Canada Cell Therapy Market Size, Share, and COVID-19 Impact Analysis, By Therapy Type (Allogenic Therapies and Autologous Therapies), By Therapeutic Area (Oncology, Cardiovascular Disease (CVD), Musculoskeletal Disorders, Dermatology, and Others), and Canada Cell Therapy Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Cell Therapy Market Insights Forecasts to 2033

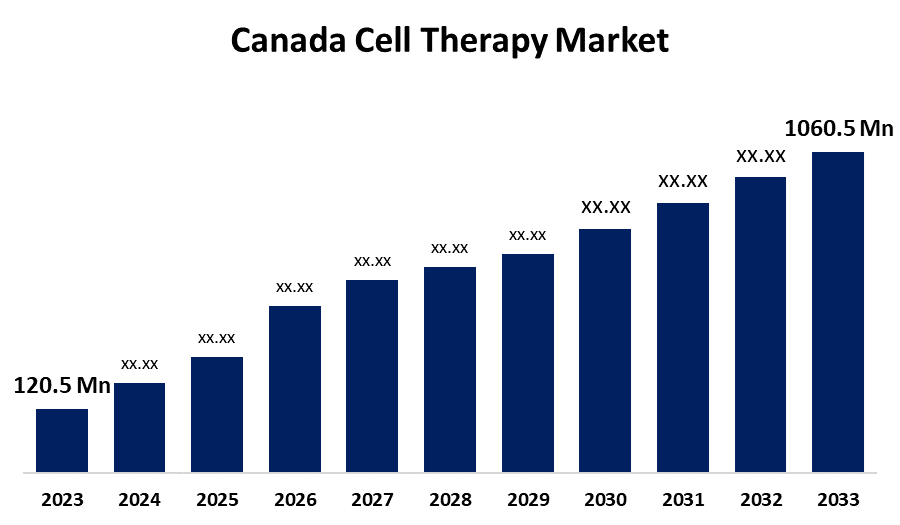

- The Canada Cell Therapy Market Size was valued at USD 120.5 Million in 2023.

- The Market is growing at a CAGR of 24.29% from 2023 to 2033

- The Canada Cell Therapy Market Size is expected to reach USD 1060.5 Million by 2033

Get more details on this report -

The Canada Cell Therapy Market is anticipated to exceed USD 1060.5 Million by 2033, growing at a CAGR of 24.29% from 2023 to 2033. The increasing adoption of regenerative medicine, introduction of novel platforms & technologies, and clinical studies pertaining to the development of cellular therapies are driving the growth of the cell therapy market in the Canada.

Market Overview

Cell therapy refers to transplantation of human cells to replace or repair damaged tissue and/or cells. Numerous cell types may be used as part of a therapy or treatment for a range of illnesses and ailments. Cell therapies may be used to treat cancer, autoimmune diseases, urinary issues, infectious diseases, repair spinal cord injuries, restore damaged joint cartilage, boost a compromised immune system, and assist individuals with neurological conditions. Among the various cells including hematopoietic (blood-forming) stem cells (HSC), skeletal muscle stem cells, mesenchymal stem cells, lymphocytes, dendritic cells, and pancreatic islet cells, the most common cell therapy is hematopoietic stem cell transplantation is used to treat a range of hematologic disorders and blood malignancies. Products derived from cell therapy may prove to be a successful and disease-modifying treatment for conditions that traditional medications would not be able to cure. The widespread application of cell therapy products for treating burns, venous leg ulcers, diabetic foot ulcers, traumas, and pressure ulcers is driving the market expansion of cell therapy. The increasing innovation and development in cell therapy including CAR T cell therapy for treating cancer in an affordable and accessible way are driving market growth opportunities.

Report Coverage

This research report categorizes the market for the Canada cell therapy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada cell therapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada cell therapy market.

Canada Cell Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 120.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 24.29% |

| 2033 Value Projection: | USD 1060.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Therapy Type, By Therapeutic Area and COVID-19 Impact Analysis |

| Companies covered:: | Gilead Sciences Inc, Bristol-Myers Squibb Co, Johnson & Johnson, Medipost and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing adoption of regenerative medicine owing to the increasing incidence of chronic ailments and genetic disorders is driving the cell therapy market. The introduction of novel platforms & technologies for streamlining the processing and manufacturing of cell therapies is responsible for driving the market growth. Further, clinical studies pertaining to the development of cellular therapies are propelling the market growth.

Restraining Factors

The high development costs, rejection risk, and intricate regulatory approval processes associated with the development of cell therapy are anticipated to restrain the Canada cell therapy market.

Market Segmentation

The Canada Cell Therapy Market share is classified into therapy type and therapeutic area.

- The autologous therapies segment dominated the market with the largest market share in 2023.

The Canada cell therapy market is segmented by therapy type into allogenic therapies and autologous therapies. Among these, the autologous therapies segment dominated the market with the largest market share in 2023. Autologous cell therapy entails removing, manipulating, or processing a person's own cells to a certain extent, and then reintroducing them. The increasing regulatory approvals for autologous CAR T cell therapies and demand for personalized medicines are responsible for driving the market growth.

- The oncology segment accounted for the largest market share during the forecast period.

The Canada cell therapy market is segmented by therapeutic area into oncology, cardiovascular disease (CVD), musculoskeletal disorders, dermatology, and others. Among these, the oncology segment accounted for the largest market share during the forecast period. Numerous forms of cellular therapy, such as CAR T cells, other genetically modified T cells, TIL, vaccines, gene therapy, and NK cells, are being investigated for cancer. The increasing investment in immune oncology and the increasing incidence of cancer are driving the market growth in the oncology segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada cell therapy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gilead Sciences Inc

- Bristol-Myers Squibb Co

- Johnson & Johnson

- Medipost

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, C3i Center Inc. received regulatory approval in the form of a Drug Establishment License (DEL) to commercially produce cell therapies, making it the first CDMO in Canada to achieve this milestone.

- In September 2022, Next Generation Manufacturing Canada (NGen), the industry-led organization behind Canada’s Global Innovation Cluster for Advanced Manufacturing, announced a $10.5 million contribution to a $34.8 million project led by OmniaBio Inc. (Hamilton) and partners ExCellThera (Montreal), MorphoCell Technologies (Montreal), Aspect Biosystems (Vancouver), and CATTI (Montreal).

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Cell Therapy Market based on the below-mentioned segments:

Canada Cell Therapy Market, By Therapy Type

- Allogenic Therapies

- Autologous Therapies

Canada Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

Need help to buy this report?