Canada Crohns Disease Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Type (Non-Surgical [Anti-Inflammatory, Immune System Suppressors, Antibiotics, and Others] and Surgical), By Route of Administration (Injectable and Oral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Canada Crohns Disease Therapeutics Market Insights Forecasts 2023 - 2033

Industry: HealthcareCanada Crohn’s Disease Therapeutics Market Insights Forecasts to 2033

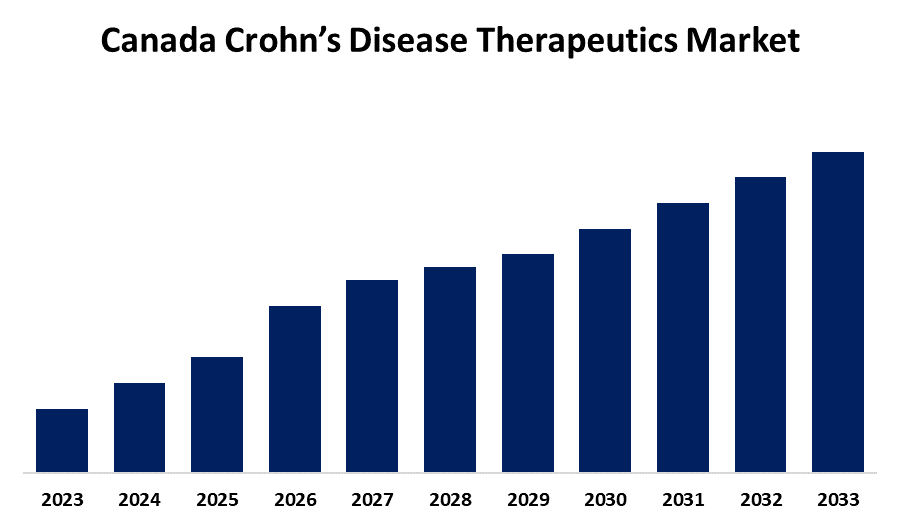

- The Canada Crohn’s Disease Therapeutics Market Size is Growing at 3.07% CAGR from 2023 to 2033.

- The Canada Crohn’s Disease Therapeutics Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The Canada Crohn’s Disease Therapeutics Market Size is expected to reach a significant share by 2033, growing at a 3.07% CAGR from 2023 to 2033.

Market Overview

The Canada Crohn's disease therapeutics market is the business involved with the production, distribution, and sale of Crohn's disease treatments in Canada. These include drugs like biologics, immunosuppressants, aminosalicylates, and corticosteroids, as well as new therapies that are designed to control inflammation, alleviate symptoms, and enhance patient quality of life. The market is fueled by drivers such as the rising prevalence of disease, development of biologic therapies, healthcare investments, and knowledge of managing Crohn's disease. The Canadian Crohn's Disease Therapeutics market provides noteworthy opportunities with the growing prevalence of the disease, the adoption of biologics, and developments in personalized medicine. Increased research on new therapies, such as stem cell therapy and microbiome-based treatment, increases market value. Increasing healthcare infrastructure, better reimbursement policies, and government efforts towards creating awareness of inflammatory bowel disease (IBD) also boost growth. Also, the development of biosimilars provides cost-saving treatment solutions, enhancing patient affordability and driving market growth during the forecast period. In October 2023, Crohn's and Colitis Canada made a $2.7 million commitment to fund 10 researchers across the country to hasten the effect of research on Crohn's and colitis. The move is a testament to the organization's dedication to moving therapeutic developments forward and enhancing patient outcomes within Canada.

Report Coverage

This research report categorizes the market for the Canada Crohn’s disease therapeutics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada Crohn’s disease therapeutics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada Crohn’s disease therapeutics market.

