Canada Dental Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (General & Diagnostics Equipment, Dental Consumables, and Others), (Orthodontic, Endodontic, Peridontic, and Prosthodontic), By End User (Hospitals, Clinics, and Others), and Canada Dental Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Dental Equipment Market Insights Forecasts to 2033

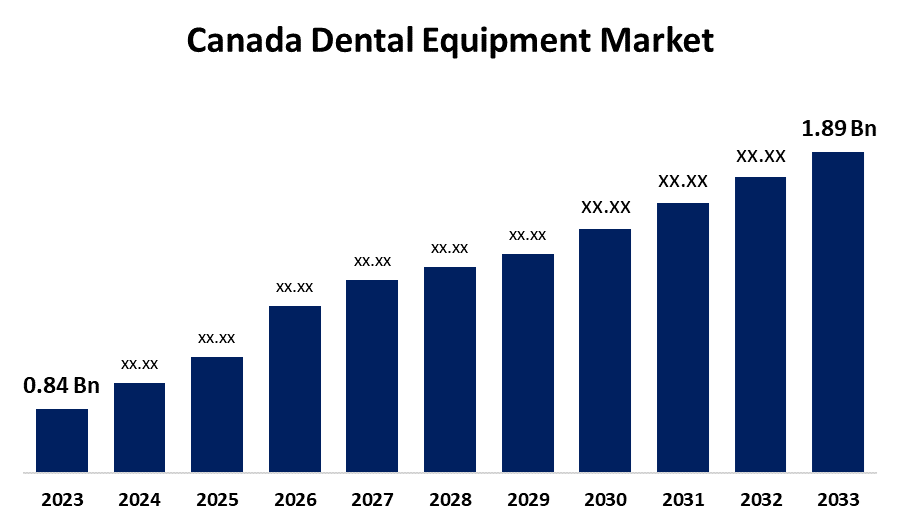

- The Canada Dental Equipment Market Size was valued at USD 0.84 Billion in 2023.

- The Market is growing at a CAGR of 8.45% from 2023 to 2033

- The Canada Dental Equipment Market Size is expected to reach USD 1.89 Billion by 2033

Get more details on this report -

The Canada Dental Equipment Market is anticipated to exceed USD 1.89 Billion by 2033, growing at a CAGR of 8.45% from 2023 to 2033. The increasing aging population & increased dental diseases, and driving demand for cosmetic dentistry are driving the growth of the dental equipment market in the Canada.

Market Overview

Dental equipment is the devices used by dentists for the treatment of dental conditions. These equipment are used to examine, manipulate, restore, and remove teeth and surrounding oral structures. They cover laboratory apparatus, hygiene maintenance tools, dental tools, and other dental devices, including dental lasers. The increased cases of dental caries and inflammation of the gingiva among the people surges the need for dental procedures, ultimately leading to driving demand for dental equipment. There is an increased demand for minimally invasive procedures owing to faster healing, and long-term oral health. Further, dental lasers are being utilized more frequently in surgical procedures such as gum elevation and teeth whitening to stop or lessen blood loss and patient discomfort. The increasing cases of dental diseases, development in oral healthcare infrastructure, and investment in dental restoration are anticipated to leverage market opportunities for the dental equipment market.

Report Coverage

This research report categorizes the market for the Canada dental equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada dental equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada dental equipment market.

Canada Dental Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.45% |

| 2033 Value Projection: | USD 1.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Treatment, By End User and COVID-19 Impact Analysis |

| Companies covered:: | 3M, Biolase Inc., Dentsply Sirona, Carestream Health, Patterson Companies Inc., Midmark Corp., Planmeca Oy, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

About 14.2 % of adults aged 60-79 years reported to have poor oral health and seniors aged 65 and older are expected to grow by 70%, resulting in an increasing prevalence of oral health-related problems. Thus, the growing prevalence of dental diseases with the growing aging population in the country is anticipated to drive the market demand. The rising trend of cosmetic dentistry which includes teeth whitening, changes in dental appearance, and malocclusion is propelling the market demand for dental equipment.

Restraining Factors

The rising cost of dental surgeries as well as the lack of proper reimbursement of dental care are challenging the Canada dental equipment market.

Market Segmentation

The Canada Dental Equipment Market share is classified into product, treatment, and end user.

- The general & diagnostics equipment dominated the market with a significant market share during the forecast period.

The Canada dental equipment market is segmented by product into general & diagnostics equipment, dental consumables, and others. Among these, the general & diagnostics equipment dominated the market with a significant market share during the forecast period. General dental equipment includes dental implants, crowns, bridges, dental biomaterials, dental chairs, and equipment while diagnostics includes a mix of digital systems, specialized tests, indicative materials, and lights that are used for detecting a range of dental conditions.

- The prosthodontic segment is anticipated to hold the largest market share during the forecast period.

The Canada dental equipment market is segmented by treatment into orthodontic, endodontic, peridontic, and prosthodontic. Among these, the prosthodontic segment is anticipated to hold the largest market share during the forecast period. Prosthodontic refers to the making of replacements for missing or damaged teeth. Dentures, dental implants, crowns, and bridges are involved in prosthodontic treatment. The demographic changes for aging in the country and the increasing prevalence of edentulism are responsible for driving the market demand.

- The hospitals segment dominated the Canada dental equipment market with the largest market share during the forecast period.

Based on the end user, the Canada dental equipment market is divided into hospitals, clinics, and others. Among these, the hospitals segment dominated the Canada dental equipment market with the largest market share during the forecast period. The hospital has high purchasing power with the presence of digitally modified dental equipment. The increasing importance of hospital-based dental programs in the country is driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada dental equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Biolase Inc.

- Dentsply Sirona

- Carestream Health

- Patterson Companies Inc.

- Midmark Corp.

- Planmeca Oy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Medline Canada Corporation, a healthcare supplies and equipment manufacturer and distributor, announced that it had completed the acquisition of Vancouver-based Sinclair Dental, Canada’s largest independent, full-service dental supplies and equipment distributor.

- In November 2023, W&H launched new product innovations for dental equipment in North America. W&H is expanding its hygiene portfolio with the addition of a new Lexa Plus Class B sterilizer and a new, technologically advanced Assistina One maintenance device bringing added peace of mind to reprocessing and infection prevention for a dental practice’s workflow.

- In December 2023, Medline Canada, Corporation, a leading healthcare supplies and equipment manufacturer and distributor, announced that it has entered into a definitive share purchase agreement for the acquisition of all of the issued and outstanding shares of Vancouver-based Sinclair Dental, Canada's largest independent, full-service dental supplies and equipment distributor.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Dental Equipment Market based on the below-mentioned segments:

Dental Equipment Market, By Product

- General & Diagnostics Equipment

- Dental Consumables

- Others

Canada Dental Equipment Market, By Treatment

- Orthodontic

- Endodontic

- Peridontic

- Prosthodontic

Canada Dental Equipment Market, By End User

- Hospitals

- Clinics

- Others

Need help to buy this report?