Canada Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Almond, Rice, and Others), By Application (Food and Beverages), By Distribution Channel (Large Retail, Small Retail, Specialty Store, and Online), and Canada Dairy Alternatives Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesCanada Dairy Alternatives Market Insights Forecasts to 2033

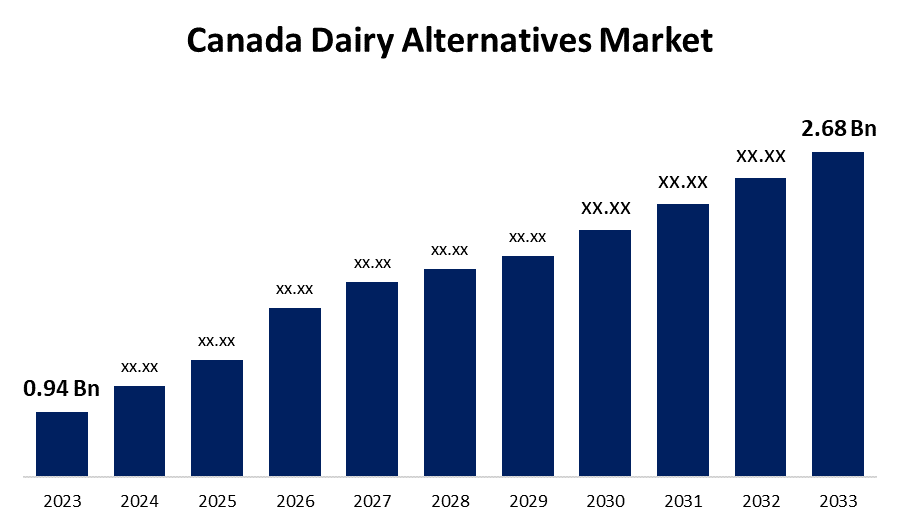

- The Canada Dairy Alternatives Market Size was valued at USD 0.94 Billion in 2023.

- The Market Size is Growing at a CAGR of 11.05% from 2023 to 2033

- The Canada Dairy Alternatives Market Size is expected to reach USD 2.68 Billion by 2033

Get more details on this report -

The Canada Dairy Alternatives Market Size is anticipated to exceed USD 2.68 Billion by 2033, growing at a CAGR of 11.05% from 2023 to 2033. The increasing preference for functional plant-based ingredients, environmental awareness, and concerns about animal welfare are driving the growth of the dairy alternatives market in Canada.

Market Overview

Dairy alternatives are plant-based milk products that are used as substitutes for dairy products. They are low-saturated and cholesterol-free and are consumed as an alternative to milk. The increasing cases of lactose intolerance and allergy to cows’ milk protein products surging the demand for milk-free products. The number of dairy alternative foods and drinks available in the market are soya, rice, oat, almond, hazelnut, coconut, quinoa, and potato drinks. These are healthier choices as they have low-fat content and are cholesterol-free. The increasing preference towards nutritious and healthier choices of food fuels the demand for dairy alternatives in the country. Further, the increasing concern regarding environmental sustainability upsurges the market expansion.

Report Coverage

This research report categorizes the market for the Canada dairy alternatives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada dairy alternatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada dairy alternatives market.

Canada Dairy Alternatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.94 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 11.05% |

| 2033 Value Projection: | USD 2.68 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Source, By Application, By Distribution Channel. |

| Companies covered:: | Agrifoods International Cooperative Ltd, Danone SA, Groupe Lactalis, Nutrisoya Foods Inc., Oat Canada Inc., Otsuka Holdings Co. Ltd, Sunrise Soya Foods, Purity Dairy Limited, SunOpta Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is high demand for plant-based protein products such as soy protein concentrate which has the highest market share 51.9%, followed by gluten (31.1%), soy protein isolate (10.4%), pea protein (5.6%), and vegetable proteins (1.0%). The increased preference for functional plant-based ingredients is driving the market. As per the estimates, the average methane produced per cow is approximately 150kg per lactation which is contributing to the dairy industry’s carbon footprint. Canadians dairy sector emits about 20% of the total greenhouse gas (GHG) emissions from the main livestock sectors. Thus, the increased environmental concerns driving the market demand for dairy alternatives. Furthermore, concerns about animal welfare are contributing to driving the market demand for dairy alternatives.

Restraining Factors

The limited availability of raw materials owing to the seasonal and climatic variations is restraining the Canada dairy alternatives market. Soy and nut allergies are the most common food allergens found among Singaporeans. Thus, the increasing cases of food allergies are restraining the market.

Market Segmentation

The Canada Dairy Alternatives Market share is classified into source, application, and distribution channel.

- The soy segment dominated the market with the largest market share during the forecast period.

The Canada dairy alternatives market is segmented by source into soy, almond, rice, and others. Among these, the soy segment dominated the market with the largest market share during the forecast period. Soy milk is the primary substitute for dairy milk and it was found that consuming soy drinks instead of one serving of dairy milk reduces greenhouse gas emissions by 9%. The increasing awareness about the nutritional content of soy milk and its preference among the general population are driving the market in the soy segment.

- The beverages segment accounted for the largest market share during the forecast period.

The Canada dairy alternatives market is segmented by application into food and beverages. Among these, the beverages segment accounted for the largest market share during the forecast period. Beverage dairy alternatives include almond milk, coconut milk, and soymilk. The increased vegan population and emphasis on the production of plant-based milk products by manufacturers are driving the market growth.

- The large retail segment dominated the Canada dairy alternatives market with the largest market share in 2023.

Based on the distribution channel, the Canada dairy alternatives market is divided into large retail, small retail, specialty store, and online. Among these, the large retail segment dominated the Canada dairy alternatives market with the largest market share in 2023. The large retail segment comprises supermarkets and hypermarkets which is a one-stop solution for purchasing products. Consumer decisions to purchase a large variety of products are contributing to propelling the market in the large retail segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada dairy alternatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agrifoods International Cooperative Ltd

- Danone SA

- Groupe Lactalis

- Nutrisoya Foods Inc.

- Oat Canada Inc.

- Otsuka Holdings Co. Ltd

- Sunrise Soya Foods

- Purity Dairy Limited

- SunOpta Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Lactalis Canada, a subsidiary of the French dairy giant, introduced a new plant-based milk brand to the market, after converting one of its facilities into a fully vegan hub.

- In August 2024, bettermoo(d) Food Corporation announced that it has expanded its presence of Moodrink (Product), available in over 500 retail locations across Canada, exceeding the Company's expectations. Since the start of 2024, bettermoo(d) has expanded its retail network from less than 30 stores to over 500 sale locations-all while still in the early stages of its rollout.

- In June 2022, Global Food and Ingredients Ltd. announced the launch of its YoFiit brand plant-based milk in Costco in Eastern Canada with key urban area warehouses rolled-out.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Dairy Alternatives Market based on the below-mentioned segments:

Canada Dairy Alternatives Market, By Source

- Soy

- Almond

- Rice

- Others

Canada Dairy Alternatives Market, By Application

- Food

- Beverages

Canada Dairy Alternatives Market, By Distribution Channel

- Large Retail

- Small Retail

- Specialty Store

- Online

Need help to buy this report?