Canada Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Asset Class (Equity, Fixed Income, Alternative Investment, Hybrid, and Cash Management), By Type of Asset Management Firms (Large Financial Institutions/Bulge Brackets Banks, Mutual Funds & ETFs, Private Equity & Venture Capital, Fixed Income Funds, Hedge Funds, and Others), and Canada Asset Management Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialCanada Asset Management Market Insights Forecasts to 2033

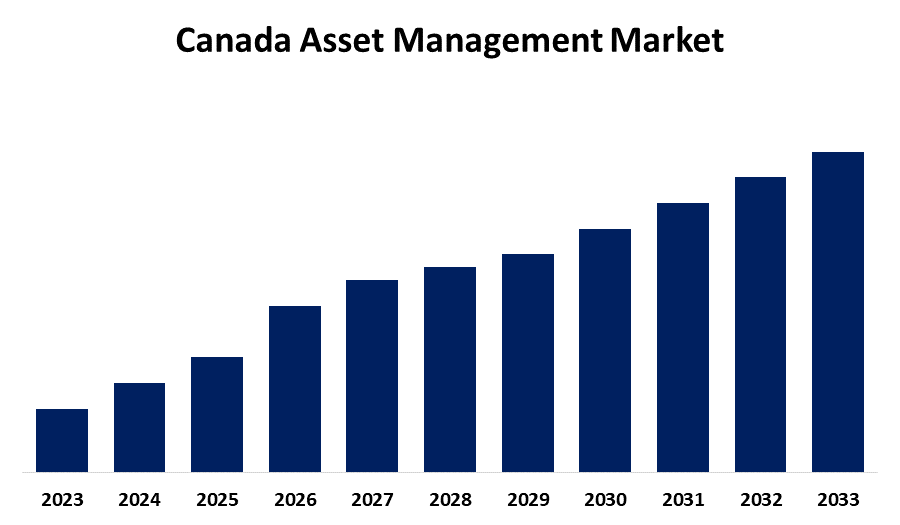

- The Canada Asset Management Market is Growing at a CAGR of 4.12% from 2023 to 2033

- The Canada Asset Management Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Canada Asset Management Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.12% from 2023 to 2033.

Market Overview

The administration of financial assets, including stock, bonds, real estate, and other securities investments, by organizations or people is the focus of the Canada asset management market. The industry provides clients with asset allocation and risk management methods through wealth management, portfolio management, and financial advice services to optimize returns. From individual retail clients to institutional investors such as sovereign wealth funds, insurance funds, and pension funds, the market serves a wide range of investors. The Canadian asset management market is expanding due to a variety of factors. The increasing demand for diversified investment portfolios, driven by high-net-worth individuals and institutional investors, has led to a surge in professional asset management services. Low interest rates and a desire for better returns have prompted investors to seek alternative assets like private equity and real estate. Canada's well-regulated financial system, backed by government policies, provides a strong base for market expansion. Regulatory institutions like the Ontario Securities Commission and Canadian Securities Administrators enhance investor protection and competition. Canada's commitment to sustainable finance supports socially responsible investment and green asset management practices.

Report Coverage

This research report categorizes the market for the Canada asset management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada asset management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada asset management market.

Canada Asset Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.12% |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 89 |

| Segments covered: | By Asset Class, By Type of Asset Management Firms |

| Companies covered:: | Royal Bank of Canada (RBC) Global Asset Management, Toronto Dominion Bank (TD) Asset Management, Manulife Investment Management, BMO Global Asset Management, CI Financial, Fidelity Investments Canada, BlackRock Canada, Brookfield Asset Management, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

The Canada asset management market is driven by factors such as the growing demand for diversified investment portfolios, the rise in high-net-worth individuals, and the complexity of financial markets. The country's sound financial system and friendly regulatory setup attract both domestic and foreign investors, sustaining market growth. Additionally, the growing demand for socially responsible investing, targeting environmental, social, and governance factors, helps expand markets as investors align their portfolios with sustainability objectives.

Restraining Factors

The complexity of financial products and the rapidly changing regulatory environment pose challenges for asset managers in maintaining compliance and staying updated. Market volatility and economic uncertainty can affect investor confidence, leading to volatility in asset valuations. Additionally, increasing competition from cheaper alternatives like robo-advisors may force asset managers to reduce fees and alter their business models, posing challenges for future market expansion and profitability.

Market Segmentation

The Canada asset management market share is classified into asset class and type of asset management firms.

- The equity segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Canada asset management market is segmented by asset class into equity, fixed income, alternative investment, hybrid, and cash management. Among these, the equity segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Equities, or equities for short, form a large part of an investment portfolio because of their high returns and growth potential, especially in a strong financial and corporate market like Canada. High-net-worth individuals as well as institutional clients tend to invest in equities as a means of benefiting from capital appreciation and dividends.

- The mutual funds & ETFs segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type of asset management firms, the Canada asset management market is divided into large financial institutions/bulge brackets banks, mutual funds & ETFs, private equity & venture capital, fixed income funds, hedge funds, and others. Among these, the mutual funds & ETFs segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The diverse portfolios and cheaper fees compared to actively managed funds make these investment products quite popular with both individual and institutional clients. Mutual funds and exchange-traded funds (ETFs) are popular options for investors seeking diversification and lower risk since they expose them to a wide range of asset classes, including stocks, fixed income, and alternative assets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada asset management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Royal Bank of Canada (RBC) Global Asset Management

- Toronto Dominion Bank (TD) Asset Management

- Manulife Investment Management

- BMO Global Asset Management

- CI Financial

- Fidelity Investments Canada

- BlackRock Canada

- Brookfield Asset Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, in the fourth quarter, Brookfield Asset Management's credit business raised about $20 billion for its credit funds and deployed $7.7 billion, which accounted for 60% of the firm's total capital raised that year. The company is certain that private credit, especially asset-based lending, will continue to expand in the future. It expects more corporate activity, such as mergers and acquisitions, to create more opportunities. Over the following five years, Brookfield wants to increase the $317 billion in assets under its credit plan.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada asset management market based on the below-mentioned segments:

Canada Asset Management Market, By Asset Class

- Equity

- Fixed Income

- Alternative Investment

- Hybrid

- Cash Management

Canada Asset Management Market, By Type of Asset Management Firms

- Large Financial Institutions/Bulge Brackets Banks

- Mutual Funds & ETFs

- Private Equity & Venture Capital

- Fixed Income Funds

- Hedge Funds

- Others

Need help to buy this report?