Canada Cardiovascular Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Diagnostic & Monitoring Devices and Therapeutic & Surgical Devices), By Application (Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, and Others), By End User (Hospitals, Specialty Clinics, and Others), and Canada Cardiovascular Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Cardiovascular Devices Market Insights Forecasts to 2033

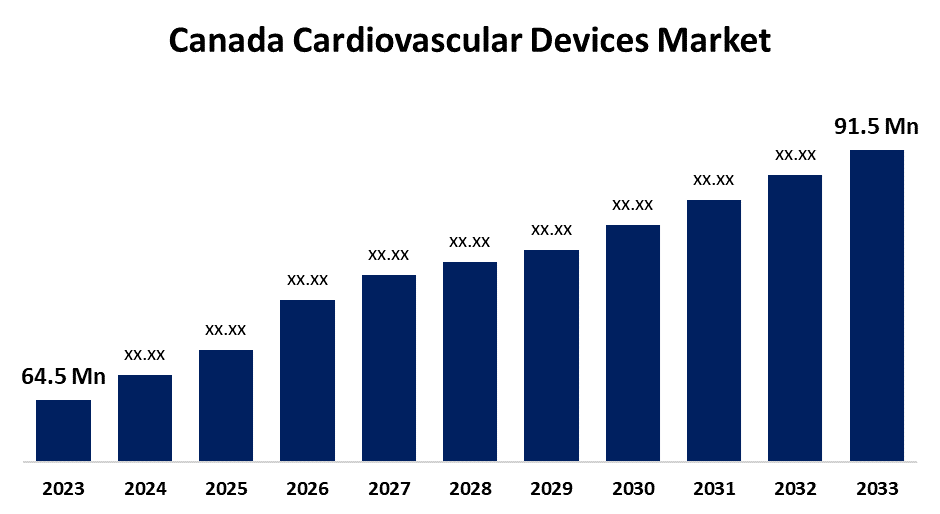

- The Canada Cardiovascular Devices Market Size was valued at USD 64.5 Million in 2023.

- The Market is growing at a CAGR of 3.56% from 2023 to 2033

- The Canada Cardiovascular Devices Market Size is expected to reach USD 91.5 Million by 2033

Get more details on this report -

The Canada Cardiovascular Devices Market is anticipated to exceed USD 91.5 Million by 2033, growing at a CAGR of 3.56% from 2023 to 2033. The increasing burden of cardiovascular diseases (CVD), the prevalence of diabetes & hypertension, and the preference for minimally invasive procedures are driving the growth of the cardiovascular devices market in Canada.

Market Overview

Cardiovascular devices refer to the medical devices used to diagnose and treat heart diseases and related health problems including coronary artery disease, heart failure, and/or arrhythmias. They are comprised of diagnostic, monitoring, and surgical devices for procedures like imaging, interventional procedures, and cardiovascular operations. Examples of these devices include pacemakers, stents, defibrillators, heart valves, and vascular grafts. The advanced use of minimally invasive surgeries involves robot-assisted heart surgery and thoracoscopic surgery are escalating the market growth. Further, the integration of artificial intelligence (AI) into cardiology for cardiovascular care and the use of these devices for patient remote monitoring are propelling the market. There is an increasing demand for cardiovascular devices with advanced features for patients suffering from advanced stages of heart disease. Thus, there is an increased focus on launching innovative and technologically advanced cardiovascular devices by the market players.

Report Coverage

This research report categorizes the market for the Canada cardiovascular devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada cardiovascular devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada cardiovascular devices market.