Canada Crohns Disease Therapeutics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.07% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Route of Administration, By Distribution Channel |

| Companies covered:: | Takeda Pharmaceutical Company Limited, AbbVie Inc., Perrigo Company plc, Pfizer Inc., Johnson & Johnson Services Inc., Ferring B.V., Bristol-Myers Squibb Company (Celgene Corporation), F. Hoffmann-La Roche Ltd (Genentech, Inc.), UCB S.A., Salix Pharmaceuticals, Gilead Sciences Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Canada Crohn's disease therapy market is impacted by some of the key drivers like the growing prevalence of Crohn's disease, the innovation of biologics and targeted therapies, and enhanced awareness towards early diagnosis and treatment. Greater disease burden due to inflammatory bowel diseases (IBD) in terms of genetic predisposition, environmental factors, and lifestyle modification has led to a greater need for effective therapeutics. The evolution in biological drug technologies like TNF inhibitors, integrin inhibitors, and JAK inhibitors revolutionized Crohn's disease therapy with higher effectiveness and maintenance of disease control over longer durations. Evolutions in the process of introducing novel small-molecule drugs and developing personalized medication protocols also drive the market's growth. Initiatives by governments towards research and development and improving reimbursement schemes contribute to making patients' access broader for better therapy. Greater application of telemedicine and healthcare technology solutions also facilitates enhanced control of diseases. Furthermore, greater numbers of clinical trials, better infrastructure for healthcare, and a growing trend towards fewer invasive patterns of treatment are all driving the market growth further. Through relentless innovation with patient-oriented therapy, Canada's Crohn's disease therapeutic market is going to experience significant growth.

Restraining Factors

The Canada Crohn's disease therapeutics market is constrained by high biologics and advanced therapy costs, reducing patient affordability. Inaccessibility of specialized treatment in rural settings, stringent regulatory approvals, and possible side effects of drugs constrain market growth. Moreover, late diagnosis, absence of curative drugs, and difficulties in patient compliance with long-term therapies also limit market growth despite increasing disease incidence and continued research progress.

Market Segment

- The non-surgical segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the Canada Crohn’s disease therapeutics market is divided into non-surgical and surgical. The non-surgical segment is divided into anti-inflammatory, immune system suppressors, antibiotics, and others. Among these, the non-surgical segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the increasing preference for biologics, immunomodulators, and anti-inflammatory drugs, which effectively manage Crohn’s disease without invasive procedures. Advancements in targeted therapies, rising patient awareness, and improved treatment adherence are expected to drive significant CAGR growth during the forecast period.

- The injectable segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe.

Based on the route of administration, the Canada Crohn’s disease therapeutics market is divided into injectable and oral. Among these, the injectable segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe. The segmental growth is attributed to the widespread use of biologics and monoclonal antibodies for Crohn’s disease treatment. These therapies offer high efficacy, longer-lasting effects, and better patient outcomes. Increasing approvals of advanced injectables and the growing adoption of targeted treatments are expected to drive significant CAGR growth.

- The hospital pharmacies segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Canada Crohn’s disease therapeutics market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the high demand for biologics and advanced Crohn’s disease treatments, which require specialized handling and administration. Increased hospital visits, rising Crohn’s disease prevalence, and improved access to prescription medications are expected to drive significant CAGR growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada Crohn’s disease therapeutics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda Pharmaceutical Company Limited

- AbbVie Inc.

- Perrigo Company plc

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- Ferring B.V.

- Bristol-Myers Squibb Company (Celgene Corporation)

- F. Hoffmann-La Roche Ltd (Genentech, Inc.)

- UCB S.A.

- Salix Pharmaceuticals

- Gilead Sciences Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Canada Crohn's disease therapeutics market based on the below-mentioned segments:

Canada Crohn’s Disease Therapeutics Market, By Type

- Non-Surgical

- Anti-Inflammatory

- Immune System Suppressors

- Antibiotics

- Others

- Surgical

Canada Crohn’s Disease Therapeutics Market, By Route of Administration

- Injectable

- Oral

Canada Crohn’s Disease Therapeutics Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Need help to buy this report?