Canada Architectural Coatings Market Size, Share, and COVID-19 Impact Analysis, By Resin (Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, and Others), By Technology (Solventborne and Waterborne), By Sub End User (Commercial and Residential), and Canada Architectural Coatings Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsCanada Architectural Coatings Market Insights Forecasts to 2033

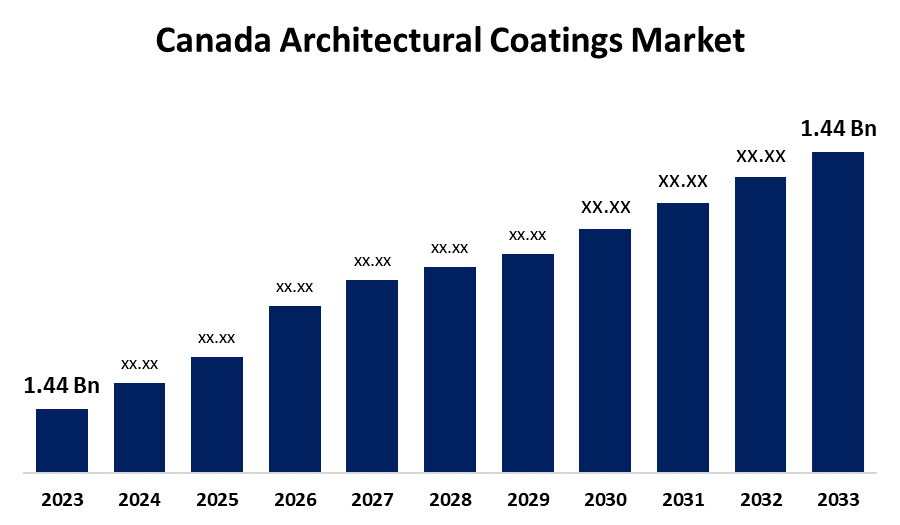

- The Canada Architectural Coatings Market Size was valued at USD 1.44 Billion in 2023.

- The Market is growing at a CAGR of 4.14% from 2023 to 2033

- The Canada Architectural Coatings Market Size is expected to reach USD 2.16 Billion by 2033

Get more details on this report -

The Canada Architectural Coatings Market is anticipated to exceed USD 2.16 Billion by 2033, growing at a CAGR of 4.14% from 2023 to 2033. The increasing construction activities, shift towards eco-friendly products, and preference for waterborne coating among architects are driving the growth of the architectural coatings market in the Canada.

Market Overview

Architectural coatings are paints and other coatings used to paint the exteriors and interior of buildings, often called exterior wall coatings or external masonry coatings. Further, they are usually designed for specific purposes including roof coatings, wall paints, or deck finishes. Chemical compatibility, sensitivity to temperature changes, and resistance to contamination are some of the benefits of architectural coatings. As a result, they are extensively utilized in residential, commercial, and industrial settings. Further, basements, bridges, walls, pavements, ceilings, decks, floors, foundations, roofs, tunnels, and walkways are some examples of the types of building surfaces or structures for which architectural coatings are typically developed or specified. The advent of biotechnology has improved the performance of coating by the emergence of a new innovation called “Smart” surfaces which is providing market opportunity for architectural coatings. For instance, architectural paints use functional additives which are naturally occurring additives and are designed to provide intelligence to coatings like self-healing, detoxification, self-degreasing surfaces, and nerve agent neutralizers.

Report Coverage

This research report categorizes the market for the Canada architectural coatings market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada architectural coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada architectural coatings market.

Canada Architectural Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.44 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.14% |

| 2033 Value Projection: | USD 2.16 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Resin, By Technology, By Sub End User, and COVID-19 Impact Analysis |

| Companies covered:: | Benjamin Moore & Co., PPG Industries, Inc., Cloverdale Paint Inc., KelCoatings Limited, Masco Canada, RPM International Inc., Selectone Paints Inc., Société Laurentide, The Sherwin-Williams Company and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for architectural coating due to new buildings in the non-residential sector and renovation activities in the country are driving market growth. The increasing focus on eco-friendly products and low-VOC (volatile organic compounds) formulations to reduce environmental impact are driving the market growth. The increasing preference for waterborne coating due to its excellent durability and aesthetic appeal that are ideal for surfaces like walls, ceilings, and trims are contributing to propelling the market.

Restraining Factors

The stringent government regulations against the emission of VOCs emitted by some architectural coatings are challenging the architectural coatings market.

Market Segmentation

The Canada Architectural Coatings Market share is classified into resin, technology, and sub end user.

- The acrylic segment dominated the market with the largest market share during the forecast period.

The Canada architectural coatings market is segmented by resin into acrylic, alkyd, epoxy, polyester, polyurethane, and others. Among these, the acrylic segment dominated the market with the largest market share during the forecast period. Acrylic coatings are the leading finishes used in the paint and coatings industry, comprising pigment particles dispersed within an acrylic polymer emulsion. The growing need for long-lasting and visually appealing architectural coatings to preserve and improve the appearance of buildings is driving the market.

- The waterborne segment dominated the Canada architectural coatings market during the forecast period.

Based on the technology, the Canada architectural coatings market is divided into solventborne and waterborne. Among these, the waterborne segment dominated the Canada architectural coatings market during the forecast period. Waterborne coating employs water as a solvent to disperse resin, and is known to be eco-friendly. The low emission of VOC and decrease in associated health risks are driving the market growth.

- The residential segment accounted for the largest market share during the forecast period.

The Canada architectural coatings market is segmented by sub end user into commercial and residential. Among these, the residential segment accounted for the largest market share during the forecast period. The residential segment is further bifurcated into new construction and remodeling & repair. The expanding construction activity and the large amount of paint used by the residential sector are propelling the market growth in the residential segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada architectural coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Benjamin Moore & Co.

- PPG Industries, Inc.

- Cloverdale Paint Inc.

- KelCoatings Limited

- Masco Canada

- RPM International Inc.

- Selectone Paints Inc.

- Société Laurentide

- The Sherwin-Williams Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, PPG Industries, a global leader in paints, coatings, and specialty materials, announced that it has agreed to sell its U.S. and Canadian architectural coatings business to American Industrial Partners (AIP) for $550 million.

- In October 2023, The Protech Group announced the acquisition of MF Paints Inc., a prominent manufacturer and distributor of premium-quality architectural paints and stains based in Laval, Quebec. The acquisition marks a significant milestone for The Protech Group, as it broadens its horizons by expanding into the retail and commercial building paints market.

- In January 2022, PPG announced an expanded relationship with The Home Depot and HD Supply to offer an extensive lineup of professional PPG paint products and services designed exclusively for professional customers.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Architectural Coatings Market based on the below-mentioned segments:

Canada Architectural Coatings Market, By Resin

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Others

Canada Architectural Coatings Market, By Technology

- Solventborne

- Waterborne

Canada Architectural Coatings Market, By Sub End User

- Commercial

- Residential

Need help to buy this report?