept Inc. received a Heatlh Canada medical device license to market the Venus Versa Pro system in the country. The Venus Versa Pro is a comprehensive aesthetic platform that houses the latest technologies in one device to offer a total skin rejuvenation experience.

- In June 2022, Croma Aesthetics Canada Ltd., doing business as Hugel Aesthetics, announced it received a Notice of Compliance from Health Canada for Letybo (letibotulinumtoxinA for injection) for temporary improvement in the appearance of moderate to severe glabellar lines associated with corrugator and/or procerus muscle activity (frown lines between the eyebrows) in adult patients under 65 years of age.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Aesthetic Devices Market based on the below-mentioned segments:

Canada Aesthetic Devices Market, By Type of Device

- Energy-based Aesthetic Device

- Non-energy based Aesthetic Device

Canada Aesthetic Devices Market, By Application

- Skin Resurfacing & Tightening

- Body Contouring & Cellulite Reduction

- Hair Removal

- Tattoo Removal

- Breast Augmentation

- Others

Canada Aesthetic Devices Market, By End-user

- Hospitals

- Clinics

- Home Settings

Need help to buy this report?