Canada Cardiovascular Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 64.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.56% |

| 2033 Value Projection: | USD 91.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Device Type, By Application, By End User, COVID-19 Empact, Challenges, Future, Growth, & Analysis |

| Companies covered:: | Abbott Laboratories, Boston Scientific Corporation, Medtronic, Cardinal Health, Biotronik, Edwards Lifesciences, Siemens Healthcare GmbH, General Electric (GE Healthcare), W. L. Gore & Associates Inc., Canon Medical Systems Corporation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to the Canadian Institute for Health Information's Hospital Morbidity Database, individuals 75–84 years old had four times higher rates of ischemic heart disease hospitalizations than patients 45–54 years old. The increasing aging population in the country is responsible for driving the market growth. The increasing awareness about cardiac devices including the safety of cardiac implantable electronic devices is propelling the market growth. According to the Canadian Chronic Disease Surveillance System (CCDSS), about 1 in 12 Canadian adults (2.6 million) age 20 and over are diagnosed with heart disease and about 14 Canadian adults age 20 and over die due to heart disease in the year 2017-18. The increased cases of heart disease in the country are responsible for driving the market demand for cardiac devices. In addition, the rising preference for minimally invasive devices for heart surgery owing to less pain and quicker recovery is propelling the market.

Restraining Factors

The stringent regulatory policies and high cost of instruments and procedures are challenging the Canada cardiovascular devices market.

Market Segmentation

The Canada Cardiovascular Devices Market share is classified into device type, application, and end user.

- The therapeutic & surgical devices segment is anticipated to hold the largest market share during the forecast period.

The Canada cardiovascular devices market is segmented by device type into diagnostic & monitoring devices and therapeutic & surgical devices. Among these, the therapeutic & surgical devices segment is anticipated to hold the largest market share during the forecast period. The cardiovascular devices used for treating heart diseases include implantable cardioverter defibrillator (ICD), cardiac resynchronization therapy (CRT), and left ventricular assist device (LVAD). The increased prevalence of chronic heart diseases and the adoption of technologically advanced cardiology devices for diagnosis and surgical purposes are driving the market.

- The coronary artery disease (CAD) segment accounted for the largest market share during the forecast period.

The Canada cardiovascular devices market is segmented by application into coronary artery disease (CAD), cardiac arrhythmia, heart failure, and others. Among these, the coronary artery disease (CAD) segment accounted for the largest market share during the forecast period. Cardiovascular devices, including coronary stents, are used to treat coronary artery disease (CAD), which is responsible for heart attacks and other cardiac disorders. The increased prevalence of coronary artery disease (CAD), advancement in diagnostic technologies, and adoption of minimally invasive procedures are driving the market growth.

- The hospitals segment dominated the Canada cardiovascular devices market during the forecast period.

Based on the end user, the Canada cardiovascular devices market is divided into hospitals, specialty clinics, and others. Among these, the hospitals segment dominated the Canada cardiovascular devices market during the forecast period. Cardiac catheterization labs and specialist cardiology departments are available in hospitals and are equipped with cutting-edge imaging technology and surgical suites. The high rates of hospitalization associated with the increased cases of heart failure are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada cardiovascular devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic

- Cardinal Health

- Biotronik

- Edwards Lifesciences

- Siemens Healthcare GmbH

- General Electric (GE Healthcare)

- W. L. Gore & Associates Inc.

- Canon Medical Systems Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Amvia Sky Launched in Canada, the World’s First Pacemaker Approved for LBBAP.

- In May 2024, MEACOR Inc. announced the successful closing of its $15 million Series A funding round. This substantial investment supports MEACOR’s mission to offer a novel transcatheter approach for the treatment of mitral and tricuspid valve regurgitation.

- In December 2022, CardioComm Solutions, Inc. confirmed a technology integration agreement with Utah-based CareXM LLC. Under the agreement, CareXM has integrated ECG monitoring capabilities through their TouchPointCare telemedicine platform.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Cardiovascular Devices Market based on the below-mentioned segments:

Canada Cardiovascular Devices Market, By Device Type

- Diagnostic & Monitoring Devices

- Therapeutic & Surgical Devices

Canada Cardiovascular Devices Market, By Application

- Coronary Artery Disease (CAD)

- Cardiac Arrhythmia

- Heart Failure

- Others

Canada Cardiovascular Devices Market, By End User

- Hospitals

- Specialty Clinics

- Others

Need help to buy this report?