Canada Diabetes Care Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Blood Glucose Monitoring Systems, Self-Monitoring Blood Glucose Monitoring Systems, Insulin Delivery Devices, and Diabetes Management Mobile Applications), By Patient Care Settings (Hospital & Specialty Clinics and Self & Home Care), and Canada Diabetes Care Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Diabetes Care Devices Market Insights Forecasts to 2033

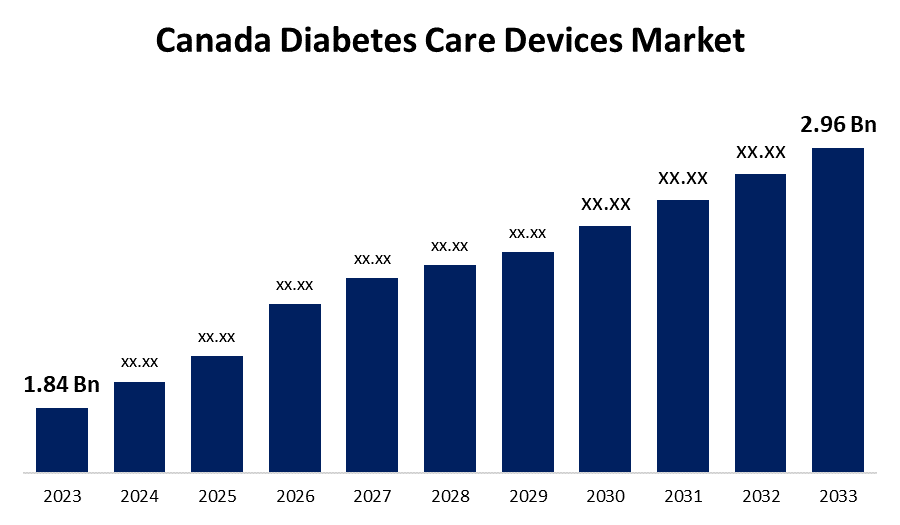

- The Canada Diabetes Care Devices Market Size was valued at USD 1.84 Billion in 2023.

- The Market is growing at a CAGR of 4.87% from 2023 to 2033

- The Canada Diabetes Care Devices Market Size is expected to reach USD 2.96 Billion by 2033

Get more details on this report -

The Canada Diabetes Care Devices Market is anticipated to exceed USD 2.96 Billion by 2033, growing at a CAGR of 4.87% from 2023 to 2033. The increasing diabetic population, awareness about diabetes treatment & management, and supportive national health programs are driving the growth of the diabetes care devices market in the Canada.

Market Overview

Diabetes care devices are the tools used by diabetes patients for managing blood sugar levels. The most commonly used diabetes devices are blood glucose meters & strips, continuous glucose monitors (CGMs), injection pens, insulin pumps, automated insulin delivery systems, and mobile coaching services. The use of diabetic care devices is essential for patient management and decreased overall healthcare costs, especially in environments with limited resources. These technologically advanced devices are improving diabetes care and improving the quality of life for patients by providing more accurate and practical means of measuring blood glucose and giving insulin. Further, the adoption of telemedicine and remote monitoring for enhancing the management of diabetes and thus providing better patient outcomes are offering lucrative market opportunities in diabetes care devices. In addition, the use of integrated healthcare platforms with AI-driven dietary management for better glycemia and more weight loss is driving market growth.

Report Coverage

This research report categorizes the market for the Canada diabetes care devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada diabetes care devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada diabetes care devices market.

Canada Diabetes Care Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.87% |

| 2033 Value Projection: | USD 2.96 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Patient Care Settings |

| Companies covered:: | Novo Nordisk A/S, Sanofi Aventis, Eli Lilly, Abbott Diabetes Care, F. Hoffmann-La Roche, Arkray, Ascensia Diabetes Care Canada Inc., Lifescan, Medtronic, Dexcom, Terumo, Ypsomed Holding AG, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

As per the estimations, around 7.8 % Canadian population (2.58 million people) are diagnosed with diabetes in 2022. Diabetes is the seventh leading cause of death in Canada in 2022 with an estimated around 2.3% death. Thus, the increasing concerns about diabetes in Canada are responsible for driving market demand. Further, around 21 % of men aged 65 years and older reported to have diabetes. The increased cases of diabetes in the older population are propelling the market. The supportive national health programs for diabetes management that include daily management, foot care and sick day management, physical activity, nutrition, and diet are propelling the diabetes care devices market.

Restraining Factors

The high cost of diabetes care restricts the adoption of devices in certain regions of Canada. Further, the adverse effects caused by using diabetes care devices may hinder the diabetes care devices market.

Market Segmentation

The Canada Diabetes Care Devices Market share is classified into type and patient care settings.

- The diabetes management mobile applications segment is anticipated to grow at the fastest CAGR during the forecast period.

The Canada diabetes care devices market is segmented by type into blood glucose monitoring systems, self-monitoring blood glucose monitoring systems, insulin delivery devices, and diabetes management mobile applications. Among these, the diabetes management mobile applications segment is anticipated to grow at the fastest CAGR during the forecast period. Diabetes management mobile applications are convenient, user-friendly, and useful in providing patients and healthcare professionals with up-to-date information about their diabetic status for integrated diabetes management. The increasing need for the use of connected devices and apps, and the adoption of cloud-based enterprise solutions for better diabetes care are driving the market growth.

- The hospital & specialty clinics segment dominated the market with a significant market share in 2023.

The Canada diabetes care devices market is segmented by patient care settings into hospital & specialty clinics and self & home care. Among these, the hospital & specialty clinics segment dominated the market with a significant market share in 2023. Diabetes patients are three times more likely to get hospitalized than non-diabetic individuals. Diabetes care devices such as insulin pens are effectively used for hospitalized patients for improved inpatient management and also improved safety for healthcare workers. The technological innovations and their adoption in hospitals and clinics for managing diabetes lead to alleviating the workload of clinical staff, ultimately leading to driving the market in the hospital & specialty clinics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada diabetes care devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk A/S

- Sanofi Aventis

- Eli Lilly

- Abbott Diabetes Care

- F. Hoffmann-La Roche

- Arkray

- Ascensia Diabetes Care Canada Inc.

- Lifescan

- Medtronic

- Dexcom

- Terumo

- Ypsomed Holding AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, NuGen Medical Devices Inc., a leader in needle-free drug delivery, announced the official launch of its InsuJet devices in Canada.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Diabetes Care Devices Market based on the below-mentioned segments

Canada Diabetes Care Devices Market, By Type

- Blood Glucose Monitoring Systems

- Self-Monitoring Blood Glucose Monitoring Systems

- Insulin Delivery Devices

- Diabetes Management Mobile Applications

Canada Diabetes Care Devices Market, By Patient Care Settings

- Hospital & Specialty Clinics

- Self & Home Care

Need help to buy this report?