Canada Commercial Banking Market Size, Share, and COVID-19 Impact Analysis, By Product (Depository Services, Non-Interest Income Generating Products, Commercial & Industrial Loans, Residential, Agricultural, Real Estate Loans, Others), By Application (Healthcare, Construction, Transportation & Logistics, Media & Entertainment, Others), and Canada Commercial Banking Market Analysis and Forecast 2023 – 2033.

Industry: Banking & FinancialCanada Commercial Banking Market Insights Forecasts to 2033

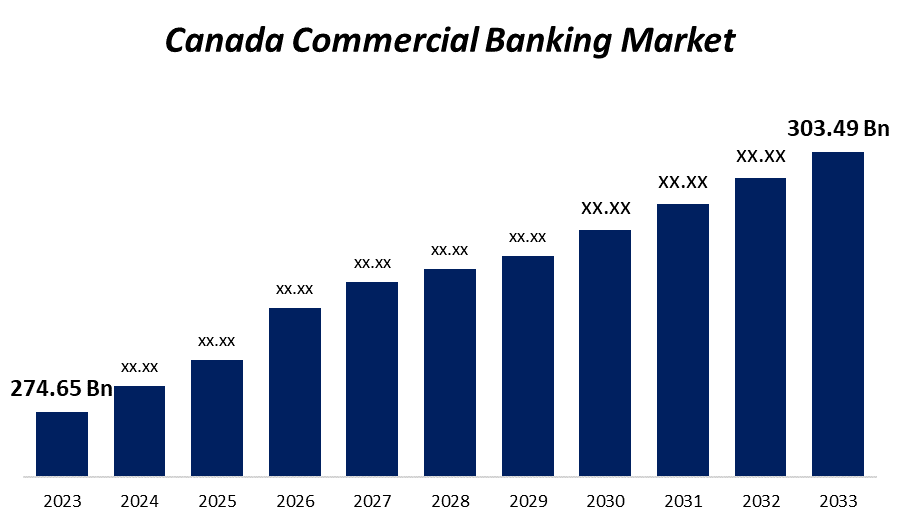

- The Canada Commercial Banking Market Size was valued at USD 274.65 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.02% from 2023 to 2033.

- The Canada Commercial Banking Market Size is expected to reach USD 303.49 Billion by 2033.

Get more details on this report -

The Canada Commercial Banking Market Size is expected to reach USD 303.49 Billion by 2033, at a CAGR of 2.02% during the forecast period 2023 to 2033.

Overview

A commercial bank is an instance of financial institution that handles all of the deposits and withdrawals for the general public, as well as providing investment loans. These banks operate solely for profit. A commercial bank has two primary characteristics: lending and borrowing. The bank accepts deposits and distributes funds to various projects to earn interest (profit). The borrowing rate is the interest rate that a bank pays to depositors, whereas the lending rate is the rate at which a bank lends money. The commercial banking market in the Canada is expected to see more payment collection partnerships between FinTech firms and digital lending companies. Open banking is expected to reshape market competition in the coming years. Banks that invest in capabilities will be better positioned to maintain their consumer brand strength. However, loan growth has increased in recent months, with annual growth slowing from nearly double digits late last year to around 9%, indicating that tighter conditions are beginning to slow bank credit growth. Over the last three years, the COVID-19 pandemic has provided excess savings and debt relief to household budgets, but this is about to change.

Canada Commercial Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 274.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.02% |

| 2033 Value Projection: | USD 303.49 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Application |

| Companies covered:: | The Royal Bank of Canada, Toronto-Dominion Bank, Toronto-Dominion Bank, Canadian Imperial Bank of Commerce, The Canadian Imperial Bank of Commerce and Scotiabank, Bank of Montreal, Bank of Nova Scotia, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Commercial banks in Canada help international trade and travel by making foreign exchange transactions easier. They assist their customers with making overseas payments. They also help with international trade by issuing letters of credit to importers and providing travellers' checks to overseas travellers. Globalization has transformed the modern economy into one without borders. There is always a need to settle international debts. Canada commercial international banks assist with cash remittances, currency exchanges, export and import assistance through document and payment transfers, and lending money to governments, institutions, and other organizations. Commercial banks have an unrestricted reach, which contributes to the world becoming more interconnected. As a result, this is one of the most important factors driving Canada commercial banking market growth.

Restraining Factors

Commercial banks typically require a high level of collateral security before making loans, which borrowers may be unable to provide. Commercial banks are reluctant to make loans to people who do not have the necessary collateral security. As a result, market growth slows. Furthermore, the risk of robbery and fraud is a major impediment to the growth of the Canada commercial banking market.

Market Segmentation

The non-interest income generating products segment dominates the market with the largest revenue share over the forecast period.

On the basis of the product, the Canada commercial banking market is segmented into depository services, non-interest income generating products, commercial & industrial loans, residential, agricultural, real estate loans, and others. Among these, the non-interest income generating products segment is dominating the market with the largest revenue share over the forecast period. The commercial bank's ability to diversify is the first and most significant advantage of having non-interest income. If a bank is reliant on interest income, its income becomes highly erratic because it fluctuates with interest rates. When interest rates rise, fewer corporations take loans, resulting in lower interest income. At the same time, as interest rates fall, more corporations take out loans, resulting in increased interest income.

The transportation & logistics segment is witnessing significant CAGR growth over the forecast period.

On the basis of application, the Canada commercial banking market is segmented into healthcare, construction, transportation & logistics, media & entertainment, and others. Among these, the transportation & logistics segment are witnessing significant growth over the forecast period. Small business loans provide transportation to the logistics company with the funds it requires to expand, increase or replace inventory, advertise, consolidate debt, and even pay taxes. We don't provide "one-size-fits-all" lending.

List of Key Market Players

- The Royal Bank of Canada

- Toronto-Dominion Bank

- Toronto-Dominion Bank

- Canadian Imperial Bank of Commerce

- The Canadian Imperial Bank of Commerce and Scotiabank

- Bank of Montreal

- Bank of Nova Scotia

- Others

Key Market Developments

- In December 2023, The Canadian federal Minister of Finance has approved Royal Bank of Canada's acquisition of HSBC Bank Canada. With this approval, Royal Bank of Canada and HSBC Canada will collaborate to ensure a smooth transition for HSBC Canada's clients and employees, who will receive more information in the coming days about what to expect as both banks work to close the transaction.

- In July 2022, as part of a global expansion that was previously announced in 2022, Citi has opened Citi Commercial Bank (CCB) in Canada. CCB provides Citi's extensive institutional products and solutions to meet the changing needs of mid-size corporations as they grow rapidly and expand globally.

Market Segment

This study forecasts revenue at regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada commercial banking market based on the below-mentioned segments:

Canada Commercial Banking Market, Product Analysis

- Depository Services

- Non-Interest Income Generating Products

- Commercial & Industrial Loans

- Residential, Agricultural

- Real Estate Loans

- Others

Canada Commercial Banking Market, Application Analysis

- Healthcare

- Construction

- Transportation & Logistics

- Media & Entertainment

- Others

Need help to buy this report?