Canada Crop Protection Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Herbicides, Insecticides, Fungicides, and Others), By Crop Type (Cereals, Oilseeds & Pulses, Fruits & Vegetables, and Others), By Source (Synthetic Chemicals and Biologicals), By Mode of Application (Foliar Spray, Soil Treatment, Seed Treatment, and Others), and Canada Crop Protection Chemicals Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureCanada Crop Protection Chemicals Market Insights Forecasts to 2033

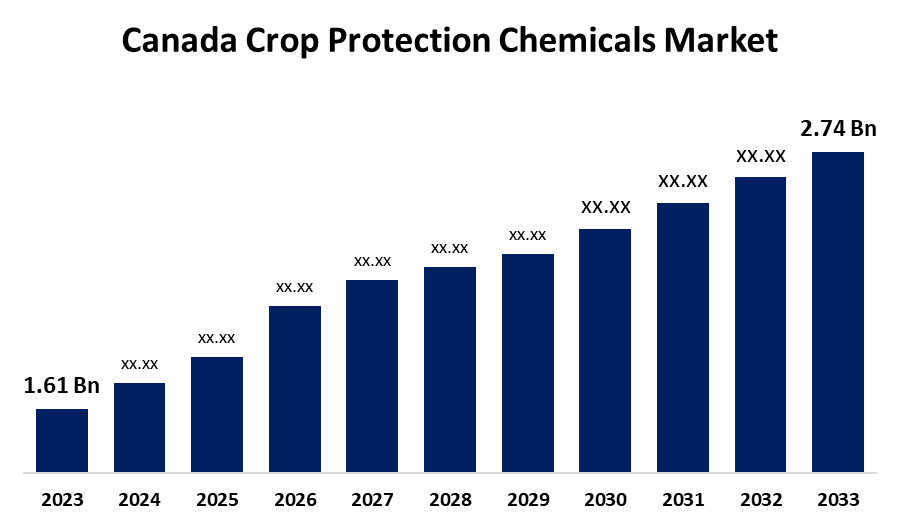

- The Canada Crop Protection Chemicals Market Size was valued at USD 1.61 Billion in 2023.

- The Market is growing at a CAGR of 5.46% from 2023 to 2033

- The Canada Crop Protection Chemicals Market Size is expected to reach USD 2.74 Billion by 2033

Get more details on this report -

The Canada Crop Protection Chemicals Market is anticipated to exceed USD 2.74 Billion by 2033, growing at a CAGR of 5.46% from 2023 to 2033. The increasing application of crop protection solutions for high-yield and emerging pests & diseases owing to fluctuations in climate conditions is driving the growth of the crop protection chemicals market in Canada.

Market Overview

Crop protection chemicals are basically herbicides, insecticides, and fungicides that are used to control pests, weeds, and other harmful organisms that would otherwise grow among a crop, competing with it for water, nutrients, and sunlight, thereby damaging crops. There is a surging adoption of crop protection chemicals among farmers to mitigate the risks associated with climate change and extreme weather conditions to ensure better harvests despite unpredictable weather patterns. Technological advancements including genetically modified crops, precision agriculture, automated machinery, biopesticides, and digital farming platforms are in agricultural trends that offer sophisticated, efficient, and sustainable solutions. Further, the use of integrated pest management emphasizing the growth of a healthy crop with the least possible disruption to agroecosystems and encouraging natural pest control mechanisms are offering lucrative market opportunities for crop protection chemicals.

Report Coverage

This research report categorizes the market for the Canadian crop protection chemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canadian crop protection chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada crop protection chemicals market.

