Canada Connected Health and Wellness Solutions Market Size, Share, and COVID-19 Impact Analysis, By Product (Personal Medical Devices, Wellness products, and Software & Services), By Function (Clinical Monitoring and Telehealth), By Application (Diagnosis & Treatment, Wellness & Prevention, Monitoring, and Others), By End-use (Hospitals & Clinics and Home Monitoring), and Canada Connected Health and Wellness Solutions Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Connected Health and Wellness Solutions Market Insights Forecasts to 2033

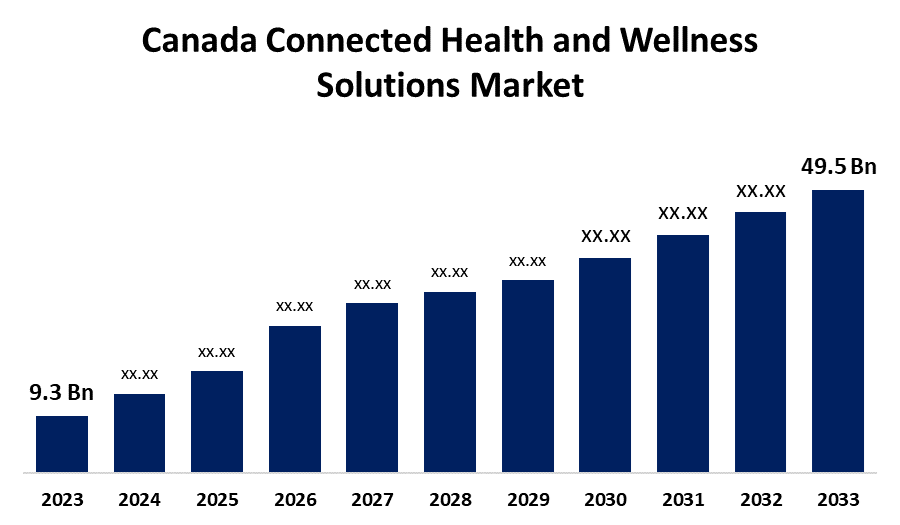

- The Canada Connected Health and Wellness Solutions Market Size was valued at USD 9.3 Billion in 2023.

- The Market is growing at a CAGR of 18.20% from 2023 to 2033

- The Canada Connected Health and Wellness Solutions Market Size is expected to reach USD 49.5 Billion by 2033

Get more details on this report -

The Canada Connected Health and Wellness Solutions Market is anticipated to exceed USD 49.5 Billion by 2033, growing at a CAGR of 18.20% from 2023 to 2033. The increasing incidences of chronic diseases, rising healthcare costs, and adoption of wearable devices & mobile apps are driving the growth of the connected health and wellness solutions market in the Canada.

Market Overview

Connected health and wellness solutions enable continuous monitoring of patients' vital signs, medication adherence, and other health metrics. For improving patient outcomes, these solutions are developed for healthcare providers via early detection of health issues and adjusting treatment quickly. Further, the use of connected health and wellness devices enables more personalized care, fostering a stronger provider-patient relationship. Glucose monitoring, cardiac rhythm monitoring, mobile personal emergency response systems, and automated compliances are some examples of health and wellness solutions. The adoption of a range of digital health technologies in healthcare including electronic health records (EHRs), electronic medical records (EMRs), telehealth & telemedicine, and personalized medicine are bolstering the market growth. Further, there is increasing focus on preventive healthcare technology that includes the use of remote monitoring systems for facilitating early detection of health issues and timely interventions.

Report Coverage

This research report categorizes the market for the Canada connected health and wellness solutions market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada connected health and wellness solutions market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada connected health and wellness solutions market.

Driving Factors

It is estimated that 45.1% of Canadians lived with at least one major chronic disease in 2021. Prevalence of most common chronic diseases and conditions: hypertension (25%), osteoarthritis (14%), mood and/or anxiety disorders (13%), diabetes (11%), and others. Thus, the use of connected health devices for detecting and managing the increasing cases of chronic diseases is driving the market demand. The increasing government investment in connected health and wellness solutions for improved healthcare service is driving the market growth. Further, the adoption of wearable device for more personalized care and tailoring treatment plans to the individual are promoting the market growth.

Restraining Factors

The technical challenges in integration and interoperability are challenging the connected health and wellness solutions market. Further, the data privacy and security concerns related to connected health and wellness devices may hamper the market growth.

Market Segmentation

The Canada Connected Health and Wellness Solutions Market share is classified into product, function, application, and end-use.

- The software & services segment dominated the market with the largest market share in 2023.

The Canada connected health and wellness solutions market is segmented by product into personal medical devices, wellness products, and software & services. Among these, the software & services segment dominated the market with the largest market share in 2023. New digital health software solutions include telemedicine, remote patient monitoring, and artificial intelligence (AI). The increasing use of digital technology for improving access and quality of care is driving the market.

- The telehealth segment is anticipated to register the fastest CAGR growth during the forecast period.

The Canada connected health and wellness solutions market is segmented by function into clinical monitoring and telehealth. Among these, the telehealth segment is anticipated to register the fastest CAGR growth during the forecast period. Videoconferencing, the internet, store-and-forward imaging, streaming media, and wireless and terrestrial connections are some technologies utilized in telehealth for evaluating and diagnosing medical conditions. Further, real-time telemedicine (Synchronous) solutions, store-and-forward (Asynchronous) telemedicine and on-site telemedicine are also considered in telehealth segment.

- The wellness & prevention segment accounted for the largest market share during the forecast period.

The Canada connected health and wellness solutions market is segmented by application into diagnosis & treatment, wellness & prevention, monitoring, and others. Among these, the wellness & prevention segment accounted for the largest market share during the forecast period. Technologies like IoT devices and fitness trackers measure nutrition to give real-time feedback and monitor vital signs, activity, & sleep respectively. The increasing use of integrated digital technologies for people’s daily living environments such as schools, sports clubs, and healthcare facilities is driving the market demand in the wellness & prevention segment.

- The hospitals & clinics segment dominated the Canada connected health and wellness solutions market with the largest market share in 2023.

Based on the end-use, the Canada connected health and wellness solutions market is divided into hospitals & clinics and home monitoring. Among these, the hospitals & clinics segment dominated the Canada connected health and wellness solutions market with the largest market share in 2023. Streamlining healthcare procedures and reducing expenses are benefits of integrating linked health and wellness solutions in clinics and hospitals. Healthcare institutions improve patient engagement, lower hospital readmission rates, and maximize resource use by utilizing digital health technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada connected health and wellness solutions market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OMRON Healthcare, Inc.

- Koninklijke Philips N.V.

- GE Healthcare

- Medtronic

- Garmin International, Inc.

- Abbott

- Boston Scientific Corporation

- Apple, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Samsung Electronics Co., Ltd. announced the new Galaxy Watch7 and Galaxy Watch Ultra, expanding the power of Galaxy AI to more people through wearables designed to provide end-to-end wellness experiences for everyone.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Connected Health and Wellness Solutions Market based on the below-mentioned segments:

Canada Connected Health and Wellness Solutions Market, By Product

- Personal Medical Devices

- Wellness products

- Software & Services

Canada Connected Health and Wellness Solutions Market, By Function

- Clinical Monitoring

- Telehealth

Canada Connected Health and Wellness Solutions Market, By Application

- Diagnosis & Treatment

- Wellness & Prevention

- Monitoring

- Others

Canada Connected Health and Wellness Solutions Market, By End-use

- Hospitals & Clinics

- Home Monitoring

Need help to buy this report?