Canada Blood Glucose Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Devices Type (Continuous Glucose Monitoring Systems and Self-Monitoring Blood Glucose Systems), By Modality (Wearable and Non-Wearable), By Type (Non-Invasive and Invasive), By Patient Type (Type-1 Diabetes and Type-2 Diabetes), By Distribution Channel (Institutional Sales and Retail Sales), and Canada Blood Glucose Monitoring Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Blood Glucose Monitoring Market Insights Forecasts to 2033

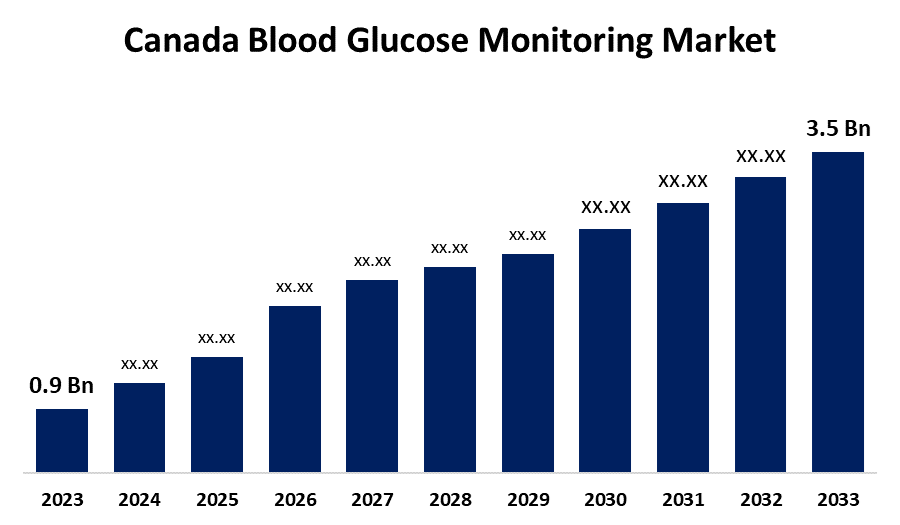

- The Canada Blood Glucose Monitoring Market Size was valued at USD 0.9 Billion in 2023.

- The Market is growing at a CAGR of 14.55% from 2023 to 2033

- The Canada Blood Glucose Monitoring Market Size is expected to reach USD 3.5 Billion by 2033

Get more details on this report -

The Canada Blood Glucose Monitoring Market is anticipated to exceed USD 3.5 Billion by 2033, growing at a CAGR of 14.55% from 2023 to 2033. The increasing prevalence of diabetes patients, adoption of technologically advanced devices, and developed per capita medical expenses are driving the growth of the blood glucose monitoring market in the Canada.

Market Overview

Blood glucose monitoring is the part of diabetes care that involves the identification of fluctuation patterns of blood glucose (sugar) levels. It is conducted in clinical facilities including CBG and plasma glucose venous blood tests while outside of clinical facilities including home (capillary blood glucose (CBG) tests). Scientists and physicians are collaborating to develop practical, patient-centered solutions that could reduce the high costs of controlling Type 1 and Type 2 diabetes as the number of individuals with these conditions continues to rise. Further, the use of continuous glucose monitoring (CGM) devices that provide real-time readings at continuous intervals throughout the day offers lucrative opportunities for glucose-monitoring devices.

Report Coverage

This research report categorizes the market for the Canada blood glucose monitoring market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada blood glucose monitoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada blood glucose monitoring market.

Canada Blood Glucose Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.55% |

| 2033 Value Projection: | USD 3.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Devices Type, By Modality, By Type, By Patient Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Abbott Diabetes Care, Dexcom Inc., Roche Holding AG, Medtronic PLC, LifeScan, Arkray Inc., Ascensia Diabetes Care, Acon Laboratories Inc., Senseonics, Bionime Corporation, Agamatrix Inc. and Others, and and key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In 2022, diabetes accounted for approximately 2.3 percent of all fatalities in Canada, making it the ninth most common cause of death in the nation. Diabetes is a growing health concern in that country. Thus, the increasing prevalence of diabetes patients is responsible for driving the market demand for blood glucose monitoring. Canada is among the developed countries with the highest health expenditures. As of 2023, the total per capita expenditure in Canada for health care was estimated to be about 8,740 Canadian dollars (as per statista data). The significant increase in medical expenses is responsible for driving the market growth. The adoption of technologically advanced devices including continuous glucose monitoring is promoting the market growth for blood glucose monitoring.

Restraining Factors

The high cost of technologically advanced devices including the CGM system leads to hampering its adoption, thereby challenging the blood glucose monitoring market.

Market Segmentation

The Canada Blood Glucose Monitoring Market share is classified into devices type, modality, type, patient type, and distribution channel.

- The continuous glucose monitoring systems dominated the market with the largest market share in 2023.

The Canada blood glucose monitoring market is segmented by devices type into continuous glucose monitoring systems and self-monitoring blood glucose systems. Among these, the continuous glucose monitoring systems dominated the market with the largest market share in 2023. Continuous glucose monitoring systems monitor blood sugar levels every five to fifteen minutes throughout 24 hours a day. The increasing need for managing health owing to the rising prevalence of diabetes is driving the market demand.

- The invasive segment accounted for the largest market share during the forecast period.

The Canada blood glucose monitoring market is segmented by type into non-invasive and invasive. Among these, the invasive segment accounted for the largest market share during the forecast period. Invasive blood glucose monitoring involves the measurement of glucose levels under the skin by inserting a sensor. The increasing application of SMBG devices and the comparatively lower cost of these devices are contributing to driving the market growth.

- The wearable segment dominated the Canada blood glucose monitoring market with the largest market share in 2023.

Based on the modality, the Canada blood glucose monitoring market is divided into wearable and non-wearable. Among these, the wearable segment dominated the Canada blood glucose monitoring market with the largest market share in 2023. Wearable devices such as continuous glucose monitoring are used to track glucose levels in real time. The increasing number of product launches and adoption of advanced innovative devices is driving the market growth.

- The type-2 diabetes segment dominates the Canada blood glucose monitoring market over the predicted timeframe.

Based on the patient type, the Canada blood glucose monitoring market is divided into type-1 diabetes and type-2 diabetes. Among these, the type-2 diabetes segment dominates the Canada blood glucose monitoring market over the predicted timeframe. The glycated hemoglobin (A1C) test is typically used to identify type 2 diabetes. The average blood sugar level over the previous two to three months is shown by this blood test. The increasing prevalence of type-2 diabetes is propelling the market demand.

- The retail sales segment dominates the market with the largest market share in 2023.

Based on the distribution channel, the Canada blood glucose monitoring market is divided into institutional sales and retail sales. Among these, the retail sales segment dominates the market with the largest market share in 2023. Market players are expanding their presence through retail channels in the country to strengthen their position. The rising number of diabetic people and the supply chain are supporting the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada blood glucose monitoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Diabetes Care

- Dexcom Inc.

- Roche Holding AG

- Medtronic PLC

- LifeScan

- Arkray Inc.

- Ascensia Diabetes Care

- Acon Laboratories Inc.

- Senseonics

- Bionime Corporation

- Agamatrix Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Tandem Diabetes Care, Inc. and Dexcom, Inc. announced the updated t:slim X2 insulin pump software is compatible with both Dexcom G7 and Dexcom G6 Continuous Glucose Monitoring (CGM) Systems and is authorized for sale by Health Canada.

- In October 2023, Dexcom, Inc., a global leader in real-time continuous glucose monitoring (rtCGM) for people with diabetes, announced that its next-generation Dexcom G7 Continuous Glucose Monitoring (CGM) System would be available for Canadians living with all types of diabetes ages two and older, including those who are pregnant.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Blood Glucose Monitoring Market based on the below-mentioned segments:

Canada Blood Glucose Monitoring Market, By Devices Type

- Continuous Glucose Monitoring Systems

- Self-Monitoring Blood Glucose Systems

Canada Blood Glucose Monitoring Market, By Modality

- Wearable

- Non-Wearable

Canada Blood Glucose Monitoring Market, By Type

- Non-Invasive

- Invasive

Canada Blood Glucose Monitoring Market, By Patient Type

- Type-1 Diabetes

- Type-2 Diabetes

Canada Blood Glucose Monitoring Market, By Distribution Channel

- Institutional Sales

- Retail Sales

Need help to buy this report?