Canada Crop Protection Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.61 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.46% |

| 2033 Value Projection: | USD 2.74 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Crop Type, By Source, By Mode of Application |

| Companies covered:: | ADAMA Agricultural Solutions Ltd, BASF Canada Agricultural Solutions, Bayer AG, Corteva Agriscience, Nufarm Ltd, Gowan Company, Sumitomo Chemical Co. Ltd, Syngenta, UPL Limited, And Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

There is a decrease in crop production in the country mostly attributed to drought conditions which results in reduced crop yields in Western Canada. These challenges lead to increased utilization of crop protection chemicals in modern agriculture for enhancing crop yield, thereby driving market growth. Growing conditions, crop yields, and the kinds of crops that can be grown in various parts of the country are all impacted by the warming globe, particularly in Canada. The emerging pests & diseases owing to fluctuations in climate conditions are driving the market demand for crop protection chemicals.

Restraining Factors

The high resistance to pests and significant decline in the effectiveness of certain crop protection chemicals are challenging the crop protection chemicals market.

Market Segmentation

The Canada Crop Protection Chemicals Market share is classified into type, crop type, source, and mode of application.

- The herbicides segment is expected to hold the largest market share during the forecast period.

The Canada crop protection chemicals market is segmented by type into herbicides, insecticides, fungicides, and others. Among these, the herbicides segment is expected to hold the largest market share during the forecast period. Herbicides are used to suppress or modify unwanted plants. They also may be applied to crops in the fall, to improve harvesting. The rising need for efficient weed management solutions and enhanced crop productivity are driving the market in the herbicides segment.

- The cereals segment is anticipated to grow at a rapid pace during the forecast period.

The Canadian crop protection chemicals market is segmented by crop type into cereals, oilseeds & pulses, fruits & vegetables, and others. Among these, the cereals segment is anticipated to grow at a rapid pace during the forecast period. Cereals are most susceptible to various pests, diseases, and weeds necessitating the use of crop protection chemicals. Further, the rising emphasis on food security among the growing population is driving market demand in the cereals segment.

- The synthetic chemicals segment is anticipated to hold the largest market share during the forecast period.

The Canada crop protection chemicals market is segmented by source into synthetic chemicals and biologicals. Among these, the synthetic chemicals segment is anticipated to hold the largest market share during the forecast period. Compared to most organic pesticides, synthetic chemicals are more widely accessible and have a longer shelf life, with no need to rely on hurried pesticide treatments and purchasing. The lower price and pest-targeted effectiveness of synthetic chemicals along with the government initiatives are driving the market growth.

- The foliar spray segment is expected to account for the largest market share during the forecast period.

Based on the mode of application, the Canada crop protection chemicals market is divided into foliar spray, soil treatment, seed treatment, and others. Among these, the foliar spray segment is expected to account for the largest market share during the forecast period. Foliar spray is the most common mode of application for pest management in crops. The rising demand for high-quality crops and need for efficient crop management practices are driving the market in the foliar spray segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canadian crop protection chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADAMA Agricultural Solutions Ltd

- BASF Canada Agricultural Solutions

- Bayer AG

- Corteva Agriscience

- Nufarm Ltd

- Gowan Company

- Sumitomo Chemical Co. Ltd

- Syngenta

- UPL Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, ADAMA Canada to offer a new Herbicide DAVAI A Plus (Imazamox +Clethodim) for Imi-tolerant lentils, as well as Peas and Soybeans. This is one part of an ongoing strategy to meet the needs of Canadian growers while adapting to ongoing global supply chain issues.

- In January 2023, Gowan Canada announced the launch of Magister SC Miticide for the Canadian Horticulture Market. Magister SC is a flowable formulation containing the active ingredient Fenazaquin, a Group 21A mode of action (MOA). It provides rapid action against certain species of mites in both Eriophyidae and Tetranychidae families and pear psylla.

Market Segment

This study forecasts revenue at Canadian, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Crop Protection Chemicals Market based on the below-mentioned segments:

Canada Crop Protection Chemicals Market, By Type

- Herbicides

- Insecticides

- Fungicides

- Others

Canada Crop Protection Chemicals Market, By Crop Type

- Cereals

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Canada Crop Protection Chemicals Market, By Source

- Synthetic Chemicals

- Biologicals

Canada Crop Protection Chemicals Market, By Mode of Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

Need help to buy this report?