Canada Avian Influenza Vaccines Market Size, Share, and COVID-19 Impact Analysis, By Strain (H5, H7, and H9), By Application (Chicken, Turkey, Duck, and Goose), and Canada Avian Influenza Vaccines Market Insights Forecasts 2023 - 2033.

Industry: HealthcareCanada Avian Influenza Vaccines Market Insights Forecasts to 2033

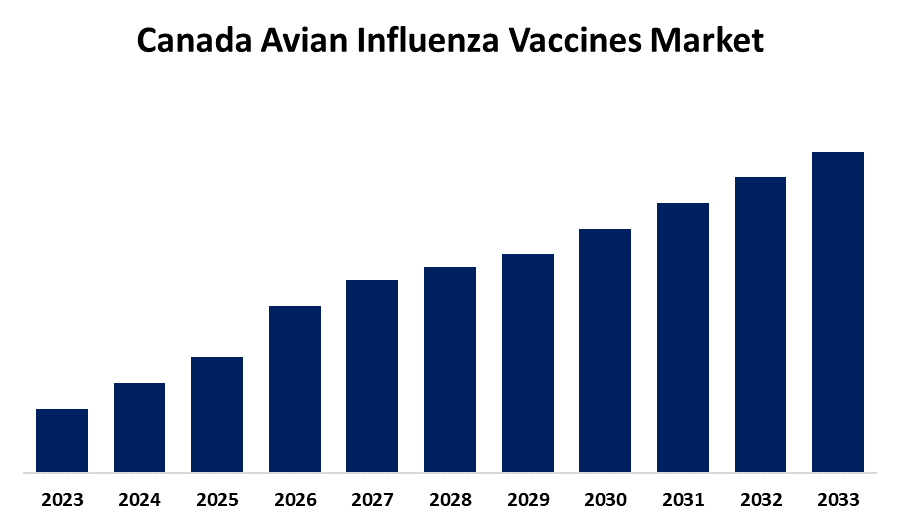

- The Canada Avian Influenza Vaccines Market Size is Growing at 4.67% CAGR from 2023 to 2033.

- The Canada Avian Influenza Vaccines Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The Canada Avian Influenza Vaccines Market Size is expected to reach a significant share by 2033, growing at a 4.67% CAGR from 2023 to 2033.

Market Overview

The Canada avian influenza vaccines market pertains to the sector engaged in developing, producing, distributing, and administering avian influenza (bird flu) prevention and control vaccines for wild birds and poultry throughout Canada. It involves many vaccine forms, like inactivated, live attenuated, and recombinant, and its focus is to hinder outbreaks, check economic losses of the poultry business, and suppress the likelihood of zoonotic spread to people. It is shaped by regulatory policies, government vaccination schemes, trends in poultry farming, and newly emerged avian influenza strains. The Canadian avian influenza vaccine market offers considerable opportunities against the backdrop of growing fears regarding H5N1 outbreaks. In February 2025, the Public Health Agency of Canada procured 500,000 doses of GSK's Arepanri H5N1 vaccine, reflecting proactive governmental initiatives to safeguard high-risk groups. Furthermore, the creation of the Highly Pathogenic Avian Influenza Vaccination Task Force seeks to investigate vaccine development and application strategies, as well as enhance collaboration between government, industry, and academia. These efforts identify an increasing market potential for vaccine manufacturers and associated stakeholders in Canada. In addition, the National Advisory Committee on Immunization (NACI) published interim advice concerning the use of human vaccines against avian influenza in non-pandemic situations. The advice is meant to guide provincial and territorial health authorities regarding possible vaccination for populations at heightened risk. These steps indicate Canada's forward-looking stance in countering avian influenza threats and improving public health preparedness.

Report Coverage

This research report categorizes the market for the Canada avian influenza vaccines market based on various segments and regions forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada avian influenza vaccines market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada avian influenza vaccines market.

Canada Avian Influenza Vaccines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.67% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Strain, By Application |

| Companies covered:: | GlaxoSmithKline (GSK), Merial (now part of Boehringer Ingelheim), Zoetis, CEVA Sante Animale, and Elanco (Lohmann) |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Canada avian influenza vaccine market is influenced by several factors. The rising number of avian influenza outbreaks has increased the need for effective preventive strategies, leading the Canadian government to purchase 500,000 doses of GSK's Arepanrix H5N1 vaccine to immunize high-risk populations. The growing consumption of poultry products also requires strong vaccination campaigns to protect poultry flocks and provide food security. Government policy and legislation, such as advanced measures to license and provide vaccines, also support market expansion. Advances in technology for the development of vaccines also improve effectiveness and safety, adding to demand. In addition, Canada's recent lifting of embargoes on imports of some French poultry products, after a vaccination effort by France, indicates increasing acceptance of vaccination as a viable means of managing avian influenza, with a possible positive impact on encouraging domestic vaccination.

Restraining Factors

The Canadian market for avian influenza vaccines is confronted with several limiting factors. Vaccination programs are very costly, involving costs for vaccines, administration, and surveillance to ensure efficacy and identify possible silent infections. There is also the issue of vaccinated birds carrying hidden infections, which has resulted in trade restrictions, such as when Canada suspended poultry imports from France after its duck vaccination program. These implications in terms of trade and the demand for strict surveillance protocols pose big challenges to the widespread use of the avian influenza vaccine in Canada.

Market Segment

- The H5 segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the strain, the Canada avian influenza vaccines market is divided into H5, H7, and H9. Among these, the H5 segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the high prevalence of H5 avian influenza strains, including H5N1 and H5N8, which pose significant risks to poultry and humans. Government vaccination initiatives, biosecurity measures, and increasing outbreaks drive demand, ensuring strong CAGR growth in the forecast period.

- The chicken segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe.

Based on the application, the Canada avian influenza vaccines market is divided into chicken, turkey, duck, and goose. Among these, the chicken segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe. The segmental growth is attributed to Canada’s large-scale poultry farming, high chicken population density, and increased vulnerability to avian influenza outbreaks. Rising biosecurity concerns, government-led vaccination programs, and growing demand for disease-free poultry products are key factors driving its significant CAGR growth over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada avian influenza vaccines market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GlaxoSmithKline (GSK)

- Merial (now part of Boehringer Ingelheim)

- Zoetis

- CEVA Sante Animale

- Elanco (Lohmann)

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Canada avian influenza vaccines market based on the below-mentioned segments:

Canada Avian Influenza Vaccines Market, By Strain

- H5

- H7

- H9

Canada Avian Influenza Vaccines Market, By Application

- Chicken

- Turkey

- Duck

- Goose

Need help to buy this report?