Canada Compound Feed Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Ruminants, Poultry, Swine, Aquaculture, and Others), By Ingredients (Cereals, Cakes & Meals, By-products, and Supplements), and Canada Compound Feed Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureCanada Compound Feed Market Insights Forecasts to 2033

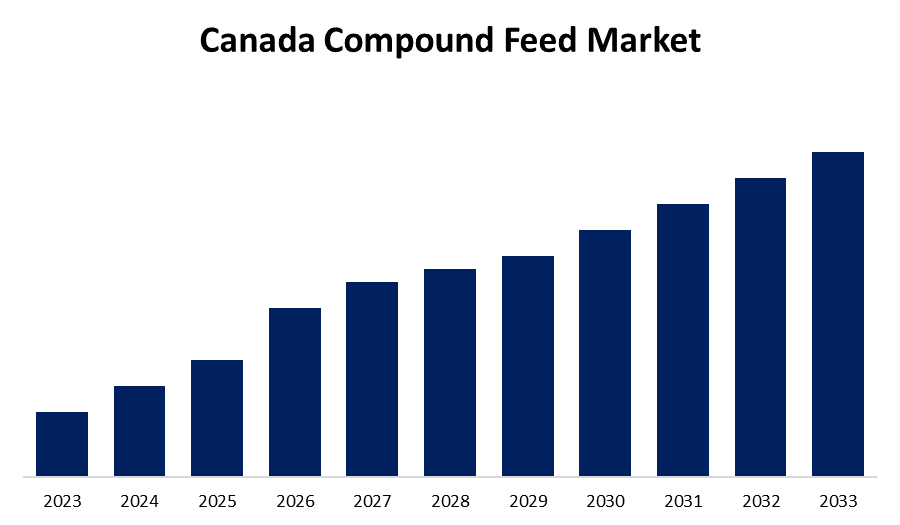

- The Market Size is Growing at a CAGR of 3.65% from 2023 to 2033

- The Canada Compound Feed Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Canada Compound Feed Market Size is anticipated to hold a significant share by 2033, growing at a CAGR of 3.65% from 2023 to 2033. The increasing surge in animal population, demand for animal products, and focus on animal health and nutrition are driving the growth of the compound feed market in Canada.

Market Overview

Compound feed refers to a mixture of products of vegetables or animal origin, fresh or preserved or derived from industrial processing. These feeds are customized as per the nutritional needs of animals containing key micro-nutrients such as vitamins and minerals. The Feeds Act and Feeds Regulations, which regulate the daily activities of feed mills and establish uniformity among feed suppliers, producers, and distributors, are two examples of the heavily regulated Canadian feed industry. In Canada, the majority of feed is produced for domestic use. Feed mills are typically situated near livestock activities, majorly located in the Prairies (22%), Atlantic (9%), BC (3%), Ontario (30%), and Quebec (36%). The market for compound feed is expanding as a result of the increased use of feed additives brought on by the rising demand for a variety of animal products, including milk, dairy products, meat products, eggs, and other non-food commodities. Furthermore, there is increasing prioritization for minimizing the environmental impact of the feed and the final protein while maintaining the lowest possible feed costs, by farmers and feed manufacturers.

Report Coverage

This research report categorizes the market for the Canada compound feed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada compound feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada compound feed market.

Canada Compound Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.65% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Animal Type, By Ingredients. |

| Companies covered:: | Cargill Inc., Novus International, Alltech Inc., Archer Daniels Midland, Neovia Group, Paragon Feeds Corp., Canadian Organic Feeds Limited, New Hope Group, Land O Lakes Purina, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is an increasing Canadian dog and cat population from 7.7 million to 7.9 million and 8.1 million to 8.5 million respectively. The growing pet population in Canada and increasing awareness about animal health and nutrition is driving the market demand. For instance, CVMA organizes a national public awareness campaign Animal Health Week each year to promote animal health. In July 2023, The Animal Nutrition Conference of Canada took place in Montreal, Quebec, hosted by the Animal Nutrition Association of Canada (ANAC). Furthermore, the rising demand for meat and animal products owing to the increasing disposable income and consumption of meat and animal products are contributing to driving the compound feed market.

Restraining Factors

The fluctuation in the prices of raw materials like seeds and plant leaves is challenging the Canada compound feed market. Warm springtime temperatures and dry weather in many regions of Alberta sped up plant maturity but decreased first-cut hay yields. The dryland output was 40% lower than the 10-year norm, with an estimated first-cut average of 0.9 tons per acre. The drought in parts of the Canadian Prairies during the year 2023 has led to slashed feed supplies, thereby hampering the compound feed market growth in the country.

Market Segmentation

The Canada Compound Feed Market share is classified into animal type and ingredients.

- The swine segment dominated the market with the largest market share during the forecast period.

The Canada compound feed market is segmented by animal type into ruminants, poultry, swine, aquaculture, and others. Among these, the swine segment dominated the market with the largest market share during the forecast period. The pork industry is the fourth largest farming industry in Canada with more than 7000 pig (swine) farms across Canada producing 25.5 million animals per year. This sector generates $ 23.8 billion, contributing to the sound economy and prosperity of the country. The increasing pork demand leads to increased pig raising, ultimately driving the market demand for compound feed.

- The cereals segment accounted for the largest market share during the forecast period.

Based on the ingredients, the Canada compound feed market is divided into cereals, cakes & meals, by-products, and supplements. Among these, the cereals segment accounted for the largest market share during the forecast period. Cereals are increasingly used in compound feeding. Cereals used in feed grains are maize, barley, wheat, sorghum, and oats. They are biotransformed into animal products that possess excellent protein quality and digestibility, and provide some essential nutrients that are scarce in cereal-based foods (i.e., calcium, iron, vitamin B12).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada compound feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- Novus International

- Alltech Inc.

- Archer Daniels Midland

- Neovia Group

- Paragon Feeds Corp.

- Canadian Organic Feeds Limited

- New Hope Group

- Land O Lakes Purina

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, ADDiCAN, a Canadian animal nutrition company, acquired a second grain processing facility in Slemon Park, Prince Edward Island, Canada. The purchase, which would expand ADDiCAN’s manufacturing and bulk handling capabilities for the North American and international markets, includes feed ingredients, grains, seeds cleaning and sorting, 500,000 bushels of grain handling capacity, plus more than 50,000 square feet of storage space.

- In September 2022, Trouw Nutrition North America has opened its largest mill in North America in Chilliwack, British Columbia. The new 40,000-square-foot mill features 50% more production capacity than the original facility, which was built in 1958 and would soon be torn down. It also has 30% more grain storage capacity.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Compound Feed Market based on the below-mentioned segments:

Canada Compound Feed Market, By Animal Type

- Ruminants

- Poultry

- Swine

- Aquaculture

- Others

Canada Compound Feed Market, By Ingredients

- Cereals

- Cakes & Meals

- By-products

- Supplements

Need help to buy this report?