Canada Carbon Credits Market Size, Share, and COVID-19 Impact Analysis, By Type (Regulatory and Voluntary), By System (Cap-and-Trade and Baseline-and-Credit), and Canada Carbon Credits Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerCanada Carbon Credits Market Insights Forecasts to 2033

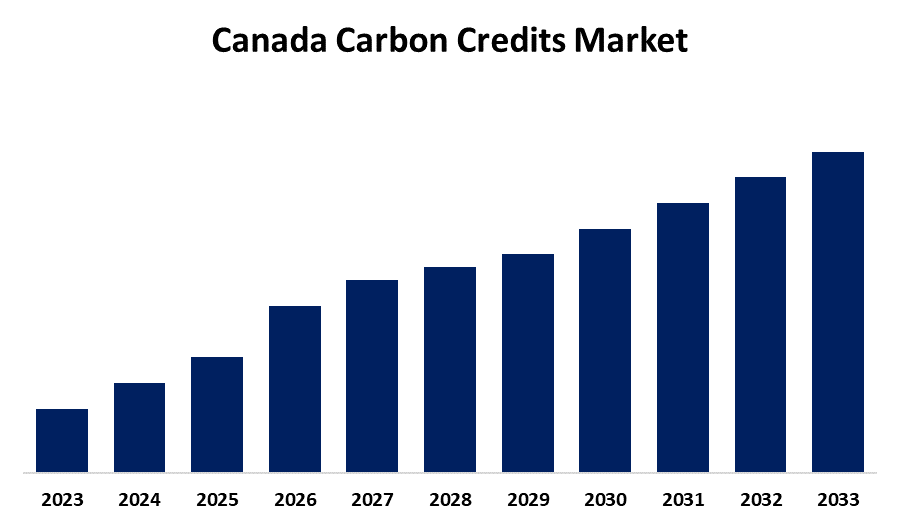

- The Canada Carbon Credits Market Size is Growing at a CAGR of 15.67% from 2023 to 2033

- The Canada Carbon Credits Market Size is Expected to Reach a Significant Share By 2033

Get more details on this report -

The Canada Carbon Credits Market Size is Anticipated to reach a significant share By 2033, Growing at a CAGR of 15.67% from 2023 to 2033

Market Overview

Canada carbon credits market is a key component of the country’s climate change mitigation strategy, facilitating the reduction of greenhouse gas emissions through the buying and selling of carbon credits. The market operates through a cap-and-trade system and carbon offset programs, where businesses that emit less than their permitted levels can sell surplus credits to higher emitters. The federal government has implemented initiatives like the output-based pricing system (OBPS) and Clean Fuel Regulations, ensuring that industries have financial incentives to lower emissions. Additionally, the Canada Carbon Rebate returns a portion of collected carbon pricing revenues to households, making carbon pricing more equitable. This market benefits businesses by promoting sustainability, encouraging innovation in clean technology, and offering financial incentives for emission reductions. Companies investing in green initiatives can sell carbon credits, generating additional revenue. For farmers and forestry sectors, carbon offsets provide financial rewards for sustainable practices like reforestation and soil carbon sequestration. The government also supports initiatives such as the Low Carbon Economy Fund and Net-Zero Accelerator to help industries transition to greener operations.

Report Coverage

This research report categorizes the market for the Canada carbon credits market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada carbon credits market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada carbon credits market.

Canada Carbon Credits Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.67% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By System and COVID-19 Impact Analysis |

| Companies covered:: | 3Degrees, TerraPass, NativeEnergy, Climate Impact Partners, Moss.Earth, South Pole, EKI Energy Services Ltd., Carbon Credit Capital, LLC., CarbonBetter, NATUREOFFICE, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The private sector’s growing focus on sustainability and corporate social responsibility (CSR) has expanded the voluntary market, with businesses increasingly purchasing carbon credits to meet net-zero targets and respond to consumer demand for environmental responsibility. Canada's international climate commitments under the Paris Agreement also contribute to the demand for carbon credits, ensuring the country meets its emissions reduction goals.

Restraining Factors

Regional variability in carbon pricing and regulations across Canada may create inconsistencies, complicating compliance efforts for companies operating in multiple provinces.

Market Segmentation

The Canada carbon credits market share is classified into type and system.

- The regulatory segment accounted for the largest revenue share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The Canada carbon credits market is segmented by type into regulatory and voluntary. Among these, the regulatory segment accounted for the largest revenue share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth is driven by government regulations and policies. It involves carbon credits that companies are required to buy or trade to comply with emissions reduction targets mandated by the government.

- The cap-and-trade segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Canada carbon credits market is segmented by system into cap-and-trade and baseline-and-credit. Among these, the cap-and-trade segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven due to the increasing demand for carbon credits, stronger regulations around emissions, and the growing desire for companies to achieve net-zero emissions goals. This growth is also supported by the stringent carbon pricing system and international commitments to address climate change.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada carbon credits market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3Degrees

- TerraPass

- NativeEnergy

- Climate Impact Partners

- Moss.Earth

- South Pole

- EKI Energy Services Ltd.

- Carbon Credit Capital, LLC.

- CarbonBetter

- NATUREOFFICE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, DeepMarkit Corp., a Canadian company, is launching MintCarbon.io, a platform that converts carbon credits into customizable NFTs (non-fungible tokens) using blockchain technology. This innovation aims to enhance transparency, liquidity, and accessibility in the voluntary carbon credit market, allowing users to trade carbon credits on decentralized exchanges.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada carbon credits market based on the below-mentioned segments

Canada Carbon Credits Market, By Type

- Regulatory

- Voluntary

Canada Carbon Credits Market, By System

- Cap-and-Trade

- Baseline-and-Credit

Need help to buy this